/A%20game%20controller%20in%20front%20of%20a%20Roblox%20computer%20screen%20by%20Miguel%20Lagoa%20via%20Shutterstock.jpg)

Roblox (RBLX) stock closed down more than 15% in Thursday trading after the gaming platform’s third-quarter earnings release reiterated profitability concerns.

Despite impressive growth, the NYSE-listed firm recorded a substantial net loss of $255.6 million for its Q3 with management projecting even wider losses in the current quarter.

In fact, RBLX now sees its margins declining next year as it continues to invest heavily in platform development, infrastructure, and safety measures.

Despite the post-earnings decline, Roblox stock is up more than 100% versus its year-to-date low.

Why Roblox Stock Is Worth Buying After Q3 Earnings

Beyond bottom-line weakness, however, Roblox earnings showcased impressive growth metrics that warrant buying the stock on the post-earnings dip.

Daily active users showed remarkable expansion, increasing 70% year-over-year to 151.5 million while platform engagement demonstrated exceptional growth with users spending over 39 billion hours on the platform, representing a 91% increase.

Meanwhile, bookings went up another 70% versus last year to $1.92 billion as Roblox continued to expand internationally and broaden its demographic appeal.

Together, these numbers reinforcing the company’s growth potential made a Goldman Sachs analyst lift his rating on RBLX shares to “Buy” and raise the price target to $180 today.

His upwardly revised estimates call for more than 50% upside in Roblox shares from current levels.

Where Options Data Suggests RBLX Shares Are Headed

Options traders also expect RBLX stock to recover as the company continues to make progress on its ambitious goal of capturing 10% of the global gaming market versus 3.2% currently.

Contracts expiring in mid-January currently suggest potential for extended gains in Roblox stock to about $131.

And the expected move of 5.16% through Nov. 7 could see it reclaim the $120 level in the near term as well, according to data from Barchart.

Historic returns also favor continued upside in Roblox through the remainder of 2025. Over the past four years, the gaming stock has gained over 10% on average in November.

Despite a sharp decline after the earnings release, RBLX held its support at $112 (13-week low), reinforcing that a rebound may be in the offing.

Wall Street Remains Bullish on Roblox

Investors should also note that profitability challenges have failed to make Wall Street analysts flinch.

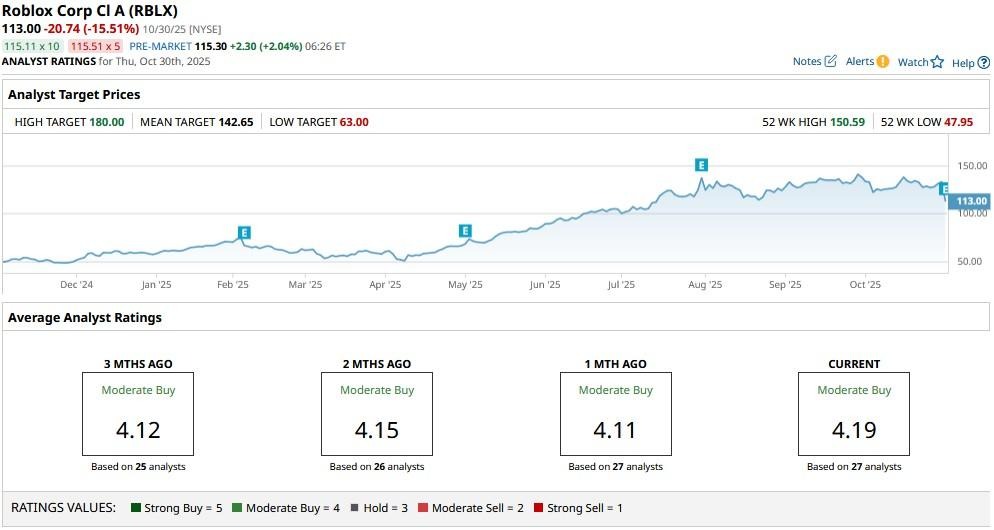

The consensus rating on RBLX shares remains at “Moderate Buy” with the mean target of about $143 indicating potential upside of more than 25% from here.

/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Microsoft%20France%20headquarters%20by%20JeanLuclchard%20via%20Shutterstock.jpg)

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/International%20Business%20Machines%20Corp_%20logo%20on%20storage%20rack-by%20Nick%20N%20A%20via%20Shutterstock.jpg)