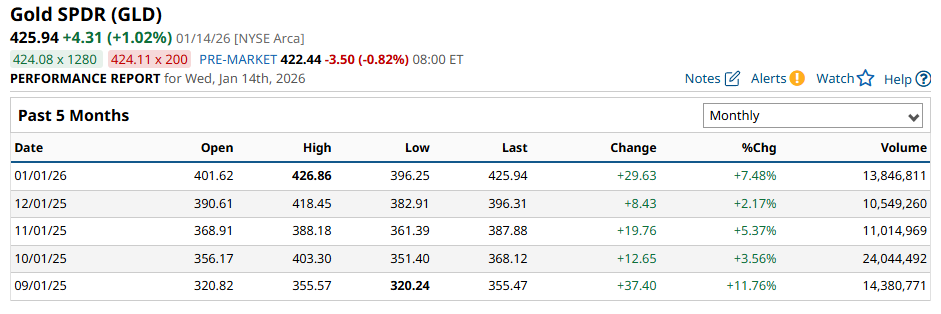

Precious metals started 2026 with a bang. Gold SPDR (GLD) is up 7% since the first trading day of the year, compared to the S&P 500’s relatively flat performance. From its ramping volume, many investors are scrambling to buy the leading precious metals ETF - and it’s not even the end of the month.

Meanwhile, those who’ve held the ETF for the past two years are enjoying returns of over 124%

Now, sharp price spikes in gold and other precious metals are prime opportunities to profit. But there’s more than one way to earn money during a bull run, and with this strategy, you can potentially buy your preferred ETF or stock at a discount.

Let me introduce you to cash-secured puts.

What Are Cash-Secured Puts?

A put option is a contract that gives you the right but not the obligation to sell an asset at a specified price, known as the strike price, at or before a specified time, known as the expiration date. Usually, the buyer wants the stock or ETF price to move below the strike price before expiration, so they can sell the put option for profit.

On the other side of the trade, you, the seller of the put, undertake the obligation to buy the asset should the buyer exercise their right (assignment) in exchange for the premium. You want the stock or ETF to stay above the strike price until expiration so you won’t get assigned.

There are two kinds of short puts: naked and cash-secured. A naked put is when you sell the put without setting aside enough cash to buy the shares if you’re assigned. You depend on margin to cover the obligation if the trade goes against you. Suffice it to say, the naked put is risky.

On the other hand, a cash-secured put (CSP) requires maintaining enough cash in your account to buy 100 shares of the underlying stock or ETF at the strike price. Most investors who sell cash-secured puts are prepared - and actually want - to buy the shares if they are assigned. That’s why it’s recommended to only sell CSPs on high-quality stocks and ETFs.

CSPs are considered safer than naked puts - but not entirely risk-free. They're used when you’re moderately bullish on the underlying, and the trade’s maximum profit is the credit you receive from the start.

Looking for GLD Cash-Secured Put Trades

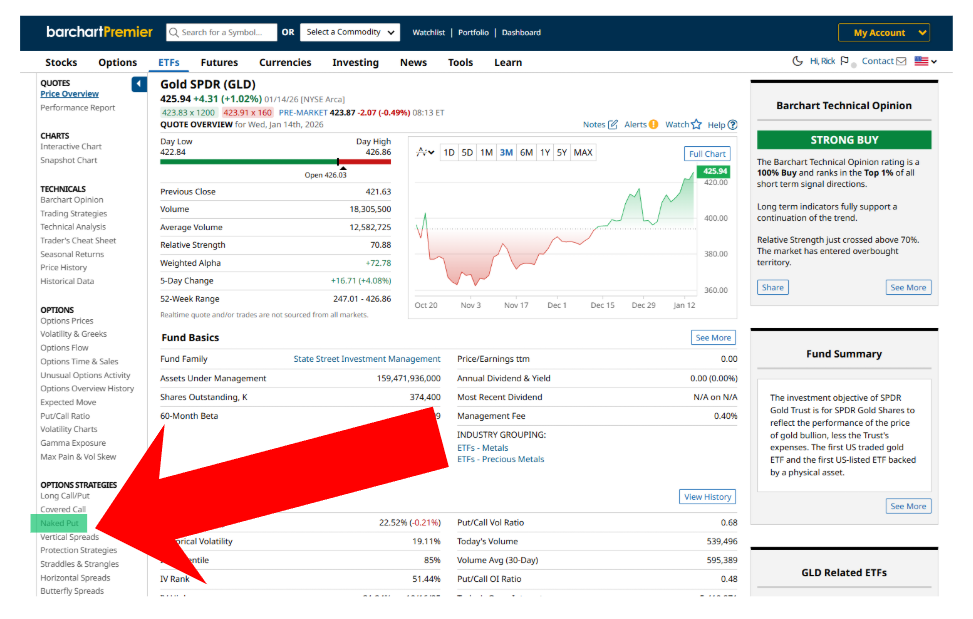

Let me show you where to look for CSP trades on Barchart.

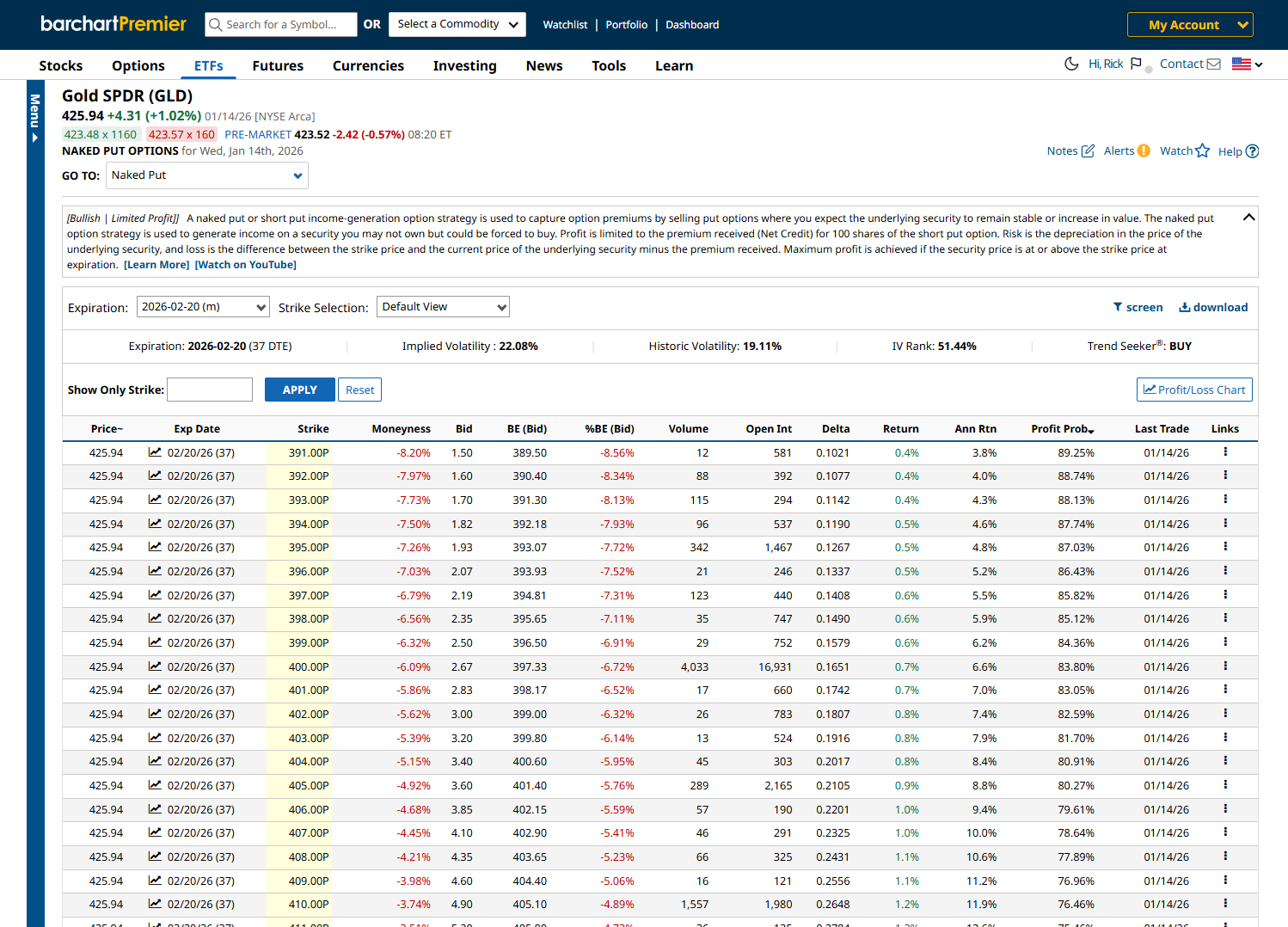

First, go to the ETF profile page, then click Naked Put under Options Strategies.

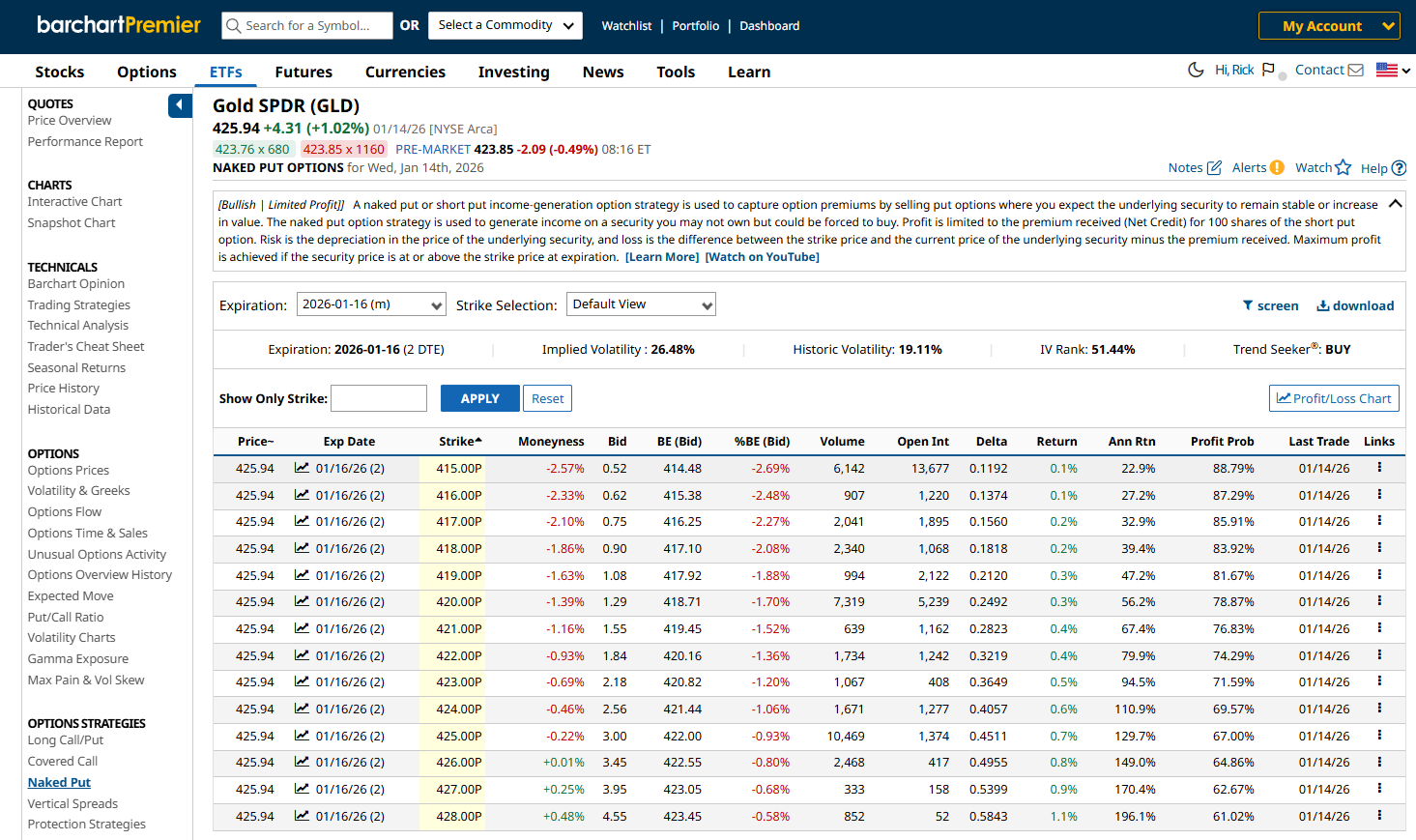

Once there, you’ll be immediately brought to the results page, where you’ll see a number of trades for the closest expiration date. These are screened using Barchart’s predefined default filters, which provide a good balance between safe and risky trades.

Now, when selling cash-secured puts, I often opt for 30-45 DTE (days to expiration) trades. These give me more premium compared to short-term puts while allowing me enough time to adjust the trade if necessary.

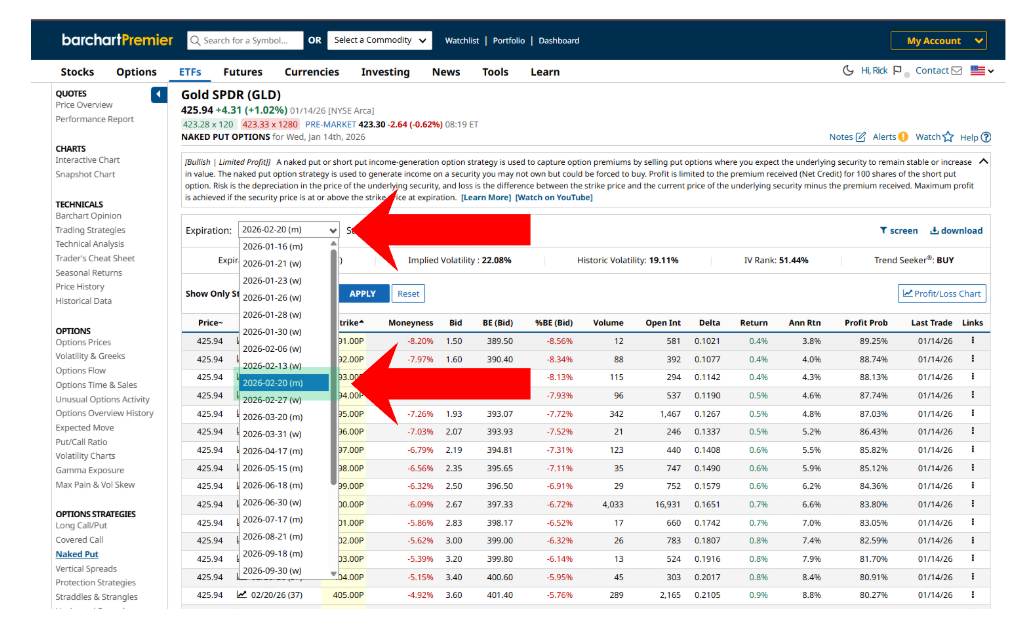

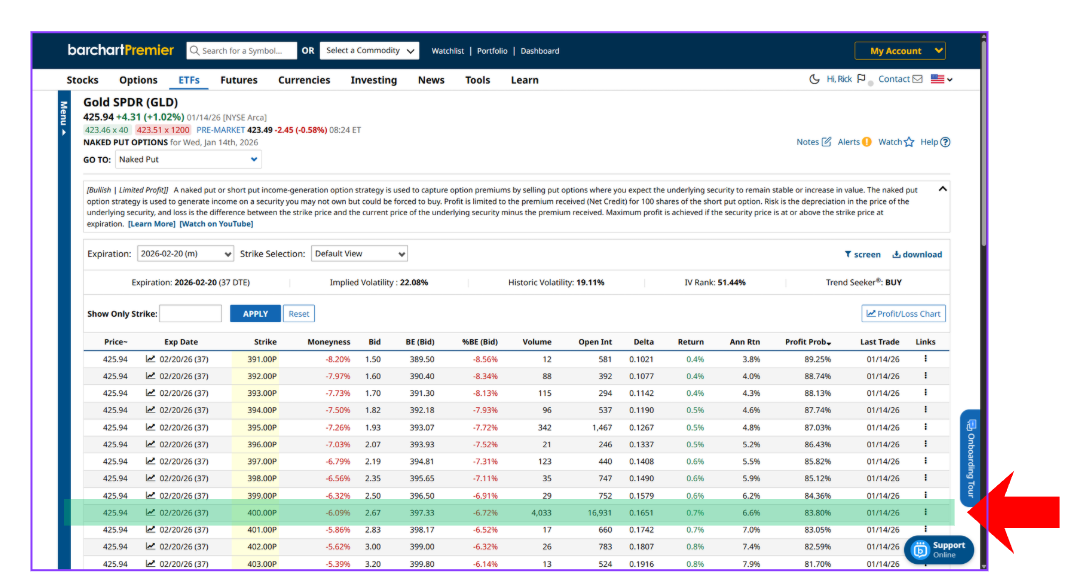

As such, I’ll click on the date dropdown and change the expiration date to February 20, 37 days from now.

Here are the results, arranged from highest to lowest probability of profit.

The Bid column shows how much premium you would receive per share if you sold that option at the current market price. Remember, premiums are expressed per share, so you’ll multiply this by 100 to get the total contract value.

Now, when selecting your cash-secured put, you’ll need to find your balance between risk and reward. You’ll want to sell contracts that cover your trading fees and give you enough money to make the trade worthwhile. Typically, traders sell cash-secured puts for as long as possible to generate more income, but some may eventually want to buy the stock.

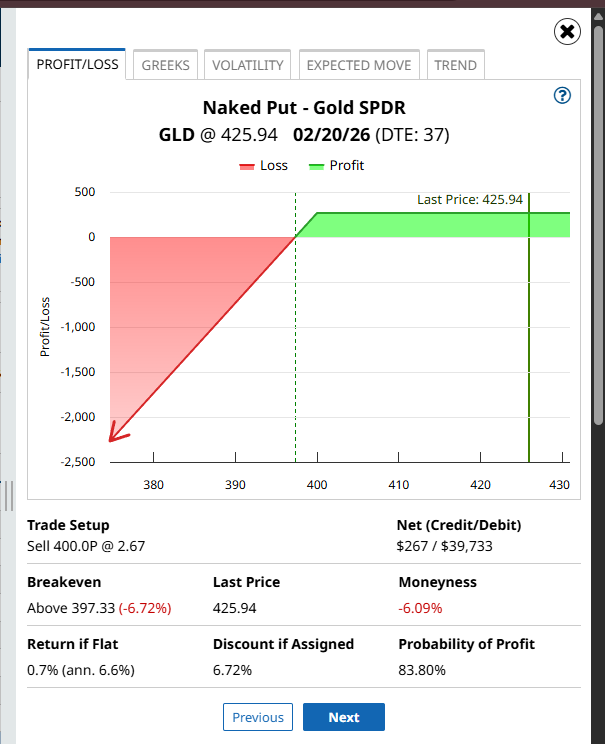

For me, I’ll be sticking with income. So, I’ll choose this trade:

Trade Breakdown

According to the screener, you can sell a 400-strike put on GLD and get $2.67 per share, or $267 per contract. This trade is 6% out of the money, which for short puts means that the underlying is trading above the strike price, and you’ll get a roughy 7% discount from its current trading price if you get assigned.

So, if the trade stays above $400 until February 20, you keep the $267 in full, the short put disappears from your account, and you are no longer at risk of assignment.

Now, if you are assigned, you’ll have to purchase GLD at $400 per share ($40,000 total, excluding trading fees). But here’s the problem: you buy it at $400 regardless of how low it goes.

So, if GLD trades at $350 at expiration, that means you’re immediately entering the position at a $50 loss per share. Even after factoring in the $267 premium you collected, you’d still be down $4,733 overall, and from there, any further downside in GLD would continue to increase your losses.

The good news is, you’re not exposed to any risk of loss on the option itself. Once you’re assigned, the put contract is gone, and your risk is now simply the same as owning 100 shares of GLD.

Final Thoughts

In general, the cash-secured put is an excellent way to earn income while waiting for your preferred purchase price for your chosen underlying asset. This 400-strike trade will allow you to generate income while getting into position to buy GLD at a lower price than what it’s trading for now.

That being said, there’s no such thing as “free money” in options trading. If GLD or your underlying asset drops sharply, you’ll be buying the shares at a potentially much higher price than what it’s worth at the moment.

But overall, if you’re bullish on gold but don’t want to chase the price at the top, you can sell cash-secured puts and get paid income for your patience.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)