Tilray Brands (TLRY) is often viewed by the market as just another volatile cannabis stock. Trading under $10, Tilray has quietly built a diversified global platform spanning medical and recreational cannabis, pharmaceutical distribution, beverages, and wellness products across more than 20 countries.

While many peers struggle with weak balance sheets and limited growth opportunities, Tilray enters the next phase with stronger fundamentals, meaningful international momentum, and the financial flexibility to capitalize on regulatory shifts. This puts this under-$10 growth stock in a much better position than investors may realize.

Let’s dig in to find out if TLRY stock is a buy now.

International Cannabis Is Emerging as a Core Growth Engine

Valued at $1.03 billion, Tilray grows cannabis, makes cannabis-based medicines, produces drinks (including beer and THC beverages), and sells wellness and hemp-based food products. Its second quarter of fiscal 2026 shows how much the business has evolved beyond a single-industry cannabis story.

Tilray reported its highest-ever second-quarter net revenue of $218 million, beating analyst estimates and increasing by 3% year-on-year (YoY). Adjusted EBITDA was $8.4 million, while adjusted cash operating income was positive at $6 million. In Canada, Tilray remained the market leader in several product categories, including dried flower, pre-rolls, beverages, oils, and edibles. Adult-use and medical cannabis revenue, net of excise tax, totaled $46 million, with recreational cannabis sales increasing during the quarter.

One of the most notable developments this quarter was the acceleration in international cannabis. It operates in more than 20 countries across North America, Europe, and Latin America. Tilray has a large pharmacy network across Europe that distributes medical cannabis, pharmaceuticals, and medical devices across countries there. Global cannabis revenue rose to $68 million, with international cannabis delivering 36% YoY growth and an impressive 51% sequential increase. International markets with high margins are becoming increasingly crucial in Tilray's profitability mix. Tilray Pharma and its distribution business achieved another strong quarter, with sales increasing 26% YoY to $85 million, its highest quarter to date. Competitive pricing, portfolio optimization, and higher medical device sales all contributed to the growth.

Management emphasized that this growth occurred despite regulatory transitions and permitting challenges in markets such as Portugal and Germany, making the performance particularly noteworthy. Europe, especially Germany, the UK, and Poland, remains a key long-term opportunity, with the company's large cultivation footprint and operational scale in Portugal, Germany, and Canada. The company plans to expand its pharmacy reach significantly in Germany, targeting thousands of additional pharmacies through strategic partnerships. This distribution network generates revenue and strengthens Tilray’s international medical cannabis strategy by improving market access and operational leverage.

Beverage Business Struggled, but Restructuring Is Showing Progress

Tilray's beverage sector achieved $50.1 million in revenue, down 20.6% YoY. While craft beer continues to experience industry-wide headwinds, the company has made progress on integration and cost-cutting strategies. It has already generated $27 million in annualized cost reductions and is on course to meet the $33 million target.

With a leading THC beverage market share in Canada and existing hemp-derived THC offerings in the U.S., the company is positioning itself for future regulatory changes. International expansion of non-alcoholic and energy beverages further diversifies revenue opportunities. Furthermore, the wellness segment generated $14.6 million in revenue, flat YoY, supported by hemp-based foods, protein ingredients, and clean energy drinks. These products contain zero THC and are shielded from regulatory uncertainty, offering Tilray a stable and defensive revenue stream alongside higher-growth cannabis and beverage operations. Analysts covering the stock predict that Tilray's revenue will rise 5.9% to $869.9 million in fiscal 2026, followed by a 4.4% increase in fiscal 2027.

Tilray's balance sheet strength also continues to stand out. It ended the quarter with approximately $292 million in cash and marketable securities and reduced its debt, resulting in a net cash position of nearly $30 million. In a sector often constrained by liquidity, this financial flexibility provides a clear strategic advantage.

Why Tilray’s Positioning May Be Underappreciated

Tilray is no longer just a cannabis story, which reduces risk. It is no longer solely dependent on one geography or one product category. International cannabis growth, a scaled medical platform, improving cash flow, and a strong balance sheet combine to create a more resilient business model than many investors associate with cannabis stocks. For investors willing to look beyond near-term volatility, this cannabis stock may be better positioned now than it was in previous years.

What Is Wall Street Saying About TLRY Stock?

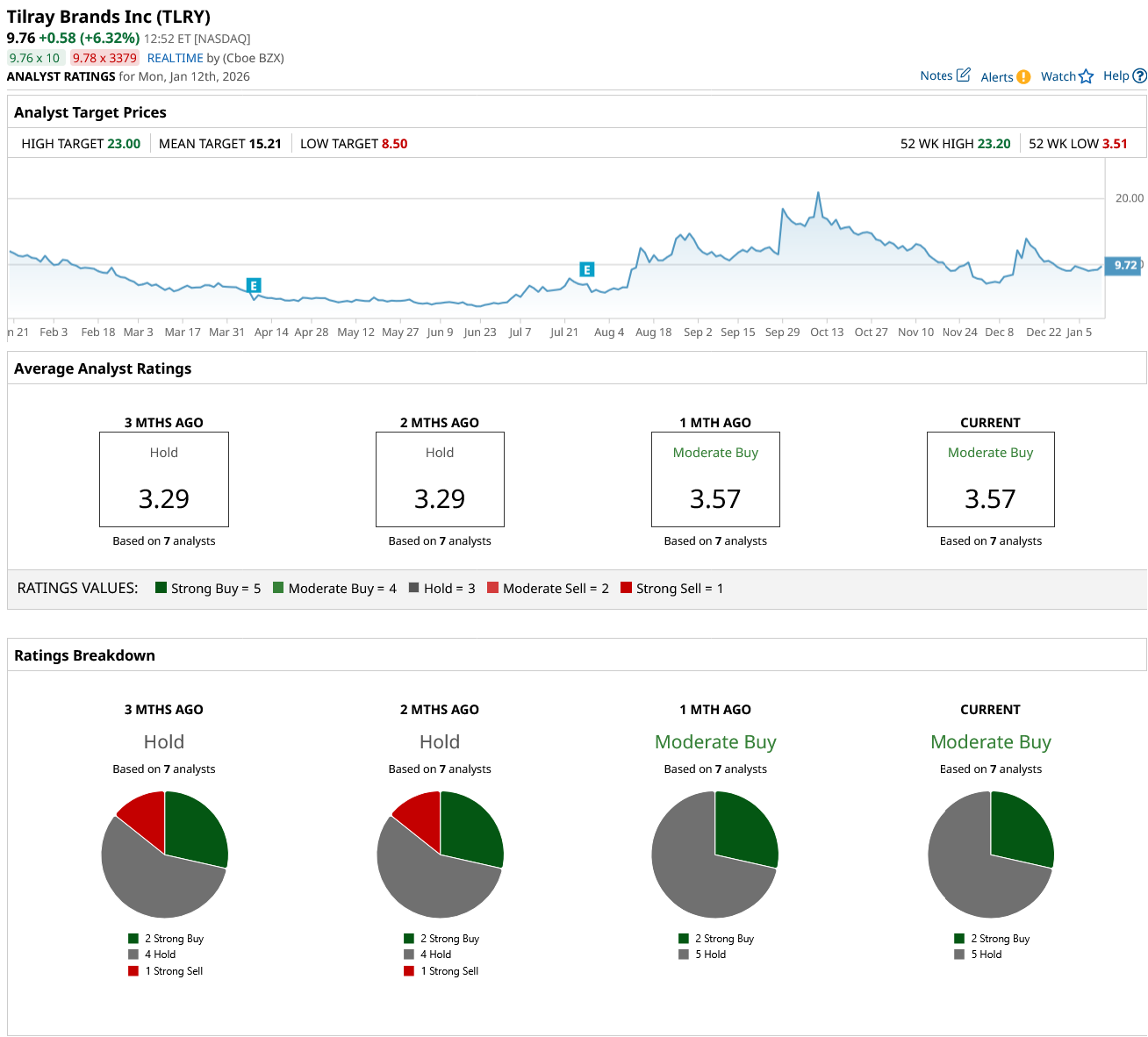

That said, TLRY stock fell 38.1% last year, compared to the S&P 500 Index's ($SPX) gain of 16%. Nonetheless, Wall Street expects the stock to rally 56% from current levels based on the average target price of $15.21. Plus, the Street-high estimate of $23 indicates the stock could rise as high as 135% in the next 12 months.

Overall, TLRY stock is a “Moderate Buy.” Out of the seven analysts who cover the stock, two rate it a “Strong Buy,” and five rate it a “Hold.”

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/ServiceNow%20Inc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)