/Cincinnati%20Financial%20Corp_%20phone%20screen-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Fairfield, Ohio-based Cincinnati Financial Corporation (CINF) provides property casualty insurance products. Valued at $25.4 billion by market cap, the company markets a variety of insurance products and provides leasing and financing services. The insurance giant is expected to announce its fiscal fourth-quarter earnings for 2025 after the market closes on Monday, Feb. 9.

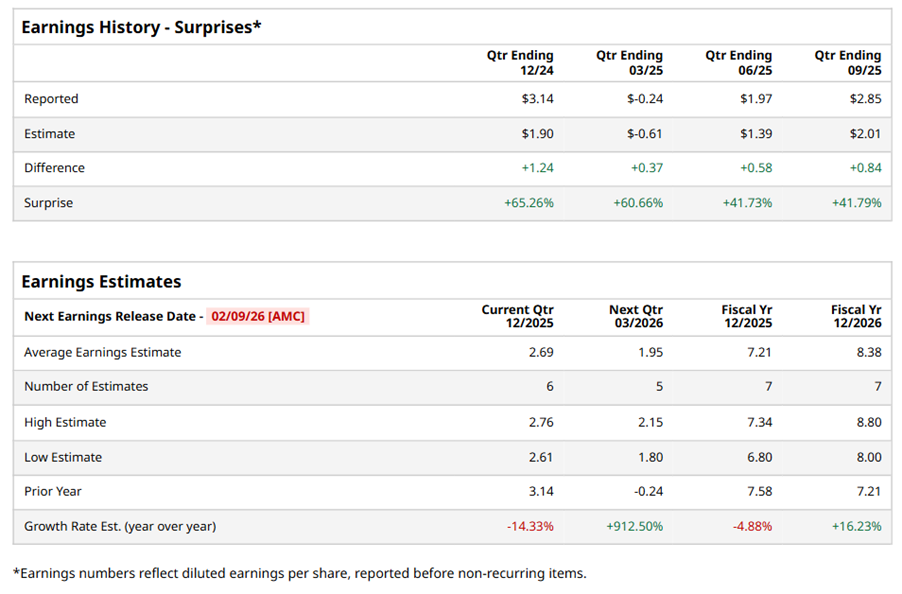

Ahead of the event, analysts expect CINF to report a profit of $2.69 per share on a diluted basis, down 14.3% from $3.14 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect CINF to report EPS of $7.21, down 4.9% from $7.58 in fiscal 2024. However, its EPS is expected to rise 16.2% year over year to $8.38 in fiscal 2026.

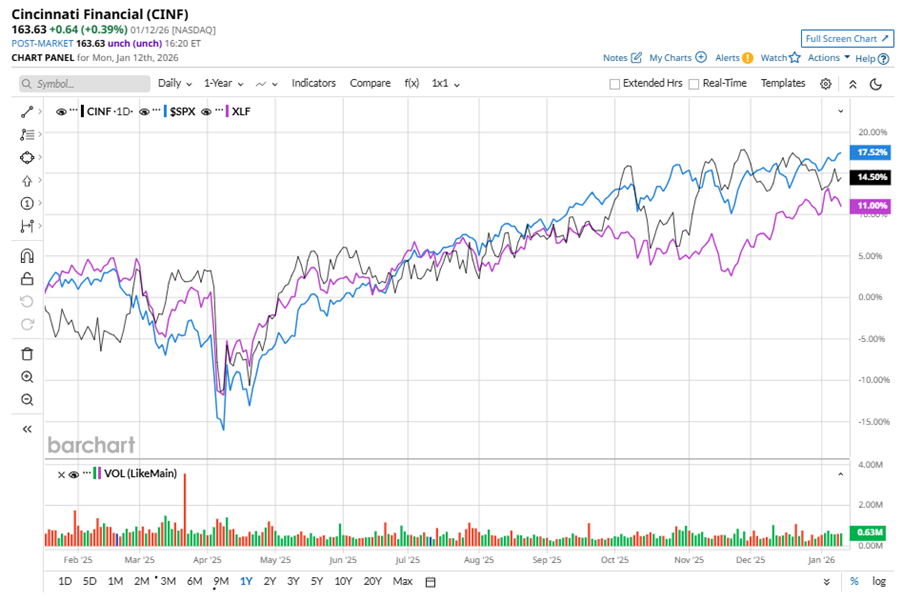

CINF stock has outperformed the S&P 500 Index’s ($SPX) 19.7% gains over the past 52 weeks, with shares up 20.7% during this period. Similarly, it outperformed the Financial Select Sector SPDR Fund’s (XLF) 16.8% gains over the same time frame.

CINF delivered strong results, attributed by management to a significant increase in investment income and disciplined underwriting, particularly in property casualty lines. CEO Steve Spray pointed to robust performance across commercial and personal segments, benefiting from lower catastrophe losses. The company also benefited from a favorable investment environment and steady reserve development, though it noted ongoing volatility in areas like commercial auto and large losses.

On Oct. 27, 2025, CINF shares closed up marginally after reporting its Q3 results. Its adjusted EPS of $2.85 beat Wall Street expectations of $2.01. The company’s revenue stood at $3.7 billion, up 12.2% year over year.

Analysts’ consensus opinion on CINF stock is moderately bullish, with a “Moderate Buy” rating overall. Out of 10 analysts covering the stock, three advise a “Strong Buy” rating, one suggests a “Moderate Buy,” and six give a “Hold.” CINF’s average analyst price target is $174.67, indicating a potential upside of 6.7% from the current levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)

/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)

/Apple%20Inc%20logo%20on%20Apple%20store-by%20PhillDanze%20via%20iStock.jpg)