Shares of aerospace and defense company Kratos Defense & Security Solutions (KTOS) exploded nearly 14% on Jan. 8, riding a powerful wave of defense-sector optimism after the U.S. government floated a massive $1.5 trillion military budget for 2027. The proposed budget, which focuses on speeding up military modernization, helped lift defense stocks across the board, with Kratos moving higher alongside its peers.

Fueling the move was a bold statement from President Donald Trump, who argued that the U.S. should go far beyond a $1 trillion defense budget to build what he called a “Dream Military” that keeps the country “safe and secure.” The market responded swiftly to the prospect of a defense-spending boom. Notably, the surge came just a day after Trump signaled tougher oversight of major defense contractors, calling for limits on stock buybacks, dividends, and executive pay until companies step up investments in factories and research.

Kratos, however, expressed strong support for the policy shift. Unlike many large defense primes, the company doesn’t pay dividends or repurchase shares, instead funneling capital directly into cutting-edge, mission-ready technologies for the modern battlefield. That reinvestment-first strategy suddenly looks tailor-made for Washington’s new priorities. So, given these latest headlines, here’s a closer look at KTOS stock.

About Kratos Defense Stock

California-based Kratos Defense & Security Solutions operates across some of the most advanced corners of modern defense, building technology, systems, and software that support military, national security, and select commercial missions. The company focuses on developing practical, affordable solutions by relying on proven, cutting-edge technology, enabling it to move from design to deployment faster and at lower cost and risk.

Kratos is especially known for engineering products that can be produced in large volumes at low cost, making it a useful partner to both the U.S. government and larger defense contractors. Its portfolio ranges from satellite command-and-control software and virtualized ground systems to jet-powered drones, propulsion systems, missile and radar electronics, and more.

Currently valued at roughly $19 billion by market capitalization, Kratos delivered a standout performance in 2025, driven by strong demand for its unmanned aerial systems, strategic acquisitions, new partnerships, and a steadily expanding contract backlog amid rising global defense spending. KTOS stock’s momentum has been hard to miss.

Shares have jumped 293% over the past year, far outpacing the broader S&P 500 Index’s ($SPX) 20% gain during the same period. Even in the short term, the trend remains strong, with KTOS up 52% in the past month, compared to just 2% for the broader market.

Inside Kratos’ Q3 Earnings Results

In early November, Kratos released its fiscal 2025 third-quarter earnings, delivering a strong performance across both revenue and profits. The company posted quarterly revenue of $347.6 million, marking a 26% year-over-year (YOY) increase and coming in well ahead of Wall Street’s $320.8 million estimate. Profitability also improved, with adjusted EPS of $0.14, up 27% YOY and comfortably above the $0.12 analysts were expecting.

Growth was broad-based across Kratos’ business lines. The company’s Unmanned Systems segment generated $87.2 million in revenue, a 36% annual increase, reflecting rising demand for its drone and autonomous platforms. Meanwhile, the Kratos Government Solutions segment brought in $260.4 million, up 23% YOY, supported by continued contract wins and program execution across defense and security customers.

Cash flow reflected the company’s ongoing investment cycle. During Q3, free cash flow used in operations totaled $41.3 million, after the company funded $28 million in capital expenditures to support production capacity, development programs, and long-term growth initiatives.

Kratos’ order activity also remained solid. The company reported consolidated bookings of $414.1 million for the quarter, translating into a book-to-bill ratio of 1.2 to 1.0, which signals that new orders exceeded revenue recognized during the period. Total backlog climbed to $1.48 billion as of Sept. 28, up from $1.414 billion at the end of June. At the same time, Kratos’ bid and proposal pipeline expanded to $13.5 billion, compared with $13 billion three months earlier.

Looking ahead, management expects momentum to continue through the rest of fiscal 2025. The company forecasts full-year revenue between $1.32 billion and $1.33 billion, along with adjusted EBITDA in the range of $114 million to $120 million, reflecting confidence in both demand trends and execution across its core defense and technology programs.

How Are Analysts Viewing Kratos Defense Stock?

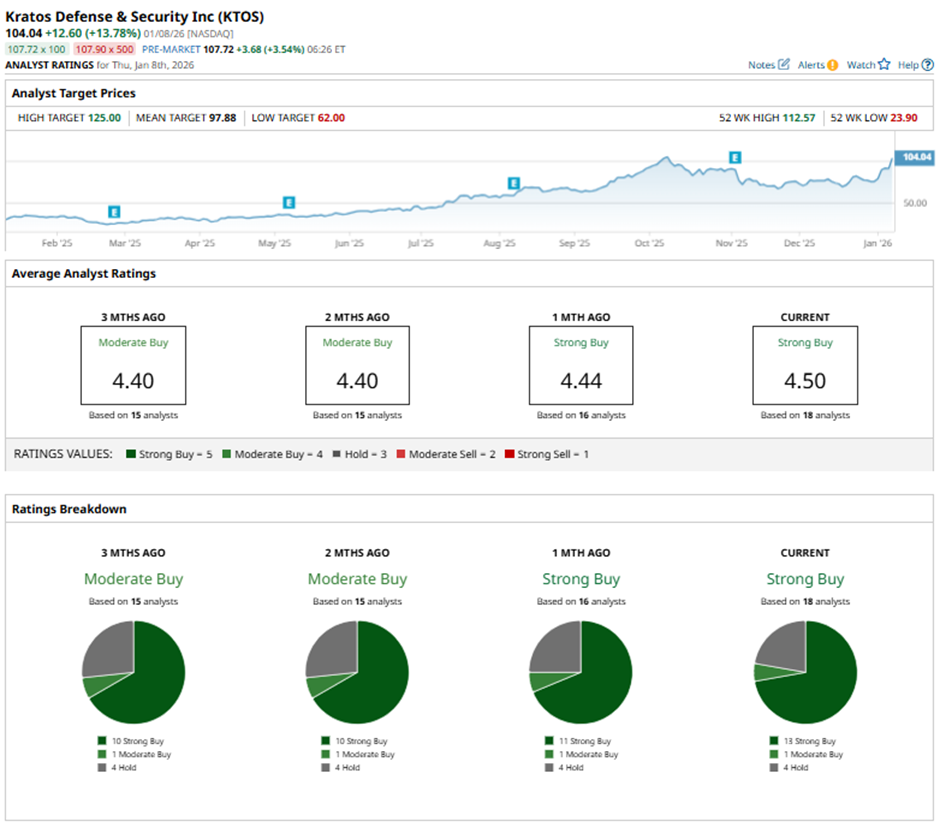

The Wall Street community remains bullish on Kratos, with the stock carrying a “Strong Buy” consensus rating. Of the 18 analysts covering KTOS stock, 13 rate it a “Strong Buy,” one has a “Moderate Buy,” and four maintain a “Hold" rating. Even after the stock’s powerful run, analysts still see upside.

While shares have already moved past the average price target of $97.88, the Street-high target of $125 suggests KTOS could still climb by about 9% from here.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)