Meta Platforms (META) has accelerated its push for sustainable energy to fuel expansive artificial intelligence (AI) data centers by forging long-term nuclear power agreements with three innovative providers: Oklo (OKLO), Vistra (VST), and TerraPower.

With Oklo, Meta is collaborating on the development of small modular reactors (SMR) in Ohio, targeting up to 1.2 gigawatts (GW) of capacity as early as 2030, where Meta will support early procurement and project advancement. Vistra's deal involves 20-year purchases from three existing plants—Perry and Davis-Besse in Ohio, plus Beaver Valley in Pennsylvania—enabling expansions and life extensions to deliver up to 6.6 GW by 2035. TerraPower's pact sees Meta funding two reactors for up to 690 megawatts by 2032, with options for six more by 2035.

These partnerships address AI's voracious power needs, positioning nuclear as a reliable, low-carbon alternative amid grid constraints.

About Oklo Stock

Oklo specializes in advanced nuclear technology, designing and developing small modular reactors (SMRs) to deliver clean, scalable energy tailored for high-demand applications like AI data centers. Its operations include securing regulatory approvals, such as the recent Department of Energy nod for its Aurora fuel-fabrication facility, and forging partnerships with entities like Equinix (EQIX) for on-site power solutions, with a planned 2027 rollout in Idaho. Headquartered in Sunnyvale, California, Oklo is backed by influential figures including OpenAI's Sam Altman.

SMRs differ from traditional nuclear plants by featuring compact, factory-built designs that enable quicker construction, lower costs, and flexible placement near end-users, minimizing transmission inefficiencies and enhancing safety through passive systems.

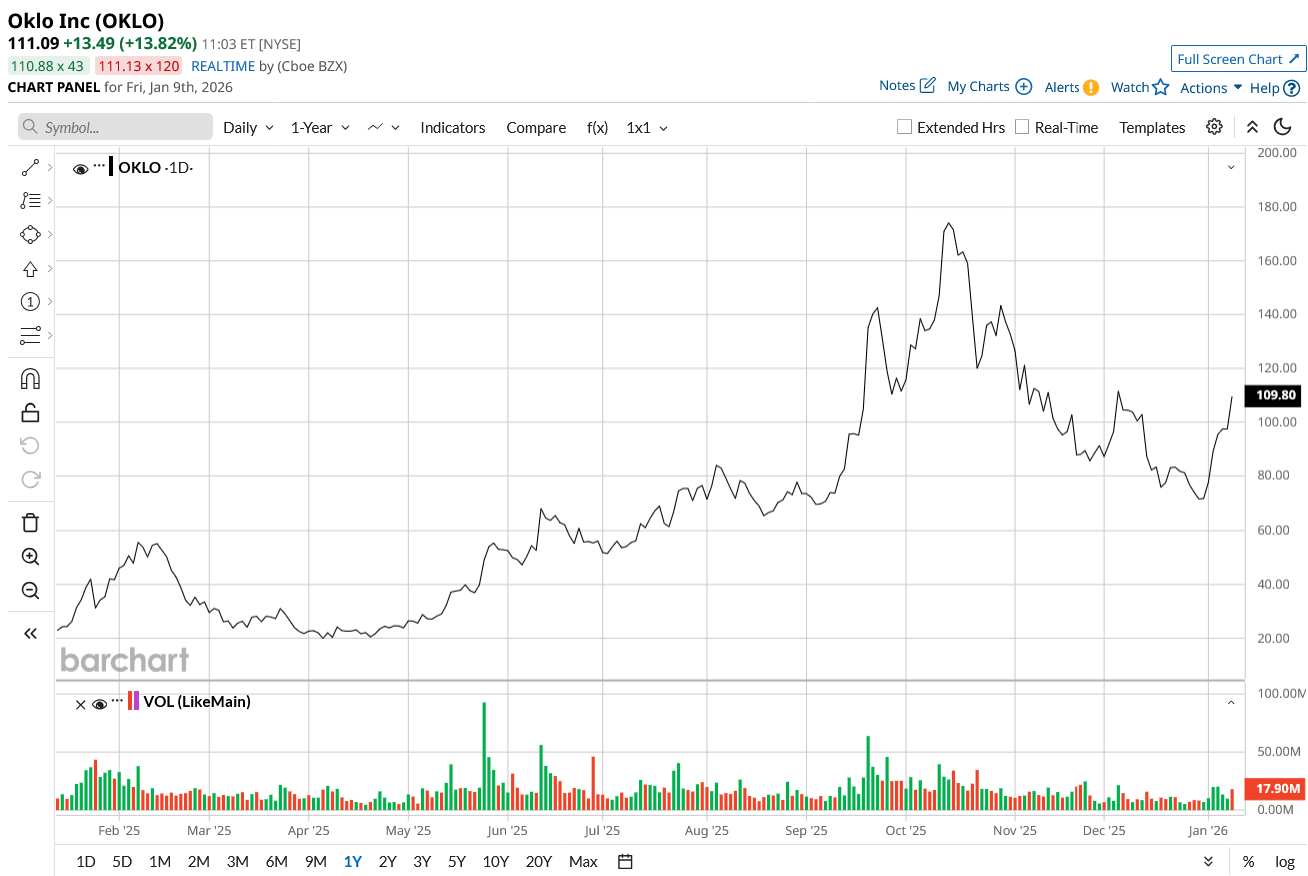

In 2025, Oklo's stock surged 238%, vastly outperforming the S&P 500's ($SPX) 16% gain, though it peaked as high as $193.84 before retreating 47%. So far in 2026, shares are up 56%, compared to the S&P's modest 1% rise.

Valuation is challenging on traditional metrics like P/E and P/S, which are unavailable due to it having no revenue, as Oklo remains pre-commercial with losses ongoing. Compared to industry averages for nuclear developers—often trading at high multiples based on future earnings potential—Oklo's $15 billion market cap reflects speculative growth bets rather than historical averages, which are limited given its recent public status. This suggests the stock is fairly valued for risk-tolerant investors eyeing nuclear power's long-term revival but potentially overvalued if deployment delays materialize.

What Oklo Brings to Meta's Table

As artificial intelligence continues to strain global energy resources, innovative nuclear solutions like those from Oklo are emerging as pivotal answers to the crisis. The company's Aurora reactor design, capable of generating up to 75 megawatts, emphasizes on-site deployment directly at data centers, bypassing overloaded grids and ensuring uninterrupted power for compute-intensive operations. This approach mitigates blackout risks and aligns with environmental goals by utilizing recycled materials as fuel, which promotes efficiency in waste management.

Looking ahead to 2026, Oklo stands poised for expansion as tech firms ramp up investments in sustainable infrastructure. Regulatory progress, such as recent safety approvals, bolsters its timeline for initial reactor activations, potentially unlocking revenue streams from custom energy contracts. While challenges like permitting bottlenecks and capital intensity persist, Oklo's edge lies in its modular scalability, allowing rapid adaptation to surging demand from AI hyperscalers. Investors should consider this as a high-reward play, given the projected tripling of data center electricity needs by 2030, where traditional sources fall short.

Furthermore, Oklo's strategic positioning in the nuclear renaissance—fueled by federal policy support for clean tech—could yield partnerships beyond its current deals, enhancing market penetration. Unlike larger, inflexible plants, its reactors offer cost-effective, safe alternatives with built-in redundancies. For those betting on energy's intersection with innovation, Oklo represents a future-oriented investment, balancing risks with the promise of transforming how we power tomorrow's digital world.

What Do Analysts Expect for OKLO Stock?

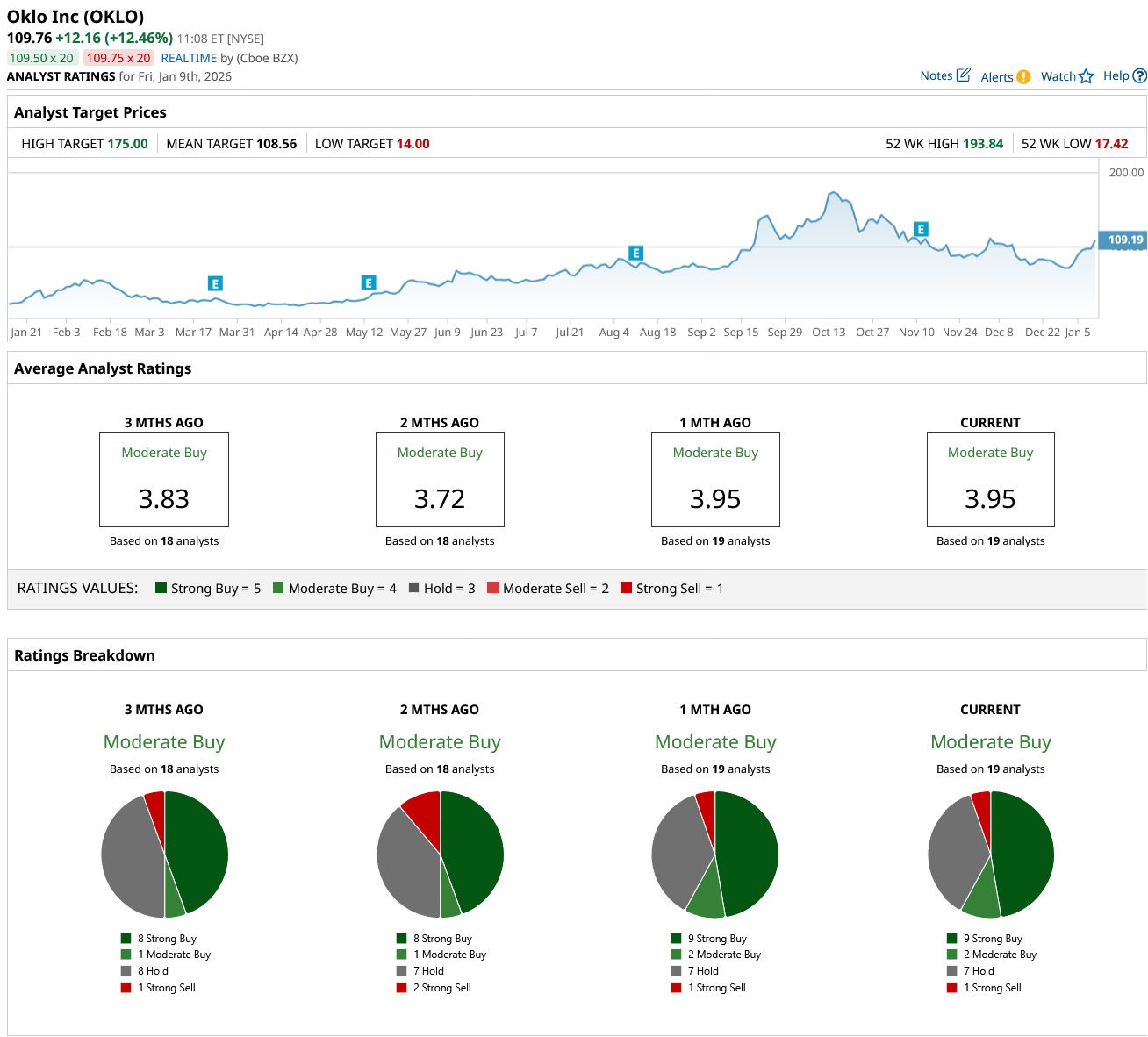

Wall Street's consensus rating on OKLO stock is a “Moderate Buy,” based on input from 19 analysts. The ratings breakdown includes nine “Strong Buy,” two “Moderate Buy,” seven “Hold,” and one “Strong Sell,” reflecting a mix of optimism and caution amid the company's early-stage profile. Over recent months, consensus has seen a slight positive shift, with the average rating score improving from 3.83 three months ago (on 18 analysts) to 3.95 currently, indicating growing confidence in nuclear's role in AI energy.

The mean price target stands at $108.56, which, thanks to this morning's roughly 13% spike, the stock has now surpassed. With highs up to $175 suggesting bullish scenarios tied to successful SMR deployments, while lower targets account for execution hurdles. Overall, the coverage highlights Oklo's transformative potential but advises patience for revenue milestones.

On the date of publication, Rich Duprey did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)