/Labcorp%20Holdings%20Inc_%20logo%20on%20laptop-by%20monticello%20via%20Shutterstock.jpg)

Labcorp Holdings Inc. (LH), headquartered in Burlington, North Carolina, stands as a premier global life sciences company specializing in clinical laboratory services. It manages one of the largest worldwide networks of labs and patient service centers in routine clinical, oncology, genetics, and esoteric diagnostics. Labcorp partners with physicians, hospitals, biopharma firms, and patients to advance healthcare decisions and accelerate drug development. The company has a market capitalization of $21.03 billion.

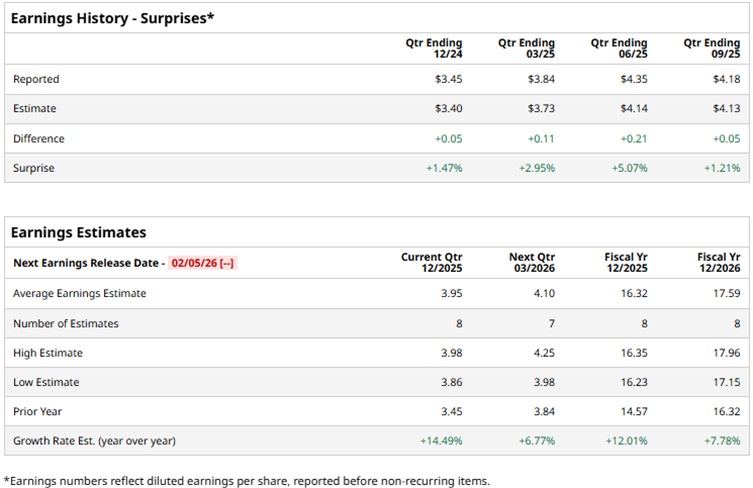

The company is expected to report its fourth-quarter results for fiscal 2025 soon. Ahead of the release, Wall Street analysts are optimistic about the company’s bottom-line trajectory.

Analysts expect Labcorp to report a profit of $3.95 per share on a diluted basis for Q4, up 14.5% year-over-year (YOY). The company has a solid history of surpassing consensus EPS estimates, topping them in all four trailing quarters. For the full fiscal year 2025, Wall Street analysts expect Labcorp’s diluted EPS to grow by 12% annually to $16.32, followed by a 7.8% improvement to $17.59 in fiscal 2026.

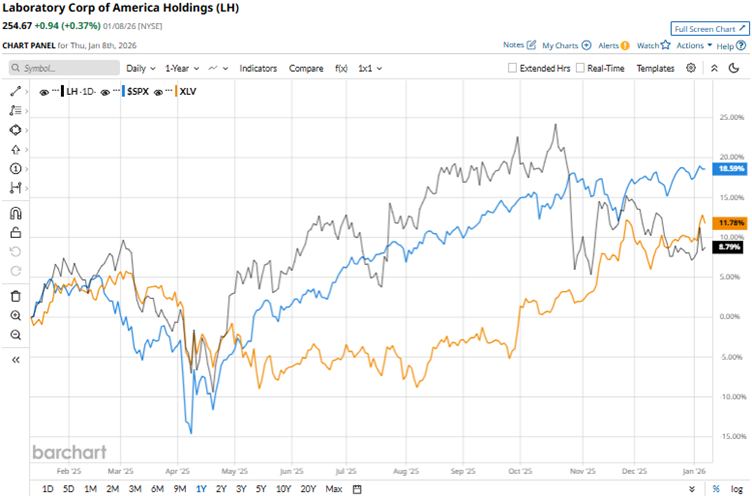

Labcorp’s stock has been underperforming the broader market over the past year. Over the past 52 weeks, the stock has gained 8.7%, but over the past six months, it has been down 1.1%. On the other hand, the broader S&P 500 Index ($SPX) has increased by 17% and 11.2% over the same periods, respectively.

Next, we compare the stock with its own sector’s performance. The State Street Health Care Select Sector SPDR ETF (XLV) has gained 12.6% over the past 52 weeks and 17.2% over the past six months. Therefore, the stock has also underperformed its sector over these periods.

On Oct. 28, 2025, Labcorp reported its third-quarter results for fiscal 2025. The company’s total revenue increased 8.6% YOY to $3.56 billion, matching Wall Street analysts’ forecasts, as its diagnostics and central laboratory businesses continued to show momentum. Its adjusted EPS was $4.18 for the quarter, up 19.4% from the prior-year period and above Street analysts’ $4.13 estimate.

However, due to currency fluctuations and changes in acquisition timing, Labcorp lowered the midpoint of its fiscal 2025 revenue growth guidance range by 40 bps. The company’s stock dropped 5.8% intraday on Oct. 28 and a further 4.5% on Oct. 29.

Wall Street analysts have been bullish about Labcorp’s future. Among the 18 analysts covering the stock, the consensus rating is “Strong Buy.” The rating configuration has remained the same over the past three months. The stock has 14 “Strong Buy” ratings and four “Holds.” The mean price target of $300.70 implies an 18.1% upside from current levels, while the Street-high price target of $342 implies 34.3% upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)