The refining sector has had a strong start to the year, and Valero Energy (VLO) has been among the leaders in this space. The shares in Valero Energy climbed to new 52-week highs in early January after yet another quarter in which the company performed well in terms of refining margin and cash returns. Analysts are also re-evaluating the entire downstream petroleum industry in light of shifting geopolitics, which are holding back supplies of heavy crude oils.

Venezuela’s oil industry has re-entered the spotlight after comments from Donald Trump signaled continued U.S. sanctions alongside deeper involvement in rebuilding the country’s broken energy infrastructure. Any normalization would be slow and capital-intensive, limiting near-term impact on global oil prices. However, even small, reliable flows of Venezuelan heavy crude could matter downstream. That dynamic favors U.S. Gulf Coast refiners like Valero Energy, which are optimized to process discounted heavy sour barrels.

About Valero Energy Corporation

Valero Energy Corporation is one of the largest independent petroleum refiners and is based out of San Antonio, Texas. The firm owns and operates 15 petroleum refineries with a capacity of about 3.2 million barrels per day in the U.S., Canada, and the UK. The company also has a substantial portfolio in renewable diesel with their Diamond Green Diesel joint venture and owns a large portfolio in the U.S. ethanol business.

Over the last 12 months, the stock has significantly outperformed the market. It has recently traded near the high end of its range over the past 52 weeks, as it has gained more than 70% from its low levels from last year, substantially outperforming the S&P 500 Index ($SPX).

Despite this robust performance, valuation does not look unreasonable. Current valuation multiples for this refining and energy play are lower than market averages and compare favorably within the refining group. A look at the market's valuation multiples reveals that it is not overly pricey regarding either its price-earnings or sales multiples. Its price-cash flow ratio of about 9x is not unreasonable due to its ability to generate free cash flow.

Valero also pays back substantially to its stockholders. The company pays an ongoing dividend payment while primarily focusing on buying back stocks whenever it fetches higher margins.

Valero Beats on Earnings as Refining Strength Continues

The latest earnings from Valero have emphasized the market’s constructive stance on the company. The firm earned a net income of $1.1 billion, or $3.53 per share, with an adjusted earnings contribution of $3.66 per share, significantly higher than last year. Valero more than doubled its earnings from refining operations on a year-over-year basis due to a high throughput utilization level of 97%.

Citing record operational results in key regions, especially the Gulf Coast and North Atlantic networks, management highlighted the company's refining throughput at 3.1 million barrels per day, emphasizing its ability to leverage margin opportunities despite the tight oil market dynamics.

Other than refinery augmentation, the ethanol segments recorded a record production level, whereas the renewable diesel segment was impacted by the overall economics of the industry. Notably, Valero remains cautious with capital spending, and a $230 million FCC unit optimization project is scheduled to be commissioned in the second half of 2026.

In terms of capital allocation, Valero distributed about $1.3 billion to its shareholders in the form of dividends and share repurchases. This is roughly 80% of its adjusted operating cash flow. In terms of the balance sheet, the company’s net debt-to-cap ratio is currently at 18%.

What Do Analysts Expect for VLO Stock?

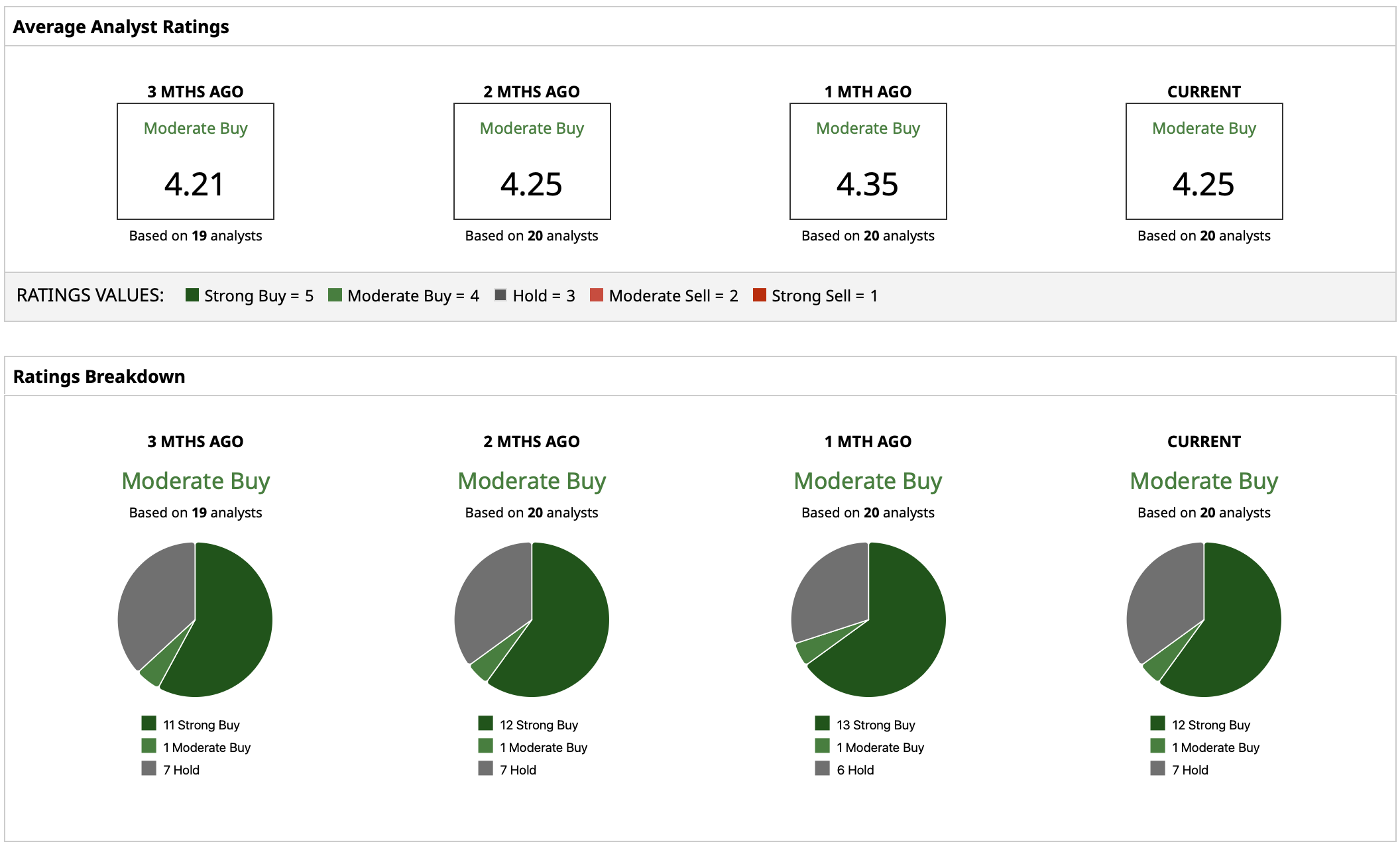

The overall Street research view remains constructive with a “Moderate Buy” rating consensus. Analysts have been incrementally raising their estimates as refining margins have held up better than anticipated through the end of the year. A mean analyst target of $186.72 implies potential upside of approximately 3% from current prices, whereas the highest target of $223 implies market confidence that the profits realized from refinement will continue higher than was assumed.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/McDonald's%20Corp%20arches%20by-%20TonyBaggett%20via%20iStock.jpg)