Sign Up to receive Walsh Trading’s 1st Half of 2026 Market Outlook First Half of 2026 Outlook

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Commentary

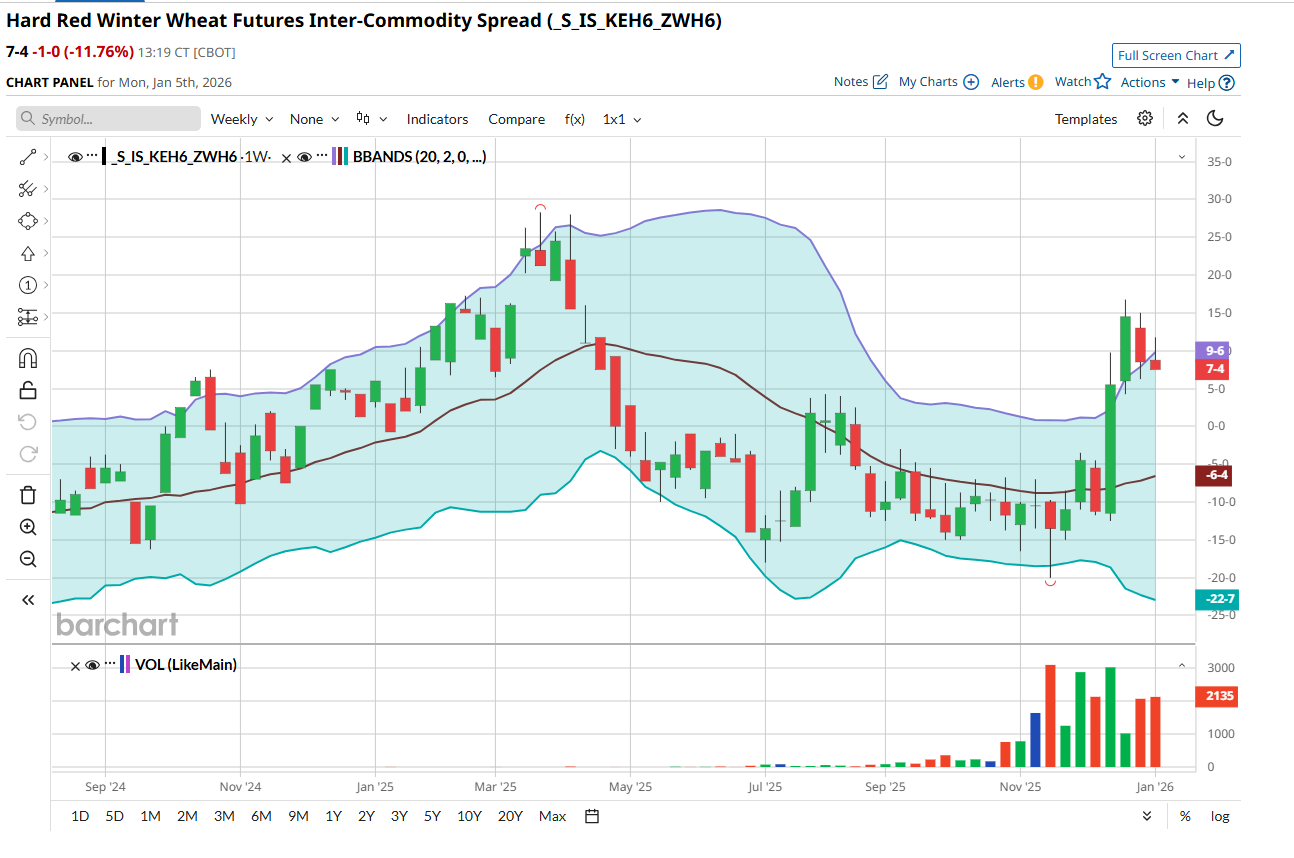

Corn, soybeans, and wheat started the first full week of the new year on the plus side as managed money flow provided support. This was a correction from money flow out of the markets that weighed on futures to finish 2025. Managed funds had sold aggressively since the Christmas rally, and we have close to 100k in Chicago so some short covering is not unexpected in my opinion amid the technical traders may favor the long side this week that will also like the short-term outlook perhaps. However, I still feel that bearish fundamentals will limit rallies. The USDA WASDE report next Monday at 11am will offer little to the wheat market for bullish data with the focus on soybeans and corn. Delayed data regarding export sales report as well as export inspections not pointing to anything bullish from the releases. USDA may need to increase export sales a bit in the WASDE report but will not make a big difference for the US balance sheet in my opinion. The January report usually offers the least number of surprises versus corn and beans in my view. World cash markets are quiet with no major tenders, and cash bids are unchanged out of the Black Sea. The US crop is dormant, and the only change coming to acreage is determined by spring weather (spring wheat) and abandonment (winter wheat) in the January report., Weather – still see this warm/dry pattern in place for the US Southern Plains continuing in the maps that will keep the wheat growing but needing moisture. Crop scouts note that the Hard Red Winter (KC Wheat) stands are good right now, but SRW and WW are not great. Moisture deficits emerging in the Southern Plains should thy occur is key for KC trading above Chicago. Funds ae only short 18K KC vs 100K short Chicago. That is wide. If weather become an issue, we could see Chicago gain and go to a premium vs KC as funds have way more to unwind than KC. Chart below.

Trade Ideas

Futures-N/A

Options-N/A

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

311 S Wacker Drive Suite 540

Chicago, Il 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

/AI%20(artificial%20intelligence)/Image%20of%20server%20racks%20in%20modern%20server%20room%20data%20center%20by%20Sashkin%20via%20Shutterstock.jpg)

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)