Today is the last Friday of 2025. I hope your Christmas Day celebrations were merry and joyful. Next up: New Year’s Eve and 2026.

As I considered what to write for today’s commentary on unusual options activity, it occurred to me that I would be writing before Christmas Day, so I needed a subject that was backward-looking yet still interesting to readers.

I like to look back from time to time to see how past option strategies played out, regardless of their success. Accountability is vital for every investor, myself included.

Looking at the unusual options activity from Nov. 26, I noticed that Tesla (TSLA), Robinhood Markets (HOOD), and FedEx (FDX) had put options expiring in 30 days on Dec. 26 that generated significant income for those who sold them short.

As a result, I’ve decided to look ahead 30 days to see whether these same three stocks can deliver a repeat performance. Here’s what I found.

Have an excellent weekend!

The TSLA, HOOD, and FDX Put Options From Nov. 26

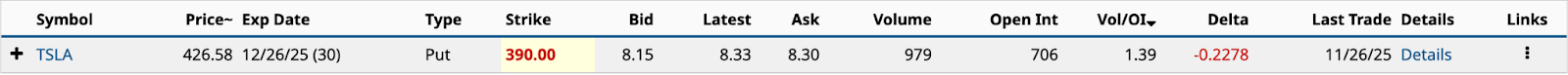

First up is the Tesla Dec. 26 $390 put with a bid price of $8.15. The Vol/OI (volume-to-open interest) ratio was 1.39, above the 1.24 cutoff. Tesla’s closing price on Nov. 26 was $426.58. As of Dec. 23, it was up 13.8% over the previous 18 trading days.

With a short day on the 24th, closed on Christmas Day, and a full day on the 26th, the $8.15 in premium income from selling the put would generate an annualized return of 25.55% [$8.15 bid price / $390 strike price - $8.15 bid price * 365 / 30 days]. The income is secure, and the shares are unlikely to be subject to assignment.

Success.

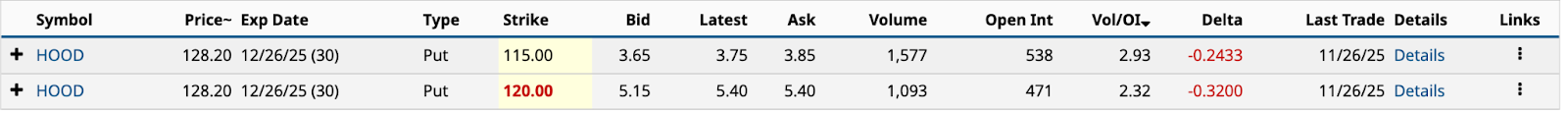

Next up is Robinhood Markets. In this case, there were two to choose from. The $115 put was 11.5% OTM (out of the money), whereas the $120 was OTM by 6.8%. When selling puts, I look for strikes 10% or more OTM to provide a margin of safety.

With the share price closing at $120.24 on Dec. 23, the margin of safety on the $115 strike would be helpful. However, the share price is down nearly 22% since hitting an all-time high of $153.86 in early October, so it’s unlikely to be deep ITM (in the money) at the Dec. 26 expiration.

With the share price closing at $120.24 on Dec. 23, the margin of safety on the $115 strike would be helpful. However, the share price is down nearly 22% since hitting an all-time high of $153.86 in early October, so it’s unlikely to be deep ITM (in the money) at the Dec. 26 expiration.

Worst-case scenario on the $120 strike: you’re assigned the shares, buying them at $114.85 [$120 strike price - $5.15 bid price], a much better entry point than two-and-a-half months ago.

On the $115 strike, your annualized return of 40.3% [$3.65 bid price / $115 strike price - $3.65 bid price * 365 / 30 days] is very healthy. Not as plentiful as the 54.9% annualized return for the $120 strike [$5.15 bid price / $120 strike price - $5.15 bid price * 365 / 30 days], but reasonable nonetheless.

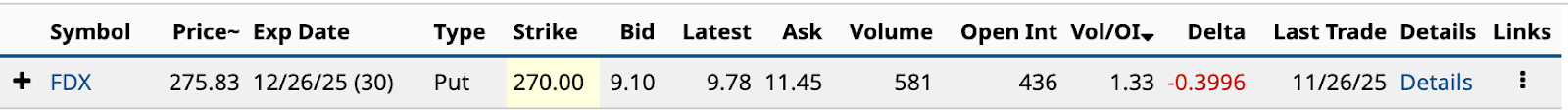

Lastly, we have the FedEx $270 put with a bid price of $9.10. The Vol/OI ratio was 1.33. FedEx’s closing price on Nov. 26 was $275.83. As of Dec. 23, it was up 7.0% over the previous 18 trading days. It’s unlikely that its share price will drop below $270 before Friday’s close. The put’s annualized return is 42.6% [$9.10 bid price / $270 strike price - $9.10 bid price * 365 / 30 days].

Lastly, we have the FedEx $270 put with a bid price of $9.10. The Vol/OI ratio was 1.33. FedEx’s closing price on Nov. 26 was $275.83. As of Dec. 23, it was up 7.0% over the previous 18 trading days. It’s unlikely that its share price will drop below $270 before Friday’s close. The put’s annualized return is 42.6% [$9.10 bid price / $270 strike price - $9.10 bid price * 365 / 30 days].

Based on $2,240 in premium income (using $120 strike) and $78,000 in cash held for the secured puts, the average annualized return is 35.4%.

I like it.

Can We Beat 35%?

I don’t see why not. I’m being facetious. It’s not easy to consistently generate 35% annualized returns from selling puts--but we’ll try just the same.

Tesla should be the easiest to deliver a good return because of its massive options volume—its 30-day average is 2.28 million, compared to 277,050 for HOOD and 14,910 for FDX. I guess we’ll see.

The $390 strike from the previous section has a bid price, as I write this, of $1.86 based on a 31-day DTE (days to expiration). That’s an annualized return of 5.6%, considerably less than the 25.55% return from the 30 days between Nov. 26 and Dec. 23. We’ll have to move closer to the money.

The Jan. 23/2026 $455 put has an annualized return of 29.3%. That’s great, but the Vol/OI ratio is just 0.14, well below the 1.24 cutoff.

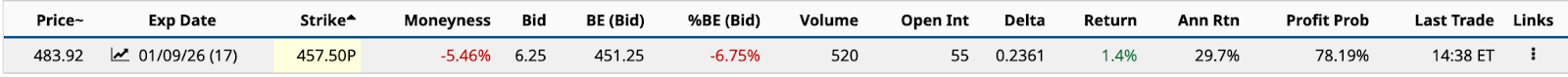

Due to limited choice, I'll have to use a different DTE. The Jan. 9/2026 $457.50 put expires in 17 days from Dec. 23 with a bid price of $6.25, an annualized return of 29.7%, and a Vol/OI ratio of 9.45.

OTM by 5.46%, the profit probability remains high, at 78.19%. I may have to use Jan. 9/2026 puts for HOOD and FDX.

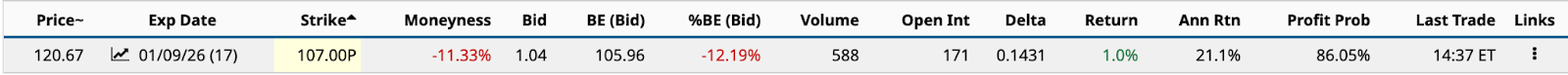

It won't be easy to find a put OTM that will generate a nearly 55% annualized return like the Dec. 26 $120 put. The best I can do—keeping in mind I’m looking for unusual options activity—is the Jan. 7/2026 $107 put.

It has a bid price of $1.04, an annualized return of 21.1%, and a 3.43 Vol/OI ratio. More importantly, an 86.05% probability of profit means there’s a good chance the share price will be above the $105.96 breakeven in 17 days.

It has a bid price of $1.04, an annualized return of 21.1%, and a 3.43 Vol/OI ratio. More importantly, an 86.05% probability of profit means there’s a good chance the share price will be above the $105.96 breakeven in 17 days.

Lastly, and the toughest of the three, is FedEx. I don’t see any of the put strike prices for Jan. 9/2026 having Vol/OI ratios above 1.24. The remaining January expiration dates also show low volume.

FedEx is out for income generation in January.

The Bottom Line Result

Reducing the DTE to 17 days from 30 has enabled me to find reasonable annualized returns of 29.7% and 21.1% for Tesla and Robinhood, respectively.

Based on $729 in premium income and $56,450 in cash held for the secured puts, the average annualized return would be 27.7%, 770 basis points lower than the returns generated by the three stocks over the past 30 days.

While disappointing, given FedEx’s low options volume, the outcome was somewhat predictable.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)