Merry Christmas to Barchart readers everywhere. I hope Santa’s been good to you and your family. It’s been another solid year for the markets.

The S&P 500, as I write this, is up 16.2% with only a handful of trading days left in 2025. It is the fourth consecutive year of annual gains. There have been six instances since 1928 in which the index has delivered four consecutive years or more of positive returns; the record, however, is eight, set between 1982 and 1989.

I find it hard to believe we’ll get anywhere close to the record, given stock valuations appear vastly overvalued relative to historical norms.

That said, wise investors know that time “in” the markets is far more important than “timing” the markets. If you’re nervous about your portfolio, you can always scale back your equity exposure, moving some of your assets to cash, fixed-income investments, or commodities such as gold.

Alternatively, you could use options to gain exposure to companies you like, without the significant upfront cash outlay.

With this in mind, I’ve identified nine stocks worth owning for the long term based on their unusual option activity to guide the way.

You’ll notice that the first letters of the nine companies spell C-H-R-I-S-T-M-A-S. Not only did they have to be reasonably attractive businesses, but they also had to have Vol/OI (volume-to-open-interest) ratios of 1.24 or higher and corporate names starting with one of the nine letters spelling out the big day—no easy task.

Happy Holidays!

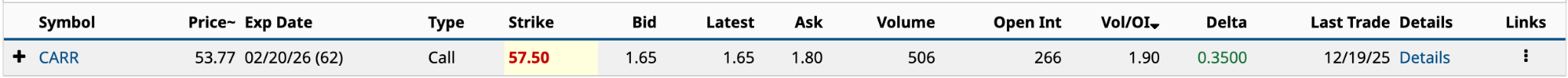

Carrier Global (CARR)

Carrier Global (CARR), the global HVAC business, was spun off by United Technologies in April 2020. Its stock’s had a rough go in 2025, down over 21% year-to-date. It’s trading at one of its lowest levels over the past two years.

I wrote about Carrier in April 2024, suggesting that “Carrier is a sensible long-term investment for anyone who thinks climate change is real.”

OTM (out of the money) by 6.5%, the $1.80 ask price is just 3.35% of its Dec. 19 closing share price. You can double your money by selling the call before expiration if the share price appreciates by $5.14 (9.6%) over the next two months. The expected move is $5.27, so it’s possible.

Analysts like Carrier stock. Of the 22 rated, 12 rate it a Buy (4.00 out of 5), with a target price of $72.85, well above its current share price.

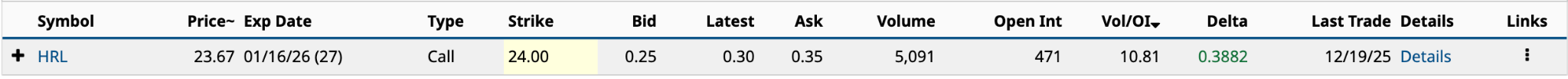

Hormel Foods (HRL)

Betting on Hormel (HRL) is a bit of a Hail Mary. The shares are down nearly 24% year-to-date in 2025.

The good news is that its earnings per share for Q4 2025 were $0.32, two cents above Wall Street’s estimate. Further, the company’s EPS estimate for fiscal 2026 (October year-end) is $1.47. While down from $1.58 in fiscal 2024, it is up 7.2% from $1.37 in 2025.

Its shares trade at a reasonable 16.1 times the 2026 estimate. The shares only have to appreciate by 90 cents (3.8%) over the next month to double your money by selling before expiration. The expected move is 98 cents. Worst case, you close out the call for a slight loss and roll it forward.

Ultimately, it has some strong brands like Planters, Skippy, and Wholly Guacamole.

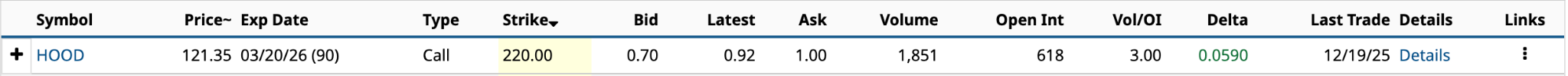

Robinhood Markets (HOOD)

How expensive is Robinhood Markets (HOOD) stock? With its stock up nearly 230% in 2025, it trades at 50.8 times its latest 12-month earnings per share, according to S&P Global Market Intelligence.

Its customer base has grown— 26.8 million funded accounts, 10% higher in Q3 2025 alone — driving significant revenue and profit growth. In the third quarter, revenues increased by 100%, while earnings per share jumped 259% to $0.61. Sequentially, its revenue in the latest quarter was 29% higher than in Q2 2025, while its net income increased by 44% from June 2025.

Of the 22 rated, 16 rate it a Buy (4.27 out of 5), with a target price of $155.89, 28% above its current share price.

With an expected move of $25.29 and an ask price of $1.00, the risk/reward proposition seems tilted in your favor.

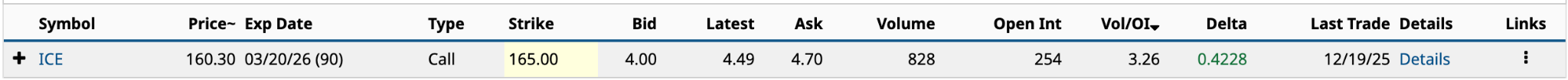

Intercontinental Exchange (ICE)

Intercontinental Exchange (ICE) acquired NYSE Euronext in November 2013 for approximately $11 billion. Since the acquisition's completion, its stock has gained 293% despite two big corrections in 2022 and 2025.

In October, ICE invested $2 billion in Polymarket, a leading prediction markets platform. As part of the investment, ICE will distribute Polymarket data related to its prediction market bets to its institutional investor customers. Unless you’ve been living under a rock the past year, you know that prediction markets are all the rage. Some day, they could be more popular than regular investing.

The March 20 $165 call had an ask price of $4.70 at the Dec. 19 close. That’s just 2.9% of its $160.30 closing share price. While the odds of the share price being above the $169.70 breakeven at expiration are about 30%, the small outlay makes the risk worth it.

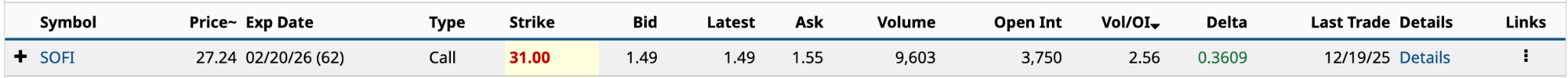

SoFi Technologies (SOFI)

While SoFi Technologies' (SOFI) stock hasn’t gained as much as Robinhood's, the share price is still up 78% with just days left in 2025. I can remember when the media wondered if its shares were worth $10, let alone $27.

CEO Anthony Noto is an exceptional leader. He’s skillfully scaled the financial services platform. It now has 12.6 million members, generating $3.29 billion in revenue for the trailing 12 months ended Sept. 30. More importantly, it is generating operating profits — $401.1 million in the past 12 months — up from an operating loss of $453.8 million in 2021.

Trading at nearly 50 times the earnings per share estimate for the next 12 months, while it might appear excessive now, in five years, you’ll be glad you didn’t let valuation concerns stop you from betting on its excellent fintech growth story.

You could generate a 50% return by selling the call before expiration if the share price appreciates by $2.15 or 7.9%.

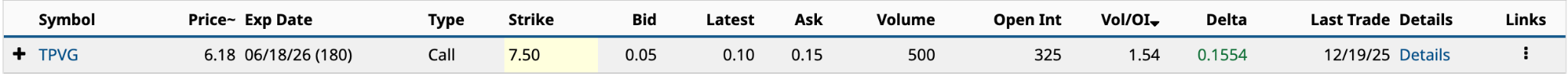

TriplePoint Venture Growth BDC (TPVG)

For several reasons, TriplePoint Venture Growth BDC (TPVG) would be the contrarian play of the nine companies in this article.

For starters, BDCs (business development companies) have become entangled with the private credit worries swirling around the country heading into 2026. In October, JPMorgan (JPM) CEO Jamie Dimon suggested analysts should look more closely at the private credit risks carried by these middle-market direct lenders.

Secondly, TPVG provides debt and equity financing to venture- and growth-stage companies in technology and other high-growth industries, backed by leading venture capital firms. The venture capital business is inherently risky. Should investors lose confidence in private credit, BDCs will have much more difficulty securing capital to lend.

As a result of these two risks, TPVG stock is down nearly 15% in 2025. With six months until expiration, you’ve got plenty of time to see if your small $15 contrarian bet pays off.

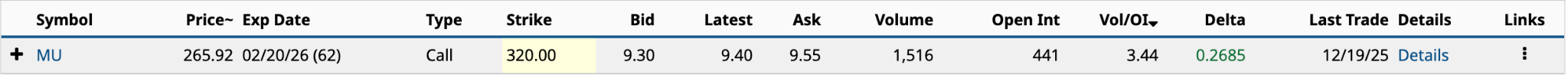

Micron Technology (MU)

On Dec. 16, the day before Micron Technology (MU) reported Q1 2026 earnings, I discussed the maker of high-performance DRAM (Dynamic Random Access Memory) and other memory and storage products’ unusual price volume from the previous day.

“I would not be in a rush to buy MU stock. Wait for tomorrow’s earnings to figure out where it’s headed in the near-term,” I wrote. The price-volume suggests MU could be lower. However, in hindsight, $233 will be a good entry point for a long-term hold.”

Sure enough, after the markets closed on Dec. 17, Micron reported excellent first-quarter results. Its stock’s been on a tear ever since. Further, its Q2 2026 revenue guidance of $18.7 billion at the midpoint was 30% higher than Wall Street’s expectations. That will lead to much higher profits.

While I should have encouraged aggressive investors to buy calls before earnings, at least I said $233 would look like a good long-term buy. Trading in the $270s as of Dec. 22, it sure does.

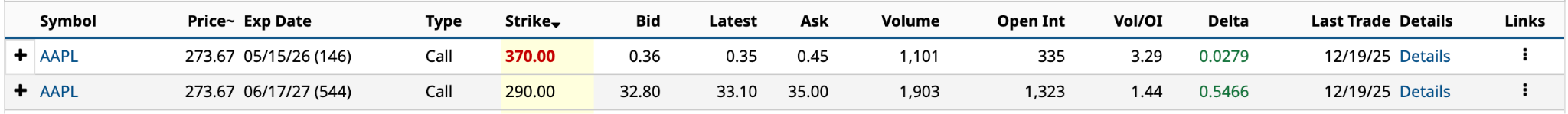

Apple (AAPL)

Except for Amazon (AMZN), Apple (AAPL) is the worst-performing Mag 7 stock over the past 12 months, up 6% as of Dec. 22, which is less than half the S&P 500's return.

On Dec. 17, Morgan Stanley raised its price target on AAPL by $10 to $315 while maintaining an Overweight rating. The firm’s analysts believe Apple’s fiscal 2027 earnings will be higher at $9.83 per share due to higher prices, increased iPhone shipments and a payoff on its AI investments.

In addition, 2026 could see CEO Tim Cook transition out of the role, providing investors with succession certainty, which has been a concern this year.

I’ve included two calls because of the enormous gap between the two ask prices. The $370 call’s $0.45 ask price is just 0.2% of its Dec. 19 closing share price. It needs only to increase by $16.13 (5.9%) to double your money by selling before next May. It’s unlikely to get anywhere near $370, whereas the $290 call is very reachable over the 18-month DTE.

Starbucks (SBUX)

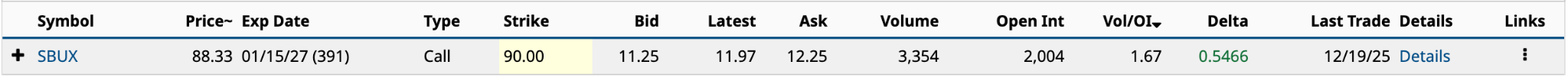

Lastly, we have the Starbucks (SBUX) Jan. 15/2027 $90 call, which doesn’t expire for another year and a month. A lot could happen to the world’s largest coffee chain in that time. The expected move is $19.16, up or down, significantly higher than the $13.92 move needed to hit the $102.25 breakeven.

Analysts are lukewarm about Apple stock. Of the 34 that rate it, only 17 give it a Buy rating (3.71 out of 5), with a $92.48 target price that is less than 5% above its current price.

CEO Brian Niccol continues to work on the company’s turnaround. There are signs it’s gaining traction, including higher traffic and stronger September results, which have led some analysts to view it more favorably.

While the $12.25 ask price is a high 13.9% of Starbucks’ Dec. 19 closing price, the 391-day DTE provides enough time for a successful turnaround to play out fully. As a long-time customer, I believe it will, but before the stock can really take flight, the Seattle firm must repair its strained relationship with frontline employees.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Quantum%20Computing/Image%20by%20Funtap%20via%20Shutterstock.jpg)