/Lululemon%20Athletica%20inc_%20logo%20on%20shop%20by-%20FinkAvenue%20via%20iStock.jpg)

Lululemon Athletica’s (LULU) once-gold-plated brand has been going through a rough stretch, and the market has not been forgiving. After years of premium growth and cult-like loyalty, the athleisure giant has stumbled into 2025 facing a mix of self-inflicted missteps and tougher industry dynamics. Management has twice cut full-year guidance, the CEO has publicly acknowledged stale product lines and slow execution, and competition from fast-rising rivals is intensifying. Add a broader fashion shift toward looser silhouettes and more variety, and the pressure has clearly shown up in LULU stock.

The turbulence has spilled beyond operations. Lululemon is set to exit the Nasdaq 100 ($IUXX) following the index’s annual reshuffle, a symbolic blow that can also trigger selling as index funds rebalance. Leadership change is imminent, with CEO Calvin McDonald preparing to step aside, leaving investors wondering what the next chapter will look like.

Yet even as sentiment around Lululemon darkens, one high-profile contrarian is leaning the other way. Michael Burry, the investor made famous by his prescient bet against the subprime mortgage market ahead of the 2008 financial crisis, has flagged LULU stock as a name worth holding despite its sharp decline.

Known for stepping into stocks others are eager to abandon, Burry has argued that periods of heavy selling, often driven by tax-loss harvesting and portfolio window dressing, can distort fundamentals. With Lululemon down 50% from its 2025 highs, Burry believes the pessimism may be overdone and sees LULU stock as “at minimum” a multi-year hold rather than a throwaway.

Is Michael Burry’s bullish view a sign that Lululemon’s bruising year marks the start of a long-term reset, and a buying opportunity for investors today?

About Lululemon Stock

Founded in 1998 and headquartered in Vancouver, Lululemon designs and markets athletic apparel, footwear, and accessories for men and women. The company’s product range — including pants, shorts, tops, and jackets — targets consumers pursuing active, healthy lifestyles such as yoga and running.

With a market capitalization of $24.8 billion, Lululemon operates globally through company-owned stores, outlets, e-commerce platforms, and partner channels, serving customers across North America, China, and other international markets.

After a pandemic-fueled surge that carried shares to an all-time high of $516.39 in late December 2023, gravity set in. Since then, the stock has been cut down sharply, sliding more than 60% as U.S. demand softened, product cycles lost some spark, and consumers turned selective with discretionary spending. Add intensifying competition, tariff pressure on e-commerce margins, and slowing growth, and investor confidence steadily leaked out. By September, LULU had fallen to a low of $159.25. Shares are down 44% year-to-date (YTD) and down 7% over the past six months.

For much of this period, the chart echoed the pessimism. Prices hugged the lower Bollinger Band, momentum was fragile, and rallies struggled to sustain. The 14-day RSI dipped into oversold territory in September, reflecting exhaustion rather than conviction. But markets rarely move in straight lines, and the tone has shifted over a month, especially recently, after the company’s stronger-than-expected third-quarter results.

Momentum is now clearly rebuilding. The 14-day RSI has climbed steadily and sits near 74, pushing into overbought territory — a sign not just of heat, but of renewed demand. The MACD tells a similar story, with the yellow MACD line firmly above the blue signal line and the histogram positive, pointing to strengthening bullish momentum. Volume has expanded alongside the price move, suggesting participation rather than a thin, speculative bounce.

Most telling, the stock is trading above the upper Bollinger Band. That often flags overbought conditions, but it can also signal a powerful trend asserting itself. After a long fall, Lululemon’s chart is starting to look less like surrender and more like a stock trying to stand back up.

From a valuation lens, Lululemon no longer looks stretched. The stock now trades at a forward earnings multiple of about 16, well below its own history and the broader apparel sector. Still, cheap does not mean easy. U.S. growth is cooling, tariff pressures linger, and margin risk remains elevated, leaving investors to balance value against uncertainty.

Lululemon’s Impressive Q3 Results and Outlook

Lululemon’s Q3 earnings results marked a cautious turning point rather than a victory lap. Reported on Dec. 11, the report sparked a near-10% rally in the subsequent trading session, easing fears that the brand’s growth engine was stalling.

Revenue climbed 7.1% year over year (YOY) to $2.57 billion, comfortably ahead of Wall Street’s expectations. The real momentum came from outside the U.S., where international revenues surged 33% on both a reported and constant-dollar basis. By contrast, the Americas continued to weigh on results, with net revenues down 2% and comparable sales falling 5%. Globally, comps edged up 1%, or 2% in constant dollars, held together by an 18% jump internationally.

Profitability, however, told a more complex tale. EPS came in at $2.59, down 9.8% YOY, reflecting softer margins pressured by higher markdowns, tariffs, and elevated SG&A expenses. Gross margin contracted by 290 basis points to 55.6%, driven largely by product margin erosion. Still, the decline was far better than management’s feared drop, thanks to stronger demand, lighter tariff impact, and tighter cost discipline.

Operationally, the business stayed steady. Store sales were flat on a constant-dollar basis, while digital revenue rose 13%, contributing $1.1 billion, or 42%, of total sales. Lululemon added 12 net new stores, ending the quarter with 796 locations. Financially, the balance sheet remained pristine, with $1 billion in cash, no debt, and a reinforced commitment to buybacks.

Lululemon’s outlook for the fourth quarter and full fiscal 2025 reflects a business still navigating pressure points, but with improving visibility and discipline. In Q4, the company plans to open 17 net new company-operated stores and complete eight store optimizations, while managing inventory levels that are expected to rise in the high teens on a dollar basis and in the high single digits per unit. Management attributed the inventory build largely to higher tariffs and unfavorable currency movements rather than demand weakness.

For the full fiscal year 2025, Lululemon now expects to open 46 net new stores, alongside 36 co-located optimizations. Overall square footage is projected to grow at a low-double-digit pace. About 15 new stores are slated for the Americas — roughly nine in Mexico — while the bulk of expansion will come internationally, led by China.

Financially, the company raised its full-year guidance. Net revenues are now expected to land between $10.96 billion and $11.05 billion. EPS for fiscal 2025 is projected at $12.92 to $13.02, with gross margin now expected to decline 270 basis points, an improvement from earlier estimates.

For Q4, Lululemon expects revenues of $3.5 billion to $3.59 billion and EPS of $4.66 to $4.76, reflecting near-term margin pressure but a steadier long-term trajectory.

Analysts tracking Lululemon are not exactly breaking a sweat over its growth. EPS for fiscal 2025 is expected to slip nearly 11% YOY to $13.07.

Why Michael Burry Sees Value in Lululemon

Michael Burry’s bullish stance on Lululemon is rooted less in fashion trends and more in valuation discipline. The stock’s steep decline, driven by guidance cuts, leadership uncertainty, and heavy year-end selling, is a classic case of sentiment overshooting fundamentals. In Burry’s view, tax-loss harvesting and portfolio window dressing have amplified the downside, probably pushing LULU into what he considers value territory.

Strong brands with global reach rarely lose their economic moat overnight, even when execution falters. With LULU trading well below prior highs, the downside risk is increasingly priced in. For Burry, Lululemon represents not a broken business, but a bruised one, offering patient investors a margin of safety over a three- to five-year horizon.

What Do Analysts Expect for Lululemon Stock?

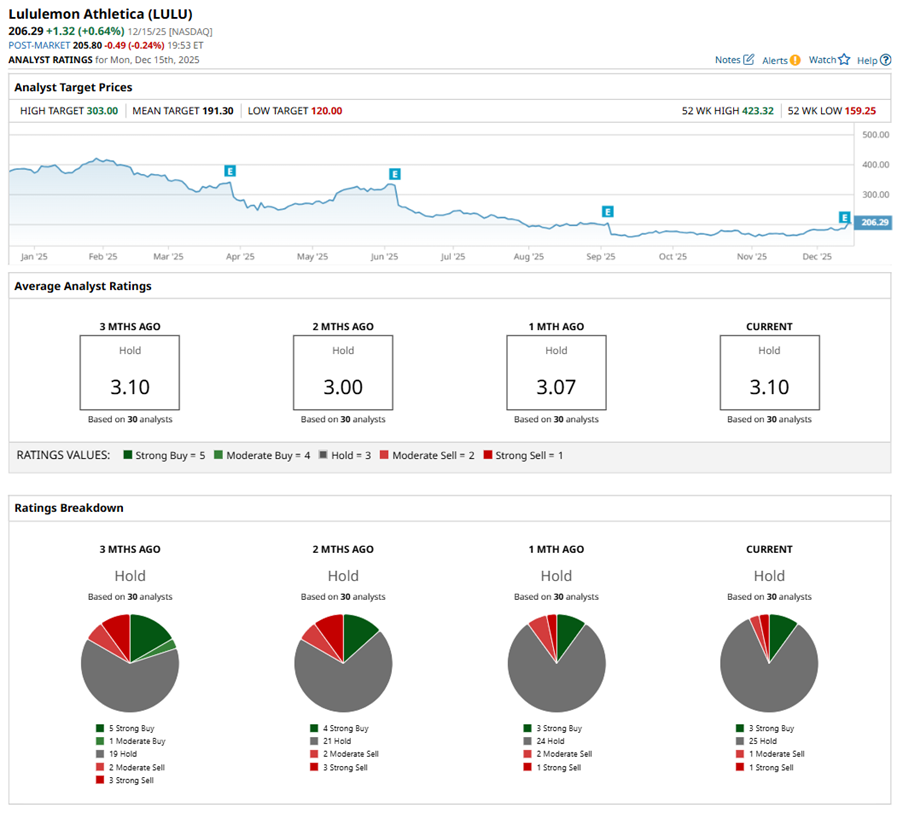

Wall Street remains measured in its stance on Lululemon. The stock currently carries a consensus “Hold” rating, reflecting a wait-and-see mood rather than outright confidence. Of the 30 analysts tracking the name, only three rate it a “Strong Buy,” while a majority of 25 analysts are on the sidelines with “Hold” recommendations. On the bearish end, one analyst has a “Moderate Sell” and another a “Strong Sell” rating.

Following the recent rally, LULU stock has already climbed above the Street’s average price target of $205.65, suggesting near-term expectations may be largely priced in. That said, the Street-high target of $303 implies upside of nearly 42%, highlighting the sharp divide between cautious consensus and bullish outliers.

Final Thoughts on LULU

Lululemon’s story today is less about flawless execution and more about resilience under pressure. The brand is navigating missteps, leadership change, and a tougher competitive landscape, all while investors remain skeptical.

Yet Michael Burry’s contrarian interest suggests the selloff may have gone too far. For investors willing to stomach uncertainty, LULU stock now sits at a crossroads — either a prolonged stumble, or a reset that rewards patience over panic.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Alphabet%20Inc_%20and%20Google%20logos%20seen%20displayed%20on%20a%20smartphone%20by%20IgorGolovniov%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)