/Close-up%20shot%20of%20Rivian%20R1T_%20Image%20by%20Trong%20Nguyen%20via%20%20Shutterstock_.jpg)

Rivian Automotive (RIVN) shares have more than doubled already over the past eight months, but a senior Wedbush Securities analyst believes they will push further up in 2026.

Dan Ives maintained his “Outperform” rating on RIVN last week and raised his price target to $25, indicating potential upside of another 11% from current levels.

At the time of writing, Rivian stock is trading near its two-year high of of $22.64.

Why Is Wedbush Constructive on Rivian Stock?

Wedbush’s positive call on RIVN shares arrives only days after the electric vehicles (EV) specialist laid out ambitious self-driving goals at its inaugural “Autonomy & AI Day.”

These included a launch of proprietary autonomy processor (RAP1) and an autonomy subscription service in 2026.

According to Dan Ives, this accelerated push into self-driving will unlock new sales avenues while keeping costs in check.

Additionally, the R2 rollout will help improve delivery metrics and drive Rivian stock higher next year, he told clients in his latest research note.

Note that the EV company is currently trading decisively above its key moving averages (50-day, 100-day, 200-day) – indicating the bulls are in control heading into 2026.

Are RIVN Shares Expensive Heading Into 2026?

Rivian Automotive came in handily above Street estimates in its recently concluded quarter, which makes the EV stock even more attractive for the coming year.

The company’s multibillion-dollar joint venture with a legacy automaker Volkswagen (VWAGY) makes up for another strong reason to believe RIVN can strengthen its competitive positioning.

From a valuation perspective as well, Rivian remains super attractive, despite its months-long rally. At the time of writing, it’s going for about 5x sales only – significantly cheaper than over 16x for Tesla (TSLA).

Finally, seasonal patterns also warrant buying Rivian shares here, given they’ve historically rallied over 6% in January.

How Wall Street Recommends Playing Rivian Automotive

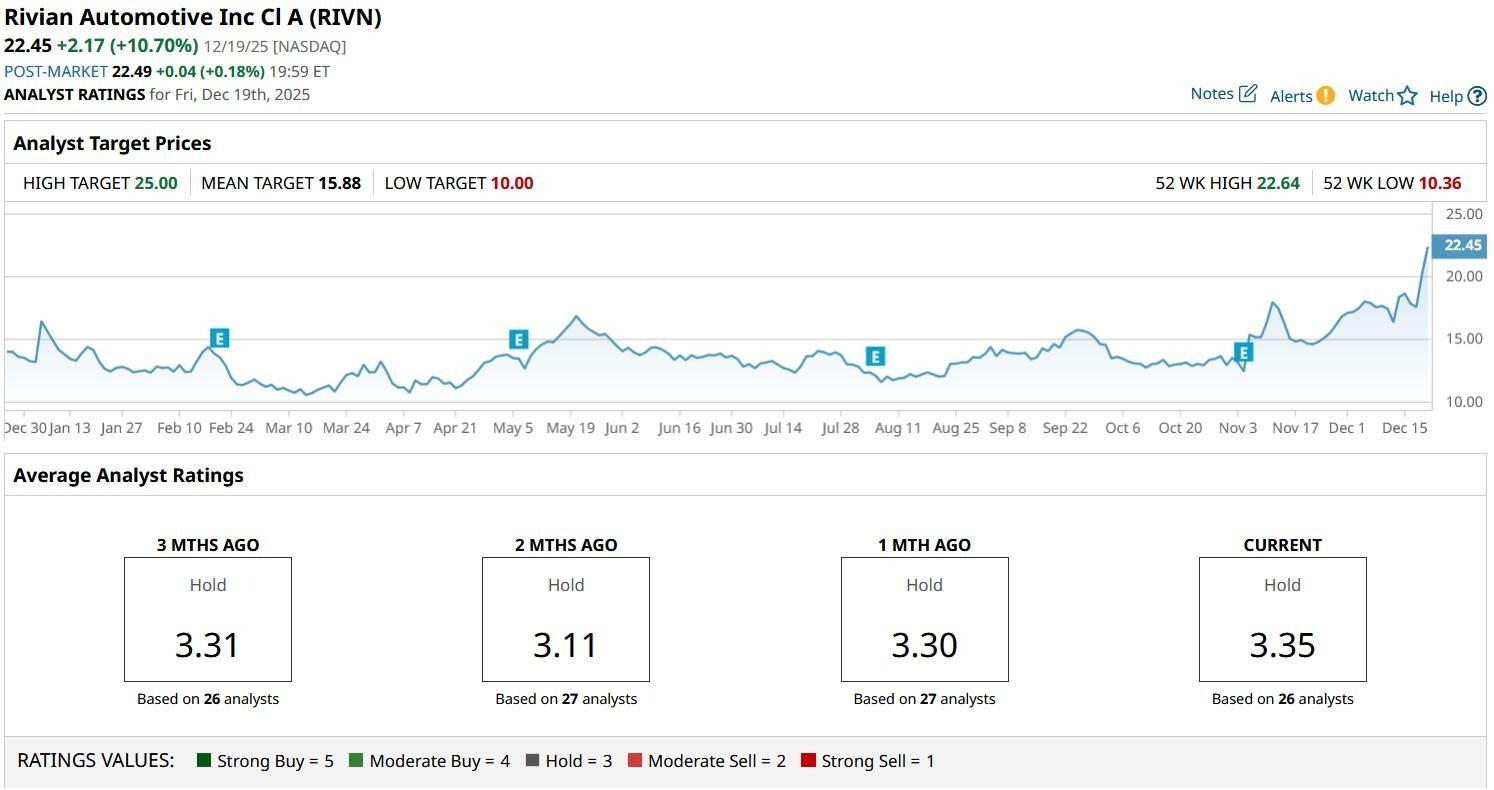

Other Wall Street analysts, however, aren’t as bullish on RIVN stock as Dan Ives.

According to Barchart, the consensus rating on Rivian shares currently sits at “Hold” only, with the mean target of about $16 indicating potential downside of about 28% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)