While most investors remain focused on mega-cap tech and index performance, a different story has been unfolding beneath the surface. In a recent Market on Close livestream, Senior Market Strategist John Rowland, CMT, highlighted a signal that often precedes sector leadership: broad participation, improving momentum, and confirmation from both economic data and price action.

That story is playing out right now in healthcare.

Why Healthcare Momentum Matters Right Now

One of the most telling signs of a healthy trend isn’t headlines; it’s participation. When John examined the healthcare sector, what stood out immediately was how many stocks were trading above their key moving averages.

Across the sector, a growing percentage of names are holding above their 50-day, 100-day, and 200-day moving averages. That alignment signals sustained demand, not just short-term speculation.

At the same time, the latest jobs report added fuel to the thesis. Of the roughly 69,000 private-sector jobs added, nearly two-thirds came from healthcare alone. That kind of concentration points to real economic momentum, not just market rotation.

This combination — technical strength paired with labor-market confirmation — is often where durable trends begin.

Beating the Index Starts With the Right Filters

Rather than guessing which healthcare names might work, John leaned on a framework taught by our Chart of the Day columnist Jim Van Meerten: if you want to outperform, start by identifying stocks already beating the index.

Using Barchart’s market sector tools and Custom Views, healthcare stocks were sorted by weighted alpha — a metric designed to measure performance relative to the broader market. While the broad healthcare ETF (XLV) is performing roughly in line with the S&P 500 Index ($SPX), many individual names inside the sector are already pulling ahead.

That dispersion is important. It tells us leadership is emerging at the stock level, even if the sector ETF hasn’t fully broken out yet.

Bristol-Myers (BMY): Value Meets Momentum

Bristol-Myers Squibb is a name John has followed — and owned — in the past, and it recently checked multiple boxes at once.

From a longer-term perspective, BMY had already gone through a multi-year decline, resetting expectations and valuations. What changed was structure. The stock began forming higher lows, then broke out of a well-defined range, signaling a shift from distribution to accumulation.

That breakout turned what began as a value idea into a momentum-driven trade, and so far the follow-through has been constructive. At current levels, John noted he’d be more focused on managing gains and watching for consolidation — a reminder that momentum trades can evolve into longer-term investments when conditions stay favorable.

Pairing Momentum With a Tactical Setup: AHR

While BMY illustrates what healthcare momentum can look like once it’s established, John also flagged a developing opportunity — one that fits a very different profile.

American Healthcare REIT (AHR) operates in senior housing, skilled nursing, and medical office real estate — an area directly tied to one of the strongest secular trends in the U.S.: an aging population.

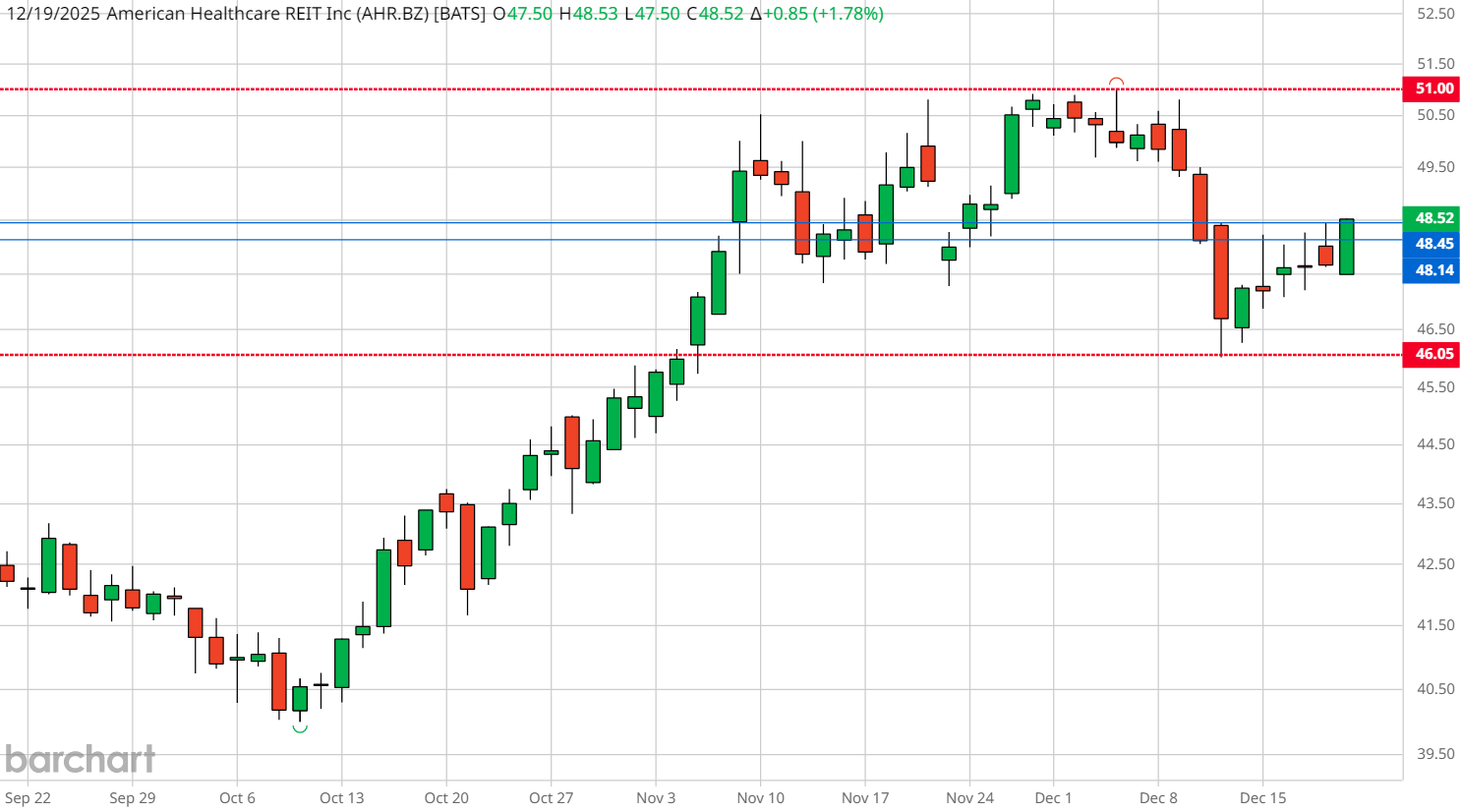

From a technical perspective, AHR is approaching a critical resistance zone near $48.50. Clearing that level would complete the trigger phase of a classic 3-Candle Drop reversal setup, a pattern John has traded throughout his career.

If price can break and hold above that level, the next resistance zone sits near $51, with a measured upside target closer to $55. Failure to clear resistance, however, would invalidate the setup — making this a defined-risk, rules-based trade rather than a prediction.

Importantly, this technical setup is reinforced by fundamentals. AHR has completed more than $950 million in acquisitions year-to-date, focused squarely on operating senior healthcare assets that management expects to drive growth into 2026 and beyond.

John has disclosed that he owns shares, reinforcing that this is not a hypothetical chart pattern, but an actively monitored opportunity.

Why Healthcare Deserves a Spot on Your Watchlist

Healthcare doesn’t move like high-beta tech. It rarely makes headlines at the top or bottom. Instead, it tends to build quietly — supported by demographics, employment growth, and steady capital deployment.

Right now, the sector is showing:

- Improving breadth beneath the surface

- Individual stocks outperforming the index

- Technical structures shifting from basing to trending

- Real-world economic demand supporting price action

That combination is exactly where traders and investors should be paying attention.

How to Explore These Opportunities on Barchart

You can follow this same process using Barchart’s tools:

- Check market performance and S&P Sectors for healthcare stock lists

- Screen using Custom Views sorted by weighted alpha

- Use interactive charts to monitor moving averages and resistance levels

- Check out our candlestick pattern education, including the 3-Candle Drop

Healthcare doesn’t need hype to work, it just needs confirmation. And right now, the charts are starting to provide it.

Watch this clip for healthcare stock picks:

- Stream the full episode of Market on Close

- Explore stocks in the S&P Healthcare sector for momentum on Barchart

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Microsoft%20France%20headquarters%20by%20JeanLuclchard%20via%20Shutterstock.jpg)

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/International%20Business%20Machines%20Corp_%20logo%20on%20storage%20rack-by%20Nick%20N%20A%20via%20Shutterstock.jpg)

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)