/Henry%20Schein%20Inc_%20logo%20on%20phone-by%20Piotr%20Swat%20via%20Shuttestock.jpg)

With a market cap of $9 billion, Henry Schein, Inc. (HSIC) is a global provider of healthcare products and services for office-based dental and medical practitioners, as well as alternate sites of care worldwide. The company offers a comprehensive range of dental and medical supplies, equipment, pharmaceuticals, and technology solutions, including practice management software and digital services.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Henry Schein fits this criterion perfectly. Henry Schein serves dental practices, laboratories, physician offices, ambulatory surgery centers, and institutional health care providers.

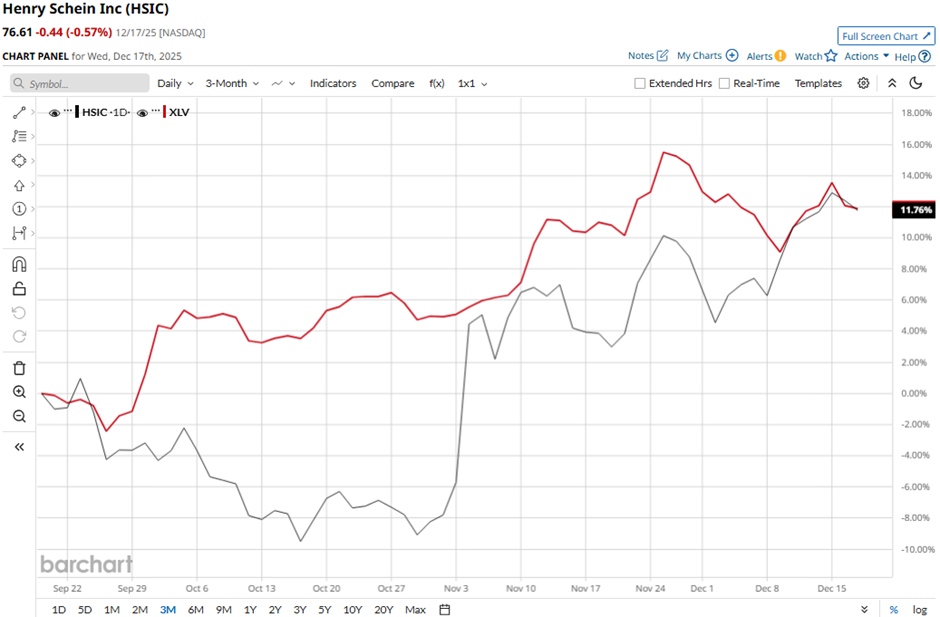

Shares of the Melville, New York-based company have decreased 7.1% from its 52-week high of $82.49. HSIC stock has soared 13.7% over the past three months, slightly outpacing the Health Care Select Sector SPDR Fund’s (XLV) 12.1% gain over the same time frame.

Longer term, HSIC stock is up 10.7% on a YTD basis, slightly lagging behind XLV’s 11.8% increase. Moreover, shares of the company have risen 4.7% over the past 52 weeks, compared to XLV’s 10.5% return over the same time frame.

However, the stock has been trading above its 50-day and 200-day moving averages since November.

Shares of Henry Schein climbed 10.8% on Nov. 4 after the company reported strong Q3 2025 results, with adjusted EPS of $1.38 beating expectations and rising from $1.22 a year earlier, while revenue of $3.34 billion exceeded forecasts. Investors also reacted positively to the company raising its full-year 2025 adjusted EPS guidance to $4.88 - $4.96 and increasing expected sales growth to 3% - 4%.

In comparison, rival Quest Diagnostics Incorporated (DGX) has outpaced HSIC stock. DGX stock has returned 18.7% on a YTD basis and 15.2% over the past 52 weeks.

Despite HSIC’s underperformance relative to its peers, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of “Moderate Buy” from 16 analysts in coverage, and the mean price target of $77.64 is a premium of 1.3% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/ServiceNow%20Inc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)