/AI%20(artificial%20intelligence)/AI%20software%20engineering%20by%20Tapati%20Rinchumrus%20via%20Shutterstock.jpg)

Robotics stocks have put their silent flight into tangible commerce. Businesses are fighting over a way to automate delivery, logistics, and the last mile. Most of the companies continue to make assurances without much evidence. Investors tend to reward companies for their ability to expand real technology, other than testing projects.

One name, Serve Robotics (SERV), recently passed that standard. The firm claimed that it achieved its 2025 objective of deploying over 2,000 autonomous delivery robots ahead of time and within the budget. That qualifies it as the largest sidewalk delivery fleet in the U.S. It has already deployed its robots in large cities and plans to roll out more in early 2026. Serve is actually making gains when the government is creating greater backing for robotics.

For investors considering young automation winners, the latest success of SERV raises a significant question: Should they buy this robotics stock? Let's find out

About Serve Robotics Stock

Based in California, Serve Robotics is a startup spun out of Uber (UBER) in 2021 that designs and operates small, AI-powered delivery robots for last-mile food delivery. Its low-emission sidewalk robots already serve Uber Eats and 7‑Eleven, and it has multi-year contracts to deploy up to 2,000 robots across U.S. cities. The company’s fleet has completed well over 100,000 deliveries to date and recently expanded service partnerships with DoorDash (DASH) and Uber to tap new customer bases.

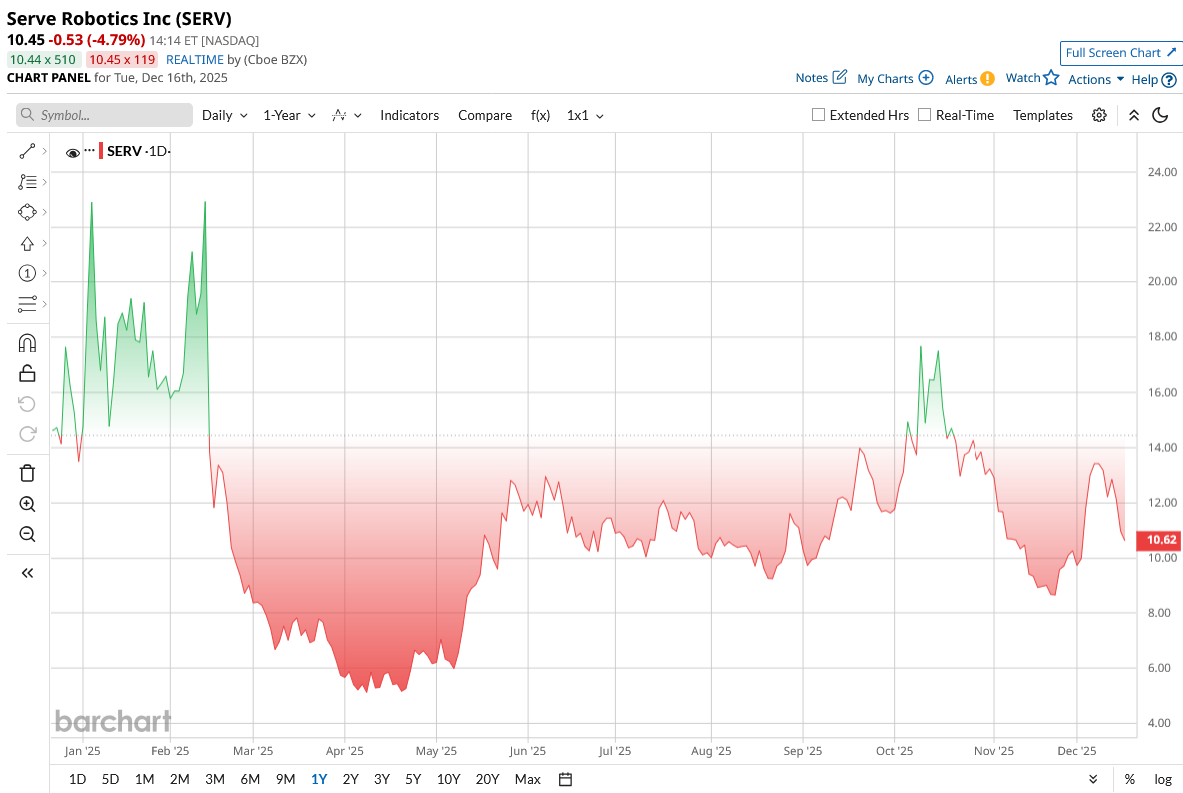

Valued at a small market cap of around $900 million. Year-to-date in 2025, SERV’s stock has mostly gone down by roughly 20%. It currently trades around $10 to $11, near its 50-day and 200-day moving averages.

On a valuation basis, SERV appears richly valued. Its stock trades at about 37 times expected sales, much higher than the industry average of 7. Serve Robotics has a price-to-book (P/B) ratio of roughly 3.3x, which is similar to its peers in the robotics and tech sector, typically ranging between 3x and 4x. This shows that while the P/B is in line with competitors, the stock’s very high price-to-sales ratio makes it appear richly valued overall.

What This Milestone Means

On Dec. 12, Serve confirmed it had deployed its 2,000th delivery robot across seven U.S. markets. Investors treated the news as largely expected, with the stock plunging nearly 5%, reflecting that the milestone was already priced in following contracts with Uber Eats and DoorDash.

Analysts note Serve now operates the largest sidewalk delivery fleet in the U.S., posting a 99.8% delivery completion rate and 66% sequential volume growth in Q3. While some market observers cautioned the stock may appear overvalued on current metrics, hitting the 2,000-robot target reinforces Serve’s operational execution rather than adding near-term revenue.

The milestone’s significance is strategic. It strengthens Serve’s lead in autonomous sidewalk delivery and supports management’s plan for roughly 10x revenue growth in 2026.

Serve's Third-Quarter 2025 Results

Serve Robotics reported its third-quarter 2025 results on Nov. 12, and the numbers showed a company growing fast but still spending heavily to scale.

Revenue climbed to about $0.69 million, more than triple from a year ago, as Serve expanded its delivery robot fleet and handled more orders. Fleet services drove most of the growth, rising sharply from the prior quarter, helped by higher delivery volumes and a big jump in branding-related income. Software, licensing, and advertising revenue remained small contributors for now.

Losses widened as investment ramped up. Serve posted a net loss of $33 million for the quarter, compared with an $8 million loss a year earlier. On an adjusted basis, losses also deepened, and EBITDA stayed deeply negative. Cash burn was heavy during the quarter as the company continued to invest in operations, technology, and expansion.

However, the balance sheet remains solid. Serve ended the quarter with more than $210 million in liquidity and added another $100 million in October, giving it room to fund growth.

Looking ahead, Serve reaffirmed full-year 2025 revenue above $2.5 million and said it expects roughly ten-times revenue growth in 2026. Management also confirmed it will deploy its 2,000th robot ahead of schedule, underscoring confidence in its long-term scaling plans.

Recent Developments

Serve has been active on several fronts. On the positive side, partnerships and expansion continue to drive momentum. In October 2025, Serve announced a multi-year partnership with DoorDash to add its robots to DoorDash’s platform. The company also launched service in Chicago with Uber Eats and expanded into new metros (e.g., Fort Lauderdale in Florida).

In September, Serve acquired Vayu, an AI autonomy startup, and Phantom Auto, a teleoperation firm, to bolster its technology stack. Management called the move a “match made in heaven” that will improve efficiency over time. Media coverage (LA Times, Reuters) has also highlighted Serve’s grocery delivery pilots in L.A. and its expanding market presence.

What Analysts Say About SERV Stock

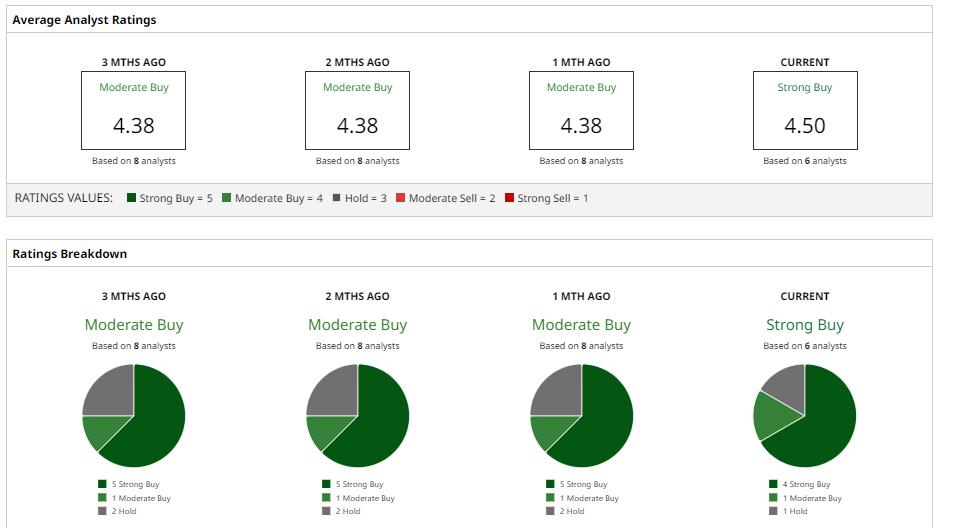

Wall Street opinions on SERV are mixed. The consensus among six analysts is a “Strong Buy” with an average 12-month price target of around $19, which suggests more than 82% upside potential.

Among different analysts, some reset their ratings this year, like Cantor Fitzgerald, which maintains an “Overweight” rating with a $17 target despite the lowered guidance. Wedbush has an “Outperform” rating and a $15 target, and Citigroup also calls SERV “Outperform” after recent reviews.

Notably, Northland Capital Markets, which is a Serve shareholder and underwriter, trimmed its 2025 EPS forecast to -$1.64 from -$1.35 on Nov. 13, far below the consensus -$0.98.

In public comments, analysts emphasize Serve’s growth potential but urge caution. Citigroup and Wedbush highlight the expanding fleet and partnerships as positives, while Cantor notes the stock still needs “a heavy volume of deliveries” to justify its price.

In short, major firms generally like the business case, hence the “Buy” ratings, but point to valuation and execution as limiting factors.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)