/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

Put options are about as popular as ever, for at least two different reasons.

When buying a put on a stock, ETF, or index, you retain for a period of time the right to sell that security at a price you choose when you buy it. The further down from the current price that “strike price” on the put option you purchased is, the less you will pay for it. It’s sort of an insurance policy against the unlikely, or very unlikely.

Sellers of put options are thinking differently. In a way, they are daring the market to drive the price of a security down to a certain level, by a certain date. If it does get there, they are obligated to buy it at that price. Even if the security’s price is way below that level by then.

But if it doesn’t reach that level, the investor keeps the money they received up front to sell the put option. That’s their reward for taking that risk. Because while a put option buyer has risk only up to what they paid for the put option, the put seller has risk well below the strike price of the put option. This is what is called a “naked put” because you don’t own the stock, just the obligation to buy it if it falls enough.

A Recent Example to Help You Form Your Own Opinion on NVDA Stock

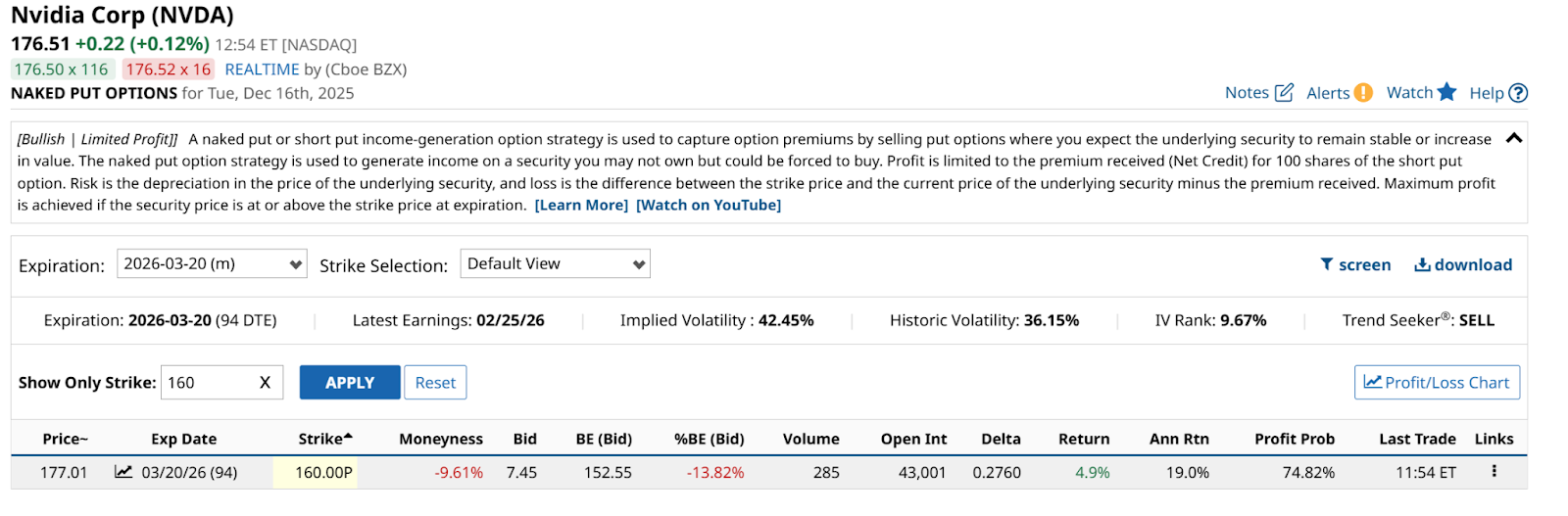

JPMorgan analyst Bram Kaplan wrote in a recent report that the firm has an “Overweight” rating on Nvidia (NVDA), with a $250 price target. But the thing that caught my attention was Kaplan’s trade idea on that stock. Specifically, the recommendation was to sell NVDA puts out to March 2026, about 3 months from now. And to choose a strike price of $160 a share. Let’s break this down, using a snapshot of that exact contract.

In yellow, we see that $160 strike price, preceded by the 3/20/2026 expiration date of the option. NVDA sells for about $177 a share, so each 1 put contract would obligate the seller to buy 100 NVDA at $160 a share if it drops below that price during the next 3 months. That’s about 10% down from here.

The option seller would receive about $7.45 per share or $745 for each contract sold. And as with nearly all U.S.-traded options, the value of this one will fluctuate intraday, every day. The more time passes, the more it favors the option seller, in the same way that a football team with the lead and the ball can “run out the clock.”

If the stock rises in prices, that helps the option seller too, as NVDA would move further away from the price that would prompt a purchase of the stock at $160. And if NVDA falls hard, the option seller is more likely to be forced to buy 100 shares. So in that case, you better have $16,000 lying around.

Where’s NVDA’s Stock Price Headed?

If you are selling puts as JP Morgan suggests, you have essentially decided that if NVDA dropped to $160 by March 20 of next year, you’d be willing to buy it there. And, you’d have more than $7 a share in your pocket already, from selling the put option now.

NVDA is not a boring stock. It can’t be, since it is the hub of the AI trade. But it is off nearly 15% from its recent peak, a move that took only 2 weeks.

And while the $160 level is a logical stopping area, roughly speaking, given the stock’s previous rally from just above that mark, the Percentage Price Oscillator (PPO) indicator and 20-day moving average suggest some risk of getting the stock put to you. The stock is more fading than bottoming in my current view.

But to each their own. Many investors with long-term confidence in a stock like NVDA, with all it has going for it, would probably take that risk of getting the stock at $160 fairly soon. The issue is if it goes back to its 2025 low around $100 a share or lower.

If that were to occur, and as quickly as it did then, the stock could be automatically bought into an account that was subject to being put the stock. And they could see it later as a $100 stock they just paid $160 for. In that case, the put premium received now might be of little solace.

Return and risk, sizing it up for your own purposes, using published investment research. So, business as usual around here. And now you know a bit more about the process of deciding, from a risk manager point of view.

Rob Isbitts, founder of Sungarden Investment Publishing, is a semi-retired chief investment officer, whose current research is found here at Barchart, and at his ETF Yourself subscription service on Substack. To copy-trade Rob’s portfolios, check out the new Pi Trade app.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)

/The%20CoreWeave%20logo%20displayed%20on%20a%20smartphone%20screen_%20Image%20by%20Robert%20Way%20via%20Shutterstock_.jpg)

/Seagate%20Technology%20Holdings%20Plc%20office-by%20JHVEPhoto%20via%20Shutterstock.jpg)