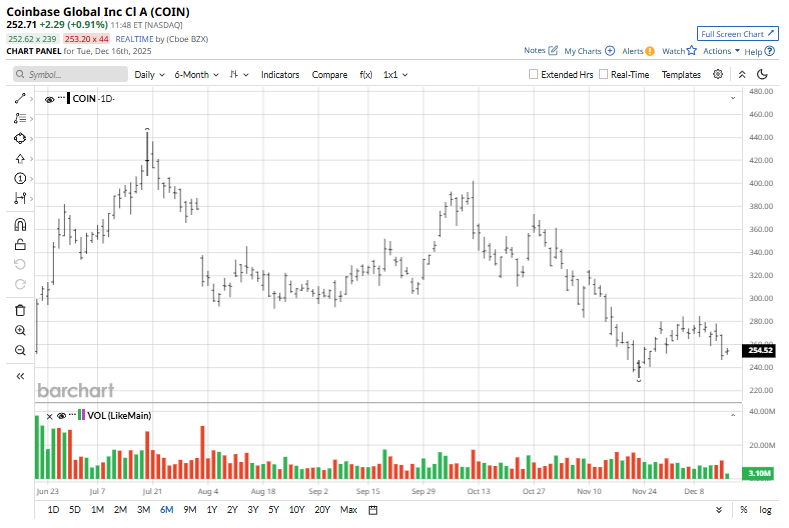

The volatility in the crypto world is clearly reflected in the price action for Coinbase (COIN) stock. In July 2025, the stock touched a 52-week high of $444.70. However, with a correction in Bitcoin (BTCUSD) and other crypto assets, COIN stock has declined by almost 40%.

While Bitcoin has still not gotten back to six digits, Coinbase stock seems attractive after the selloff. Recently, speculation has started to swirl that Coinbase is likely to launch prediction markets and tokenized equities as early as Dec. 17.

This could be a potential growth catalyst as Coinbase looks to broaden its product basket amid challenging times. Further, considering a meaningful correction from highs, the launch could be a possible trigger for a reversal in the stock's trend.

About Coinbase Stock

Coinbase, headquartered in New York, provides a platform for trading crypto assets in the United States and globally. Currently, the company supports approximately 90% of the total crypto asset market capitalization for trading on its platform.

Besides trading, the company offers services including staking, safekeeping, and free global transfers. As of Q3 2025, Coinbase reported assets on platform and assets under custody of $516 billion and $300 billion, respectively. Further, the company reported revenue of $1.86 billion for the quarter.

Given the broader volatility in crypto, COIN stock has largely traded sideways, down about 2% in the last six months. With expansion plans on multiple fronts, COIN stock seems interesting.

Strong Cash Buffer for Investments

One factor that makes Coinbase attractive is its healthy fundamentals. As of Q3 2025, Coinbase reported a liquidity buffer of $11.9 billion. The boost in liquid resources primarily came from a $3 billion convertible debt issuance in August 2025.

Additionally, Coinbase reported crypto assets held for investment of $2.6 billion and crypto assets held as collateral of $1 billion. This further enhances the liquidity buffer to $15.9 billion.

A robust cash buffer provides ample financial room for Coinbase to pursue aggressive organic and inorganic growth. It’s worth noting that Coinbase reported an adjusted EBITDA margin of 44.7% for Q3. The business has the potential to deliver strong operating cash flows when trading and investing activity is robust.

The Everything Exchange Can Boost Growth

A challenge that Coinbase faces is high volatility in the crypto market and its impact on earnings and cash flows. To navigate this, Coinbase is building “The Everything Exchange.”

In Q2, the exchange was introduced as a one-stop shop to trade all asset classes. This includes equities, prediction markets, and commodities. In Q3, the company expanded the spot coverage by increasing its derivatives offering. With the addition of the decentralized exchange, the number of total tradable assets has increased to 40,000 in the United States.

With the expected upcoming launch of prediction markets and equities, Coinbase will further diversify its offering. It’s important to note that the company is looking beyond trading on the platform.

Coinbase believes that global payments will increasingly shift to stablecoins and that stablecoin adoption will accelerate. Once “The Everything Exchange” gains traction in terms of trading and financial services, there is ample scope for value creation.

What Analysts Say About COIN Stock

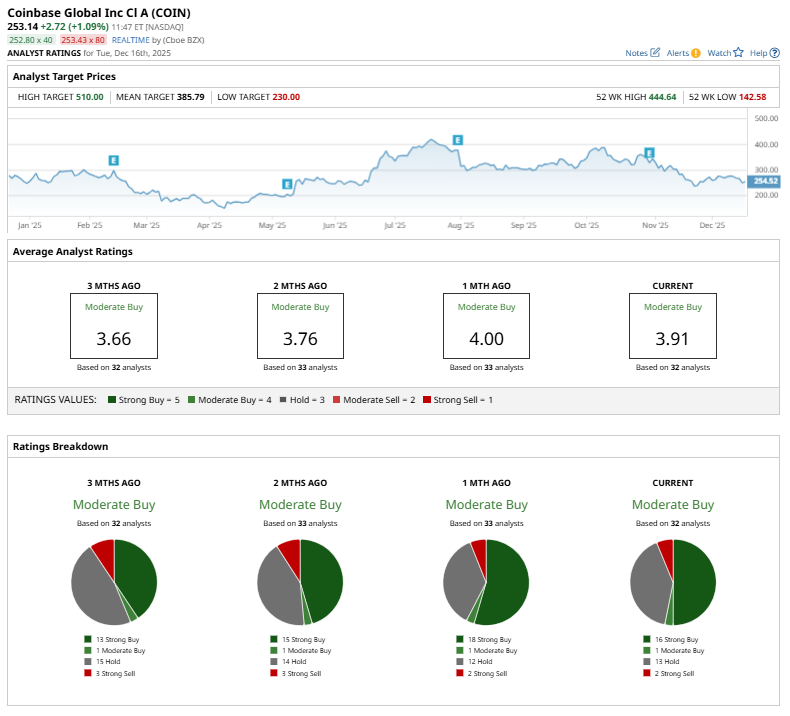

Based on the rating of 32 analysts, COIN stock is a consensus “Moderate Buy.”

While 16 analysts have assigned a “Strong Buy” rating, one has a “Moderate Buy,” and 13 analysts have a “Hold” rating. Additionally, two analysts believe that COIN stock is a “Strong Sell.”

Based on these ratings, the analysts have a mean price target of $385.79, implying upside potential from current levels. The most bullish price target is $510.

On the valuation front, Argus Research estimates that COIN stock is trading at 39x 2026 earnings. Valuations seem expensive compared to peers. However, with the potential for growth acceleration, COIN stock could potentially trend higher.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.