/International%20Business%20Machines%20Corp_%20logo%20on%20storage%20rack-by%20Nick%20N%20A%20via%20Shutterstock.jpg)

As the tech sector hurtles toward a new era of computational power and market leadership, International Business Machines Corporation (IBM) remains in the limelight. Once a titan of enterprise computing, IBM has faced years of scrutiny over its growth prospects. But recent strategic moves and breakthroughs may be rewriting its narrative.

From an aggressive push into artificial intelligence (AI) and cloud with blockbuster acquisitions to cutting-edge developments in quantum computing that could redefine the future of technology, IBM is staking its claim at the forefront of tomorrow’s innovation.

With expectations around quantum advantage, are we at the point at which quantum machines could outperform classical systems by the end of 2026? Could IBM’s decades-long investment in quantum tech be the catalyst that propels it back into tech leadership and makes its stock a standout buy for the year ahead?

About International Business Machines Stock

Headquartered in Armonk, New York, IBM is a global technology and consulting powerhouse that was founded in 1911 as the Computing-Tabulating-Recording Company. Rebranded in 1924, IBM today operates in more than 170 countries and offers a broad portfolio spanning hybrid cloud platforms, AI solutions, infrastructure hardware, software, consulting services, and financing. IBM’s market cap is around $290.5 billion.

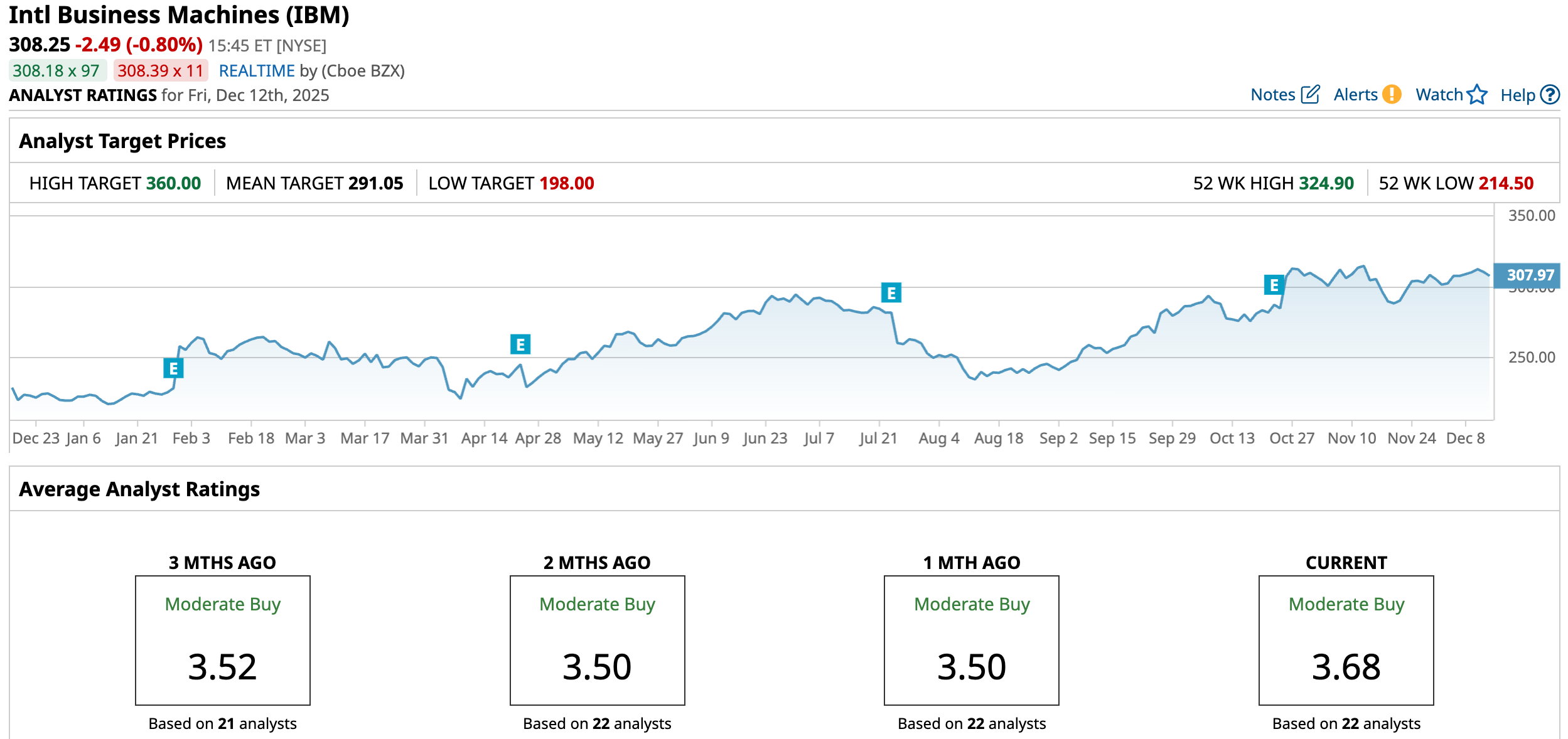

Over the past 52 weeks, the stock has gained 32.35% and 39.83% year-to-date (YTD), a notable increase that has outpaced broader market performance and reflects strong investor confidence in the company’s transformation. The stock is just 5.5% down from its 52-week high of $324.90 reached on Nov. 12, propelled by major announcements at IBM’s Quantum Developer Conference, particularly the unveiling of its new IBM Quantum Nighthawk processor.

IBM’s strategic pivot toward software, cloud services, and AI has resonated with investors. Robust growth in its AI-related software business and strong bookings for enterprise AI services helped lift sentiment earlier in the year and contributed to earnings beats that boosted the stock.

The stock is currently trading at a premium valuation compared to industry peers at 27.37 times forward earnings.

IBM Advancing Its Quantum Game

The tech behemoth has significantly advanced its quantum hardware and roadmap toward practical quantum computing, moving beyond incremental upgrades to showcase major technological milestones. In November 2025, the company unveiled new quantum processors and software breakthroughs that are explicitly aimed at reaching quantum advantage by the end of 2026, while also laying groundwork for fault-tolerant machines in the years thereafter.

The newly introduced Quantum Nighthawk processor, for example, complements high-performing quantum software and connectivity in a way that allows more complex quantum circuits than earlier systems. In parallel, IBM has been refining quantum error correction techniques to dramatically speed up decoding cycles, bringing the company closer to reliable and scalable quantum computation.

On the deployment front, IBM has begun placing its more powerful quantum systems in real research environments. Europe’s first IBM Quantum System Two, featuring a high-performance Heron processor, was installed at the IBM-Euskadi Quantum Computational Center, offering researchers access to capability-scaled quantum computing for materials science, physics, and algorithm development. This installation represents both a technological and strategic expansion of IBM’s ecosystem.

Stable Q3 Performance

IBM released its third-quarter 2025 results on Oct. 22. The company reported revenue of $16.3 billion, representing a year-over-year (YOY) increase of 9%.

Segment results were mixed but broadly positive. The software business generated around $7.2 billion, up about 10%. Within that, the hybrid cloud unit grew 14%, automation climbed 24%, while transaction processing declined slightly. The consulting segment recorded revenue of roughly $5.3 billion, rising 3% YOY. The infrastructure segment delivered around $3.6 billion, up 17% YOY.

On the earnings front, IBM posted adjusted non-GAAP EPS of $2.65, rising 15% YOY and beating analyst expectations. Gross margin expanded to 58.7%, up 1.2 percentage points, and pre-tax operating margin rose to 18.6%.

Importantly, IBM raised its full-year guidance. The company now expects revenue growth of more than 5% at constant currency, up from a prior “at least 5%” target and projects free cash flow of about $14 billion for 2025.

Despite the strong headline numbers, investor concerns emerged over decelerating growth in IBM’s high-margin hybrid-cloud software segment as growth in that unit slowed from 16% in the prior period to 14%. This weighed on market reaction, causing a stock price decline following Q3 earnings release.

Analysts predict EPS to be around $11.39 for fiscal 2025, up 10.3% YOY, before surging by another 7.4% annually to $12.23 in fiscal 2026.

What Do Analysts Expect for IBM Stock?

This month, Stifel boosted its price target on IBM to $325 from $295 after the company announced its $11 billion all-cash acquisition of Confluent (CFLT), reaffirming its “Buy” rating. The firm sees the deal as strategically sound, given Confluent’s leadership in real-time data streaming through Apache Kafka and its strong presence in Fortune 500 enterprises.

Also, Erste Group upgraded IBM from “Hold” to “Buy” after the company delivered a strong third quarter. Erste expects the company to post even stronger sales growth next year. However, Bernstein SocGen is maintaining a cautious stance and reaffirmed its “Market Perform” rating on IBM with a $280 price target.

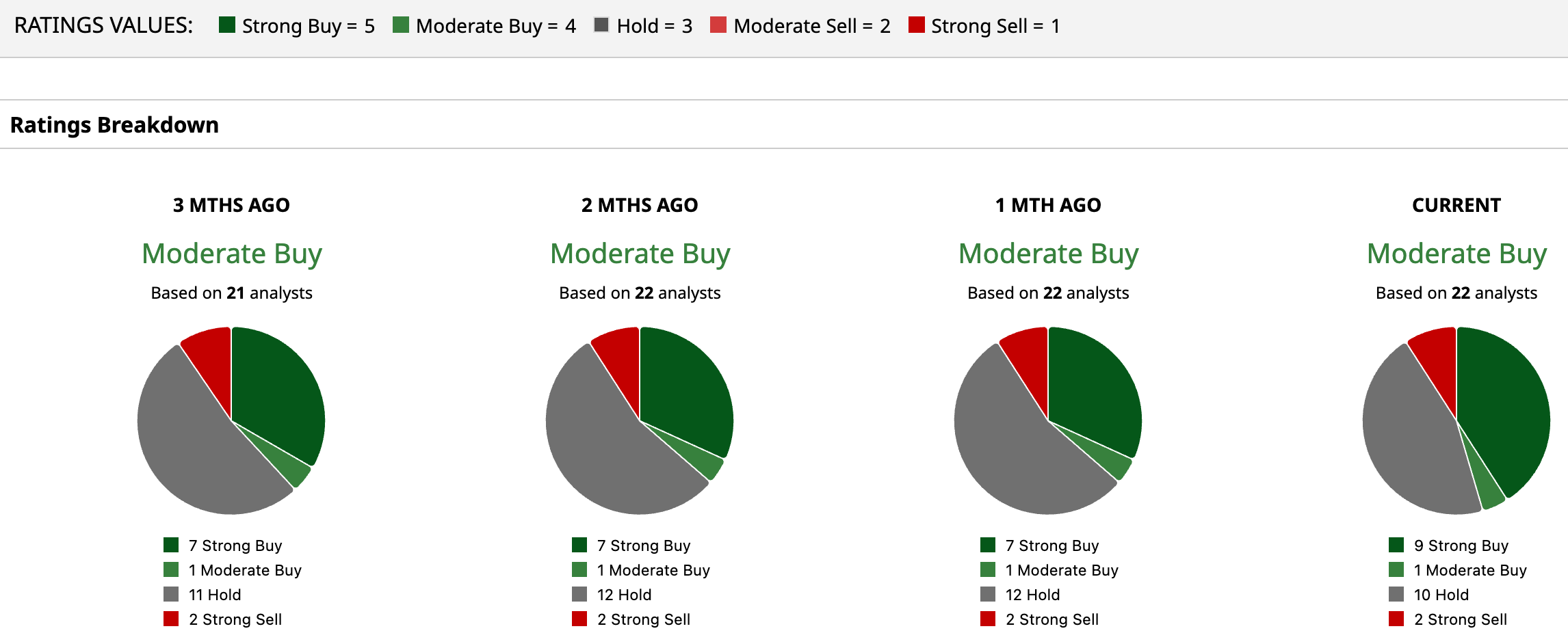

Wall Street is fairly bullish on IBM. Overall, IBM has a consensus “Moderate Buy” rating. Of the 22 analysts covering the stock, nine advise a “Strong Buy,” one suggests a “Moderate Buy,” 10 analysts are on the sidelines, giving it a “Hold” rating, and two “Strong Sell.”

The stock has surged past its average analyst price target of $291.05. However, the Street-high target price of $360 suggests that the stock could rally as much as 16.9%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)