Biotech investors hunting for explosive growth may want to look closely at two emerging innovators making significant progress in high-impact therapeutic areas. Kyverna Therapeutics (KYTX) is advancing its breakthrough CAR T-cell programs in autoimmune diseases, while Janux Therapeutics (JANX) is using its cutting-edge TRACTr, TRACIr, and ARM platforms to alter tumor-activated immunotherapy. Both have earned “Strong Buy” ratings from analysts, with Wall Street forecasting extraordinary upside in 2026.

Biotech Stocks With Huge Upside Potential: Kyverna Therapeutics (KYTX)

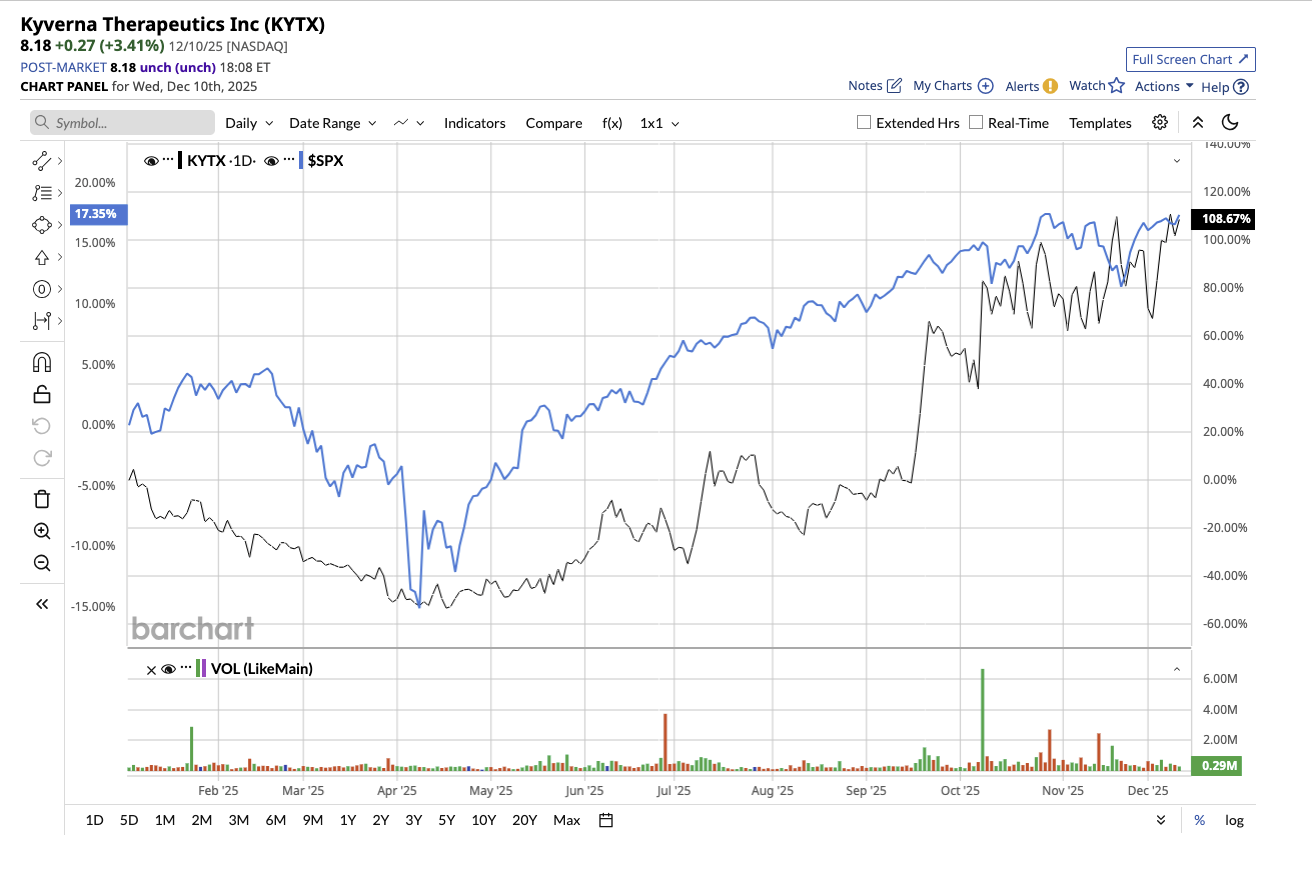

Valued at $358.2 million, Kyverna Therapeutics is a clinical-stage biopharmaceutical company developing CAR T-cell therapies for autoimmune diseases. Kyverna's flagship program, KYV-101, is moving quickly through late-stage development. It is a CD19 CAR T-cell treatment intended to eradicate the harmful B cells that cause autoimmune disorders. This has led to the stock skyrocketing 108% year-to-date (YTD), outperforming the S&P 500 Index ($SPX) gain of 17%.

Kyverna’s lead program, KYV-101, is progressing as planned. The company expects topline data from the registrational trial in stiff person syndrome (SPS) by early 2026. It remains on track to file its first Biologics License Application (BLA) in the first half of 2026. SPS remains a high-need neuroimmunology problem, and if effective, KYV-101 could be the first CAR T-cell therapy approved for an autoimmune disease.

Furthermore, momentum is building in generalized myasthenia gravis (gMG). Kyverna presented positive interim Phase 2 data from its registrational KYSA-6 trial at AANEM in October 2025. The findings showed KYV-101's ability to provide long-term, drug-free, disease-free remission, with 100% of patients experiencing immediate and sustained improvement at 24 weeks. Additionally, all patients stopped using immunosuppressive medications for up to 24 weeks. The company expects to begin enrollment for the registrational Phase 3 portion by year-end, with updated Phase 2 results planned for 2026.

Kyverna continues to explore KYV-101 in numerous autoimmune disorders, including multiple sclerosis (MS) and rheumatoid arthritis (RA), through its own trials and investigator-initiated studies, providing a broad platform for indication expansion. Kyverna is also investing in next-generation cell therapy platforms with KYV-102, which retains the KYV-101 CAR construct while using a whole blood, rapid manufacturing process. The company remains on schedule to file an IND in the fourth quarter of 2025.

Being a clinical-stage biotech, Kyverna reported a net loss of $36.8 million. However, to support its accelerating pipeline and pre-launch activities, Kyverna secured a $150 million loan facility with Oxford Finance in November 2025, drawing an initial $25 million. The company had $171.1 million in cash, equivalents, and marketable securities at the end of the third quarter. It expects this capital to help with the SPS BLA application, the gMG Phase 3 trial, and other essential activities until 2027.

Kyverna Therapeutics is entering the new year with "strong momentum" on both clinical and corporate fronts. If its next readouts continue to support the efficacy of CAR T-cell therapy in autoimmune disorders, Kyverna is poised for explosive growth in 2026 and beyond.

This makes Wall Street strongly bullish on KYTX stock. Out of the seven analysts who cover the stock, six rate it a “Strong Buy,” and one rates it a “Hold.” The average price target of $25.25 suggests the stock can rally as much as 208% from current levels. However, its high target price of $31 implies potential upside of 279% in the next 12 months.

Biotech Stocks With Huge Upside Potential: Janux Therapeutics (JANX)

Valued at $937.1 million, Janux Therapeutics is a clinical-stage biopharmaceutical company developing novel immunotherapies to treat cancer and immune-related diseases. It uses proprietary technology to design therapies that activate the immune system specifically within tumors or modulate immune responses in disease.

While Janux stock is down 70% YTD, Wall Street sees more potential ahead.

Janux’s pipeline is built on three proprietary technology platforms: TRACTr (Tumor Activated T Cell Engagers), TRACIr (Tumor Activated Immunomodulators), and ARM (Adaptive Immune Response Modulator). These platforms are designed to help the immune system precisely attack solid tumors more safely and effectively.

Janux’s two lead clinical candidates continue to advance through first-in-human studies. The company’s first clinical candidate, JANX007, continues enrollment in a Phase 1 trial for metastatic castration-resistant prostate cancer (mCRPC) (NCT05519449). The therapy targets PSMA and represents Janux’s first TRACTr therapeutic designed to activate T cells only in the tumor microenvironment.

The company has also begun enrollment for the Phase 1 trial for JANX008 (NCT05783622), which targets EGFR in advanced or metastatic solid tumors. It is applicable across several cancers, including colorectal carcinoma, NSCLC, renal cell carcinoma, pancreatic cancer, SCLC, head and neck cancers, and triple-negative breast cancer. Both programs remain on track to deliver additional data in the fourth quarter of 2025, with updates planned at company events.

Janux continues to expand its line of tumor-activated immunotherapies and immune modulators. Janux is developing its first ARM candidate, CD19-ARM, for the potential treatment of autoimmune disorders. Additional TRACTr, TRACIr, and ARM programs are in development for future expansion into both oncology and immunology. While the company earned $10 million in collaboration revenue in Q3, net loss stood at $24.3 million. Janux ended the third quarter of 2025 with $989 million in cash, cash equivalents, and short-term investments, reflecting a robust financial base to support ongoing and future trials.

With ongoing enrollment, anticipated clinical updates for JANX007 and JANX008, and multiple preclinical candidates moving toward the clinic, Janux enters the final months of 2025 with significant momentum.

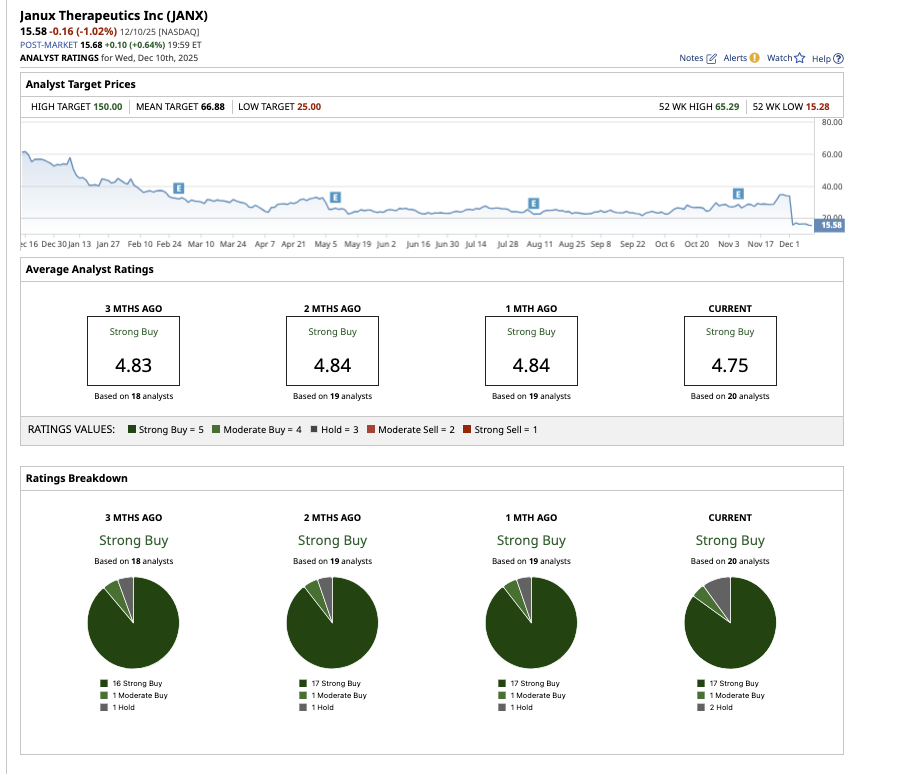

Overall, JANX stock has earned a “Strong Buy” rating on Wall Street. Out of the 20 analysts that cover the stock, 17 rate it a “Strong Buy,” one says it is a “Moderate Buy,” and two rate it a “Hold.” Its average price target of $66.88 suggests an upside potential of 329.3% from current levels. Plus, its high target price of $150 implies a potential upside of 862.7% in the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20SoFi%20logo%20on%20an%20office%20building%20by%20Tada%20Images%20via%20Shutterstock.jpg)

/Stickers%20with%20AMD%20Radeon%20and%20Nvidia%20GeForce%20RTX%20graphics%20on%20new%20laptop%20computer%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)