Valued at a market cap of $14.9 billion, Omnicom Group Inc. (OMC) is an advertising, marketing, and corporate communications company based in New York. It provides a range of services in the areas of media and advertising, precision marketing, public relations, healthcare, branding and retail commerce, experiential, execution, and support.

Companies worth $10 billion or more are typically classified as “large-cap stocks,” and OMC fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the advertising agencies industry. The company works with many of the world’s largest brands across industries, offering integrated, data-driven marketing solutions through well-known agency networks like BBDO, DDB, TBWA, OMD, and FleishmanHillard. It is recognized for its creative excellence, global scale, and ability to combine strategy, media, and analytics to help clients strengthen brand presence and drive customer engagement.

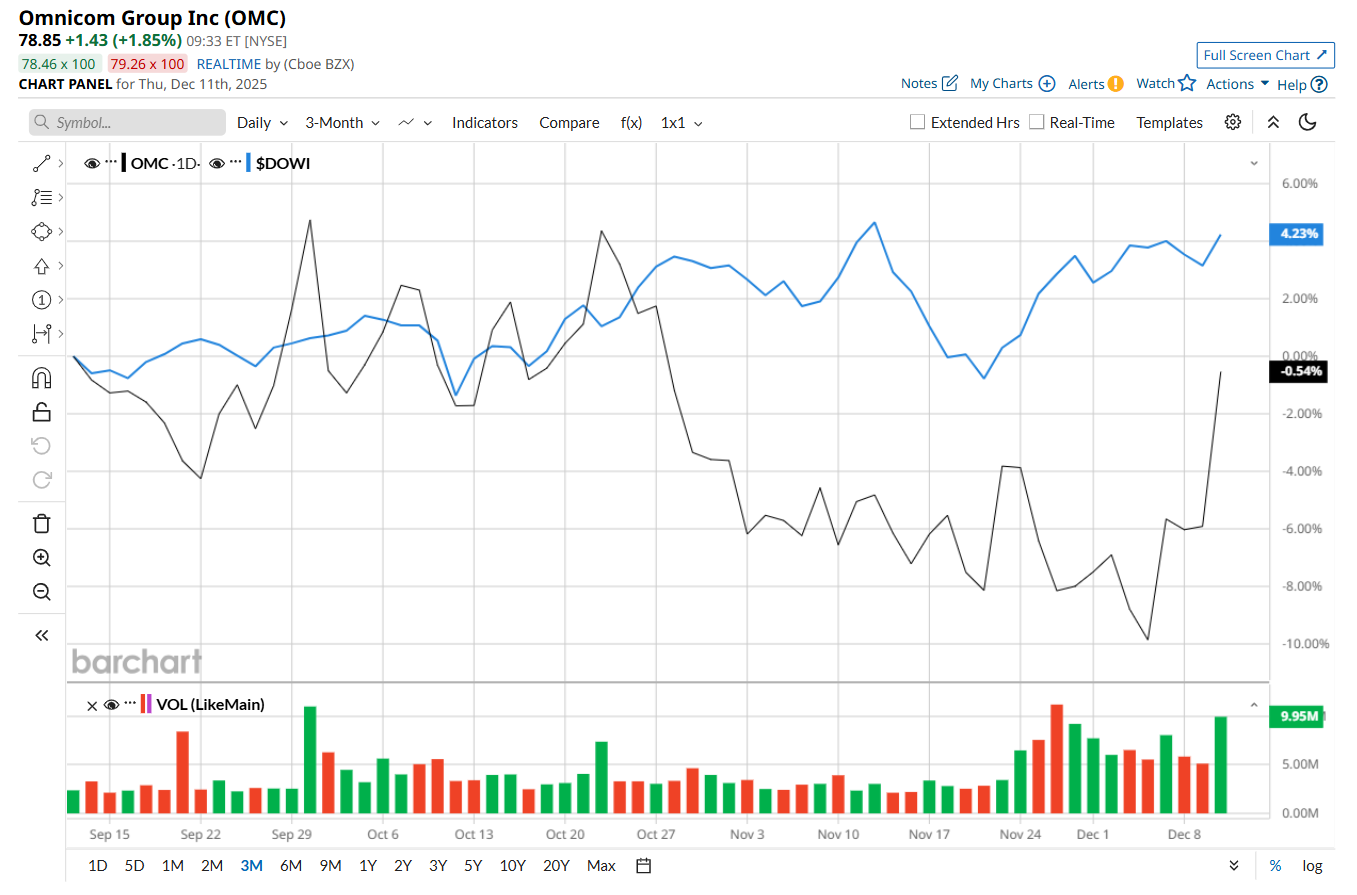

This advertising company has slipped 17.1% below its 52-week high of $93.42, reached on Dec. 11, 2024. Shares of OMC have gained 1.9% over the past three months, underperforming the Dow Jones Industrial Average’s ($DOWI) 5.6% rise during the same time frame.

Moreover, on a YTD basis, shares of OMC are down 10%, compared to DOWI’s 13% return. In the longer term, OMC has fallen 16.3% over the past 52 weeks, considerably lagging behind DOWI’s 8.6% uptick over the same time frame.

To confirm its bullish trend, OMC has recently started trading above its 200-day and 50-day moving averages since early December.

On Oct. 21, OMC reported better-than-expected Q3 earnings results, and its shares surged 3.2% in the following trading session. The company’s overall revenue climbed 4% year over year to $4 billion, surpassing consensus estimates by a slight margin. Additionally, its adjusted EPS advanced 10.3% from the year-ago quarter to $2.24, handily topping analyst expectations of $2.15.

OMC has outpaced its rival, WPP plc (WPP), which declined 61.3% over the past 52 weeks and 57.6% on a YTD basis.

Despite OMC’s recent underperformance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of "Moderate Buy” from the 10 analysts covering it, and the mean price target of $97.38 suggests a 24.2% premium to its current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Server%20racks%20by%20dotshock%20via%20Shutterstock.jpg)