/Quantum%20Computing/Image%20by%20Funtap%20via%20Shutterstock.jpg)

IonQ (IONQ) is making headlines again in the investor community with its large European expansion. Recently, ID Quantique launched the first quantum communication nationwide in Slovakia based on IonQ’s solutions. IONQ stock has been trading close to $51.76 of late, marking a sharp gain of 6% in the last five trading days while making more inroads into the global quantum landscape, especially as governments ramp up quantum infrastructure investments in their respective countries.

The news comes off the back of a very positive third-quarter earnings announcement, with the company recording 222% year-over-year (YOY) growth and breaking numerous records in the process. The rising importance of quantum computing as a long-duration investment theme and the emergence of new geographic deployments in the European Union mean that IonQ's strategic movements are making the company more universally relevant. At the same time, the overall sector continues to be buoyed by the macro theme of high-performance computing and security.

About IonQ Stock

IonQ (IONQ) is a quantum computing firm based in College Park, Maryland, and its focus is the development of full-stack trapped ion quantum solutions. The company has recently improved its full-stack platform through the acquisitions of two other firms, namely Oxford Ionics and Vector Atomic. Through these moves, IonQ will be able to offer customers electronic qubit control, quantum sensing, and enhanced navigation solutions in one platform. The company currently has a market capitalization of $18 billion, well above the levels it recorded last year due to its cash holdings following a $2 billion equity offering.

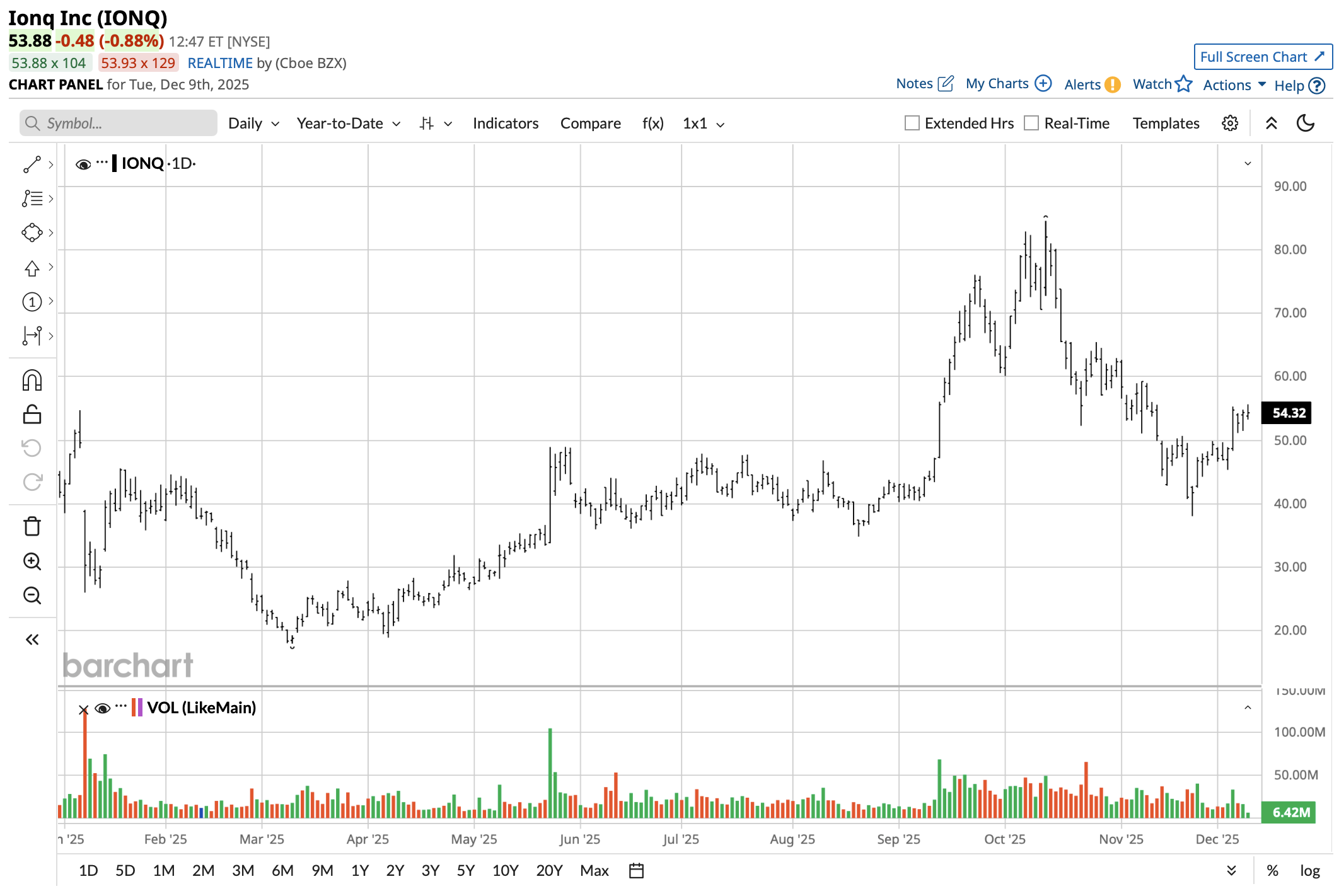

Over the past 52 weeks, IONQ stock has ranged from $17.88 to a high of $84.64, an indicator of the high-volatility characteristic of early-stage quantum tech firms. Given its current stock price, IonQ is currently lower than its 2025 peak but has fared better than most rivals, buoyed by enhanced fundamentals and technological achievements. Its year-to-date (YTD) performance has been volatile, but shows signs of improvement in comparison to the S&P 500 Index ($SPX). IONQ stock is up 24% YTD versus the S&P 500's gain of 14% over the same period.

IonQ continues to be valued strongly in terms of traditional ratios, with its price-to-sales ratio of 439 times significantly higher than the tech sector average. The negative profitability ratios of the company, including a -127% return on equity and -770% profit margins, emphasize the investment phase that the company has reached in scaling its hardware, software, and infrastructure across the global landscape. Since the company is unprofitable, traditional value anchors remain less relevant, supporting the point that the price of IONQ stock is more a function of its growth prospects rather than the current results.

The company does not pay a dividend, and based upon its growth profile, income investors do not consider the company for dividend payout in the foreseeable future.

IonQ Beats on Earnings

IonQ posted strong Q3 2025 results, beating the high side of revenue guidance by 37% with $39.9 million in the quarter, a 222% increase from the prior-year period. The company revised its full-year revenue guidance to between $106 million and $110 million, a clear indication of the effective execution of contracts and an increase in clients. However, IonQ also posted a GAAP EPS loss of $3.58 and an adjusted EPS loss of $0.17, indicating rigorous R&D expenses and the implementation of newly acquired subsidiaries.

Guidance from management remains quite aggressive, too. IonQ reaffirmed its long-term roadmap of achieving 2 million physical and 80,000 logical qubits by the end of 2030, facilitated through its record achievement of 99.99% two-qubit gate performance. This achievement will prove to be an important stepping stone in the path towards realizing complete fault tolerance, a necessity to achieve economic-sized quantum computing.

The company’s quarterly report gave a detailed technical background. The company reached its #AQ 64 milestone achievement well before schedule, “unlocking 36 quadrillion times more computational space than leading commercial superconducting systems.” IonQ's purchase of both Oxford Ionics and Vector Atomic also gives the company considerably added importance to its roadmap in the area of quantum-based solutions for navigation, timing, and secure communications.

What to Expect from IonQ Stock

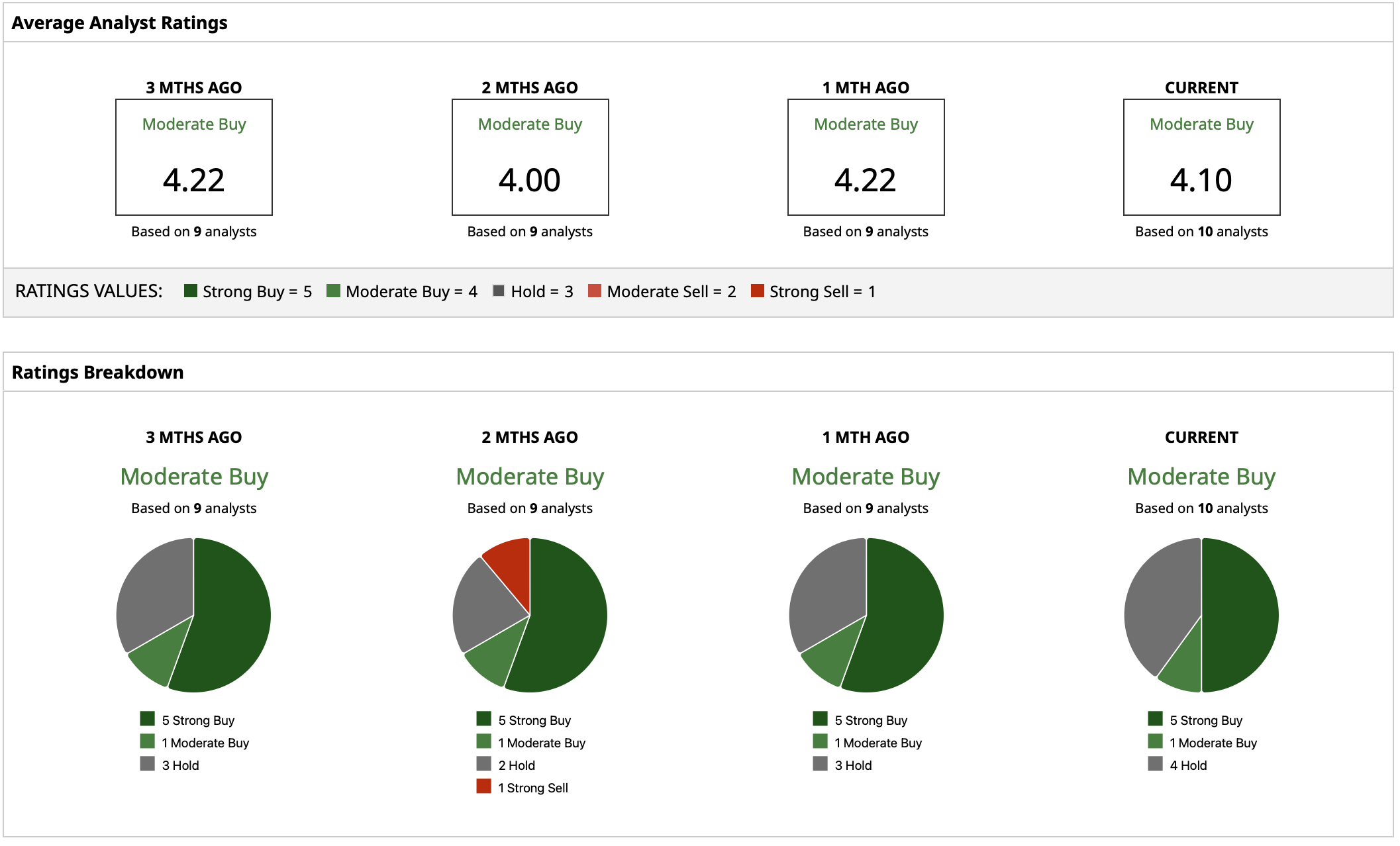

IonQ has a “Moderate Buy” consensus rating based on the views of analysts who cover IONQ stock, owed in part to rising institutional interest in the company based on its fundraising actions and improved balance sheet. The mean target price of $72.89 shows potential upside of approximately 41% from current levels. Price targets for IONQ vary from a low of $47 to a high of $100, showing a considerable range of expectations due to the speculative nature of the quantum computing sector.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)