/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)

Synopsys (SNPS), a developer of design software used to create integrated circuits, also markets solutions that enable artificial intelligence (AI) chips and AI-enabled systems to be created more quickly and efficiently. On Dec. 1, Nvidia (NVDA) announced that it had purchased $2 billion of SNPS stock and would enhance its existing partnership with Synopsys.

Under the new arrangement, Nvidia will attempt to enable the two firms to upgrade products more efficiently, while allowing Synopsys to more intensively utilize the cloud. Nvidia added that the partnership will also boost Synopsys's marketing efforts and improve the “precision” of the systems that the two partners produce.

"The partnership we’re announcing today is about revolutionizing one of the most compute-intensive industries in the world: design and engineering,” Nvidia CEO Jensen Huang said on CNBC.

About SNPS Stock

In the five days that ended on Dec. 10, Synopsys shares rose 2.01%. However, they had dropped 1.96% year-to-date.

Synopsys has a market capitalization of $86.5 billion, while its trailing price-to-sales ratio is 48.3x and its price-to-sales ratio is 11.44x. However, the firm's price-to-book ratio is a low 2.6x.

In the year that ended in July, Synopsys generated earnings per share (EPS) of $9.60. In its fiscal third quarter, the company's revenue came in at $892.36 million, up from $803.15 million during the same period a year earlier. However, due partly to a surge in the firm's costs, its operating income dropped to $165.27 million from $360.2 million in the previous period.

The company stated that its Q3 results were negatively impacted by the weaker-than-expected performance of its IP business. The factors that negatively impacted the unit were “new export restrictions (that) disrupted design starts in China, challenges at a major foundry customer,” and strategies that did not yield the anticipated results.

Despite these challenges, the company still expects to deliver record revenue during its current fiscal year.

However, those revenues will be boosted by the company's acquisition of Ansys, which closed in July.

"With Ansys' leading system simulation and analysis solutions now part of Synopsys, we can maximize the capabilities of engineering teams broadly, igniting their innovation from silicon to systems," CEO Sassine Ghazi said in July.

The Street Is Bullish on Synopsys

Japanese bank Mizuho believes that Synopsys' deal with Mizuho will improve its products because the agreement will allow the tech firm to access Nvidia's CUDA acceleration software and utilize the chip giant's AI acumen. Mizuho reiterated a $600 price target and an “Outperform” rating on the stock.

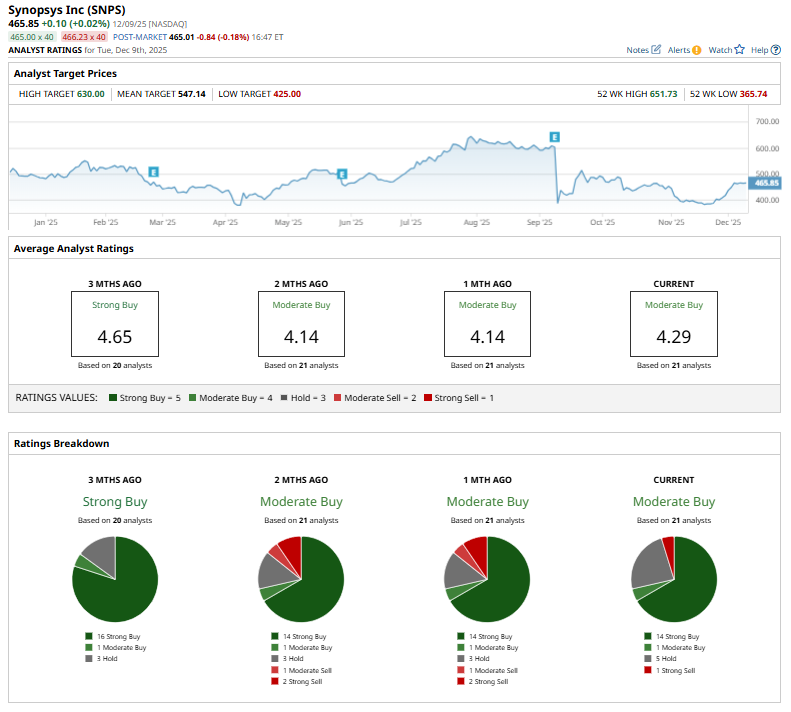

Of the 21 analysts who cover SNPS stock, 14 have a “Strong Buy” rating, and one has a “Moderate Buy” rating. The mean price target on the shares is $547.14. Analysts' mean earnings estimate calls for the firm's earnings per share to jump to $9.15 in fiscal 2026, up from $7.98 in fiscal year 2025.

On the date of publication, Larry Ramer did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.