Nextdoor (NXDR) stock soared as much as 45% on Wednesday morning after Eric Jackson dubbed the hyperlocal social networking service “the most mispriced Agentic-AI platform of the 2020s.”

Jackson’s call bears significant weight since his retail activist campaign has triggered a more than 15x rally in Opendoor (OPEN) shares in the back half of 2025.

At its intraday peak, Nextdoor stock was seen trading at a new year-to-date high. It has, however, reversed part of the gain in recent hours and is now hovering around $2.53.

Nextdoor Stock Hitting $374 in the Long Run

According to Eric Jackson, the market is massively underappreciating NXDR’s strategic blend of “identity, trust, proximity, and AI.”

Nextdoor has some 100 million real users on its online platform, which the activist investor dubbed an asset that “couldn’t be replicated by $10B and a thousand engineers.”

NXDR has achieved the EBITDA milestone under the leadership of Nirav Tolia.

Plus, operational improvements, including higher revenue per employee and reduced spam alerts, warrant upward revisions of estimates for Nextdoor Holdings as well, he wrote on X today.

A modest 14.6x sales multiple (similar to Reddit (RDDT)) would value NXDR stock at $11, but in the long run, if the AI-driven revenue streams scale as expected, it could be worth as much as $374, Jackson estimated.

NXDR Shares Are More Speculation Than Substance

While Jackson painted an overly optimistic picture in his social media post, beneath the surface lie structural weaknesses that warrant caution in playing Nextdoor shares at current levels.

For one, the firm’s user base, while large, has struggled to translate into meaningful monetization, with advertising revenue growth lagging behind rivals including Reddit and Meta Platforms (META).

Plus, a focus on highly localized engagement limits NXDR’s scalability compared to global social networks, while muted cash flow generation means investors are exposed to dilution risk if capital raise becomes necessary.

In short, the company’s artificial intelligence-driven promise is undermined by structural challenges in monetization, competitive positioning, and scale.

Note that Nextdoor’s relative strength index (14-day) also currently sits at 79 roughly, indicating the upward momentum is already near exhaustion.

How Wall Street Recommends Playing Nextdoor

Being a penny stock, Nextdoor is vulnerable to excess volatility and price manipulation as well.

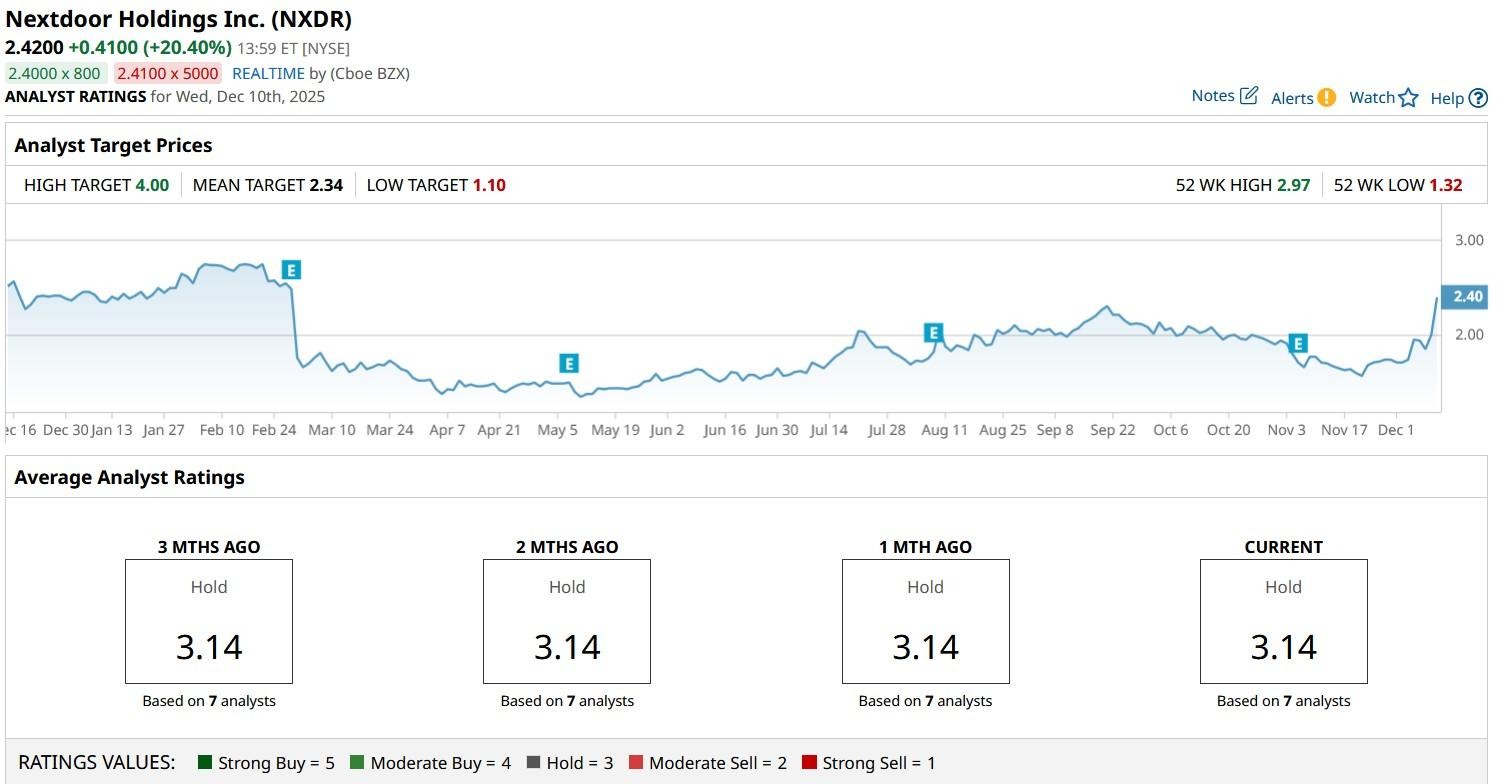

That’s why Wall Street currently rates it at “Hold” only with the mean target of $2.34 already in line with the price at which NXDR shares are trading currently.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)