The demand for rich, interactive 2D, 3D, Virtual Reality (VR), and Augmented Reality (AR) experiences continues to grow, and while the metaverse still sits somewhere between hype and hope, the need for tools that bring these digital worlds to life is fully grounded in reality. From games and 3D tours to interactive films, creators want platforms that shorten development cycles and expand what is possible on screen.

In this landscape, Unity Software (U) has become that backbone. It already powers over half of the world’s mobile games and is steadily extending its reach into sectors like automotive, architecture, engineering, and beyond. The market has taken notice as the stock, which was already up almost 116% year-to-date (YTD), gained another 3.7% on Friday, Dec. 5, after Wells Fargo & Company (WFC) upgraded the stock, owing to Unity’s solid fundamentals.

The firm raised Unity’s rating to “Overweight” from “Equal-Weight,” pointing to a stronger industry outlook for 2026 and growing confidence in Unity’s new “Unity Commerce” platform, a shift that supports direct payments and reduces reliance on app-store economics.

Analyst Alec Brondolo followed through by boosting his FY26 revenue growth forecast to 17% year-over-year (YOY) and lifting his price target for the stock. With expectations rising, what stance investors should take on U stock at this stage?

About Unity Software Stock

Headquartered in San Francisco, California, Unity Software provides a platform to create and scale interactive 2D, 3D, and XR experiences across mobile, PC, console, and emerging mixed-reality devices. With a market cap of nearly $19.6 billion, the company offers a full suite of tools, including artificial intelligence (AI)-powered capabilities, that support the entire development lifecycle from creation to launch and ongoing live operations.

U shares have risen 75% over the past 52 weeks, and the pace accelerated sharply in recent months. The stock climbed 93% in the last six months, handily outperforming the broader S&P 500 Index’s ($SPX) 12.47% gain over the past year and its 14.16% rise across the same six-month period.

At present, U trades at 10.66 times sales. The figures are well above typical industry averages, suggesting a premium. This reflects the market’s willingness to pay for Unity’s potential.

Unity Software Surpasses Q3 Earnings

U's stock jumped 18.1% on Nov. 5 after the company delivered a Q3 FY2025 earnings report that comfortably topped Wall Street expectations and paired it with an upbeat Q4 revenue outlook.

Revenue climbed 5.4% YOY to $470.6 million, while adjusted EPS rose 5.3% to $0.20, beating consensus estimates of $450.1 million and $0.17, respectively. Performance was solid across key metrics as adjusted EBITDA increased 19.4% from the prior year to $109.5 million, supported by a 23% margin.

Adjusted net income also rose 16.7% YOY to $96.7 million. Furthermore, Unity’s liquidity position improved meaningfully. As of Sept. 30, cash, cash equivalents, and restricted cash totaled $1.91 billion, up $381 million from $1.53 billion on Dec. 31, 2024.

The momentum continues into Q4. Unity has guided midpoint revenue to $485 million, topping expectations. Profitability guidance, however, came in a touch softer as management expects adjusted EBITDA of $110 million to $115 million, slightly below Street estimates.

On the other hand, analysts anticipate Q4 FY2025 loss per share to improve 96.7% YOY to $0.01. For the full year fiscal 2025, loss per share is projected to narrow 98.2% to $0.03, before swinging to positive territory with $0.11 EPS in FY2026, a sharp 466.7% rebound.

What Do Analysts Expect for Unity Software Stock?

Arete Research recently shifted its stance on U, upgrading the stock to “Buy” from “Neutral” and setting a new price target of $48. Wells Fargo followed with its own adjustment, as analyst Alec Brondolo raised his target to $51 from $42, reinforcing the view that Unity’s long-term positioning continues to strengthen.

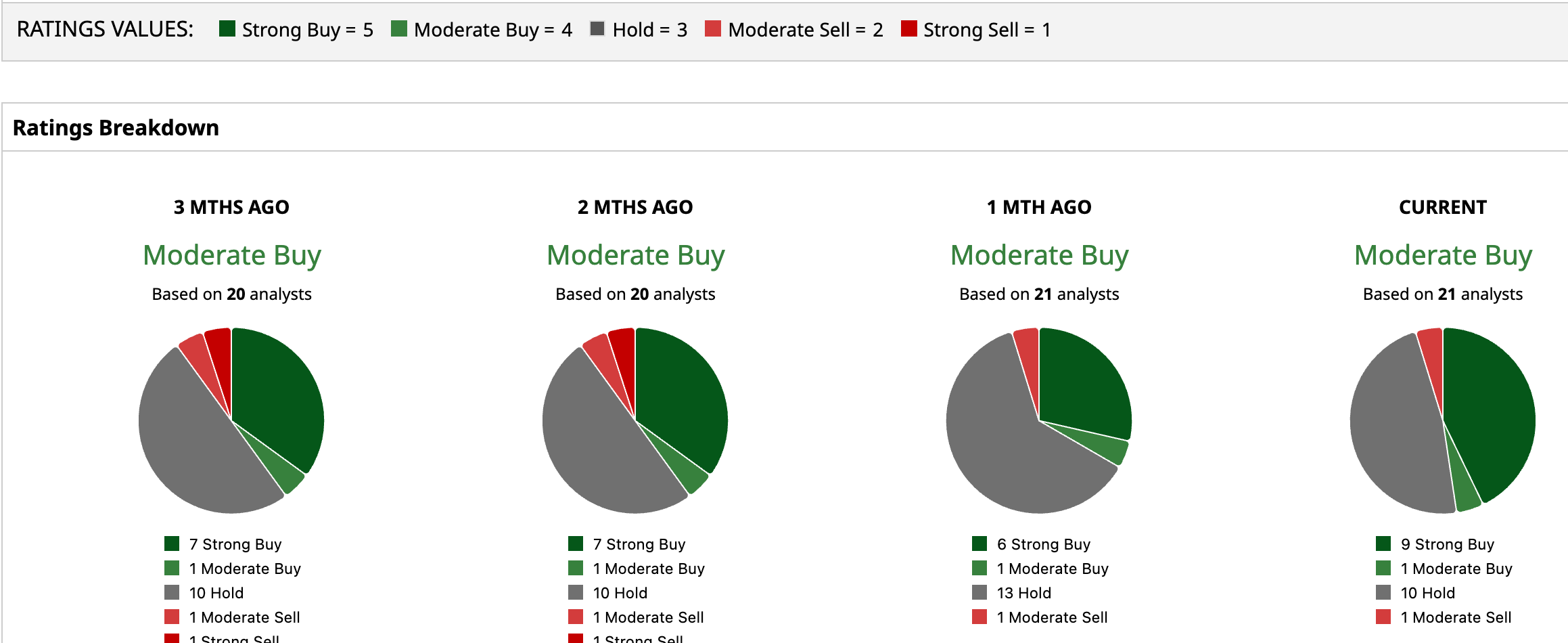

Across Wall Street, sentiment remains constructive. Analysts have assigned U an overall “Moderate Buy” rating. Of the 21 covering analysts, nine call the stock a “Strong Buy,” one recommends a “Moderate Buy,” 10 advise “Hold,” and one maintains a “Moderate Sell.”

U already trades above its average price target of $44.11. Meanwhile, Wedbush holds the Street-high target at $55, implying potential upside of 13% from current levels while maintaining an “Outperform” rating.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)