/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)

Netflix (NFLX) shares are slipping at the time of writing after the streaming giant agreed to acquire Warner Bros. Discovery’s (WBD) assets for a whopping $83 billion in cash and stock.

The agreement that’s broadly expected to make NFLX the most formidable force in the Hollywood industry values WBD’s studios and streaming assets at $27.75 per share.

At the time of writing, Netflix stock is down roughly 25% versus its year-to-date high set in late June.

Why Is Netflix Stock Trading Down on Friday?

NFLX shares are inching down this morning mostly because of two big reasons.

One – the WBD transaction sure is expensive. As a senior Lightshed Partners’ expert, Rich Greenfield, put it in a CNBC interview today: “This is a huge … number that’s just too big.”

And two – investors are wondering whether global regulators will agree to this deal given Netflix and HBO are two of the three largest streaming platforms.

Senator Mike Lee, for example, has already voiced concerns that NFLX’s takeover of WBD assets will reduce competition, consumer choice, and incentive for innovation.

Should You Buy the Dip in NFLX Shares?

Irrespective of how things unfold on the WBD front, Evercore ISI’s head of internet research Mark Mahaney recommends sticking with Netflix shares heading into 2026.

In his research note, he touted the company’s competitive positioning, adding that its compelling value proposition and excellent execution track record are hallmarks of exceptional fundamentals for the long term.

Evercore ISI maintains an “Outperform” rating on Netflix shares with a $138 price target indicating potential upside of about 37% from here.

The investment firm agrees NFLX isn’t inexpensive at north of 41x forward earnings, but its sheer scale and dominance in the streaming market does warrant a meaningful premium, it told clients.

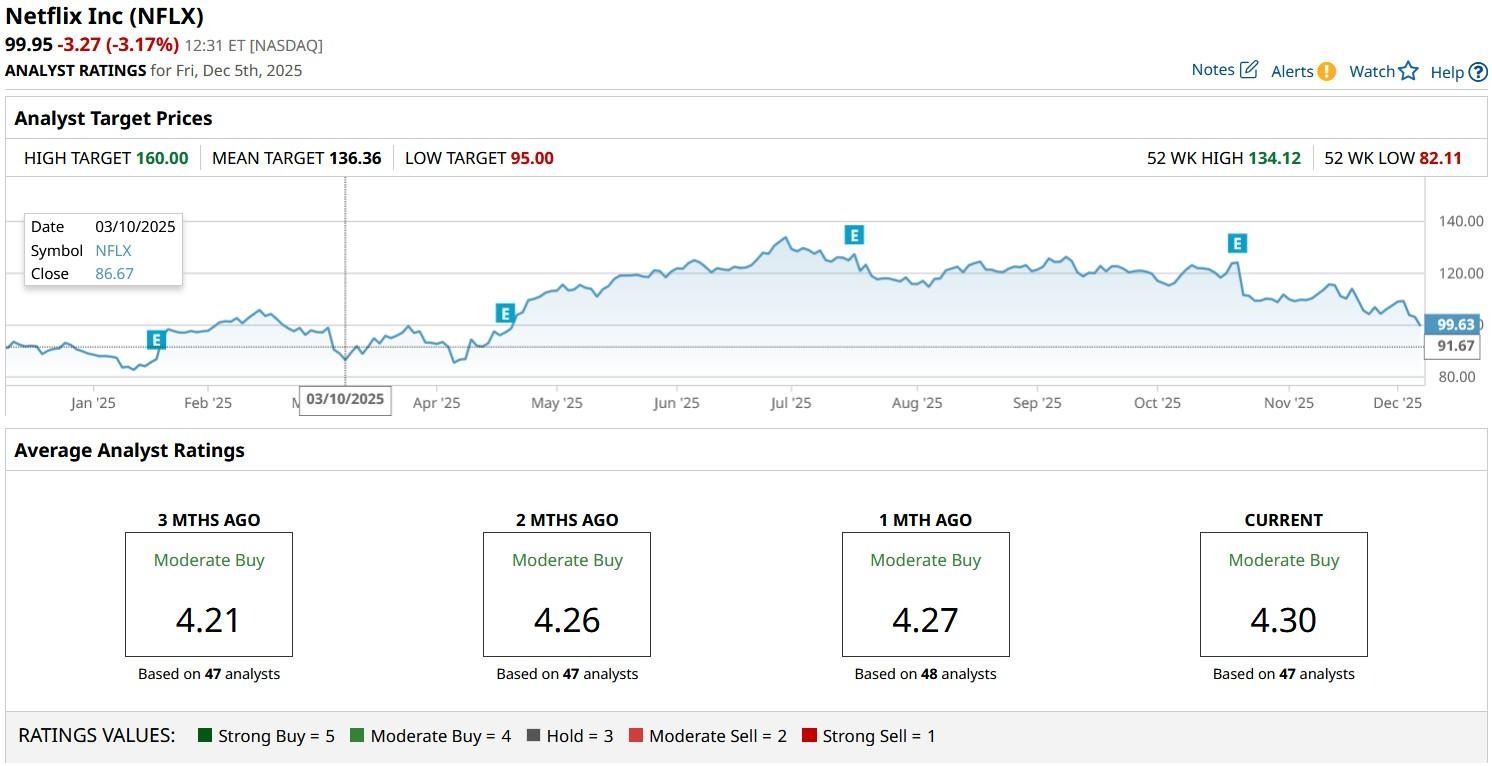

What’s the Consensus Rating on Netflix?

Other Wall Street analysts agree with Mahaney’s bullish view on Netflix stock as well.

According to Barchart, the consensus rating on NFLX shares currently sits at “Strong Buy” with price targets going as high as $160, signaling potential for a more-than-55% rally in the coming year.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/A%20photo%20of%20a%20Sandisk%20Solid%20State%20Drive%20by%20Top%20Popular%20Vector%20by%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20phone%20and%20site-by%20Majahid%20Mottakin%20via%20Shutterstock.jpg)