Dividend investors usually don’t bother with timing entries, at least not from a technical standpoint. There’s really no need to check things like 7-day indicators, 20, 50 or 200-day moving averages, MACD oscillators, Bollinger Bands, or Commodity Channel Indexes.

The best income investors (myself included) tend to focus on the fundamentals, such as whether the stock is cheap or undervalued right now. But, that doesn’t mean that you can’t use technical indicators, becuase sometimes, the best way to start a position is to incorporate them in your trading. That said, it's a lot of work to do and requires finding a shortcut - and Barchart offers just that.

Using Barchart Opinion, you can easily scan for stocks with positive technical indicators. Further limit your choices to Dividend Aristocrats, which are companies that have paid increasing dividends for 25 or more years, and you get a shortlist of highly attractive stocks for both growth and income.

How I Came Up With The Following Stocks

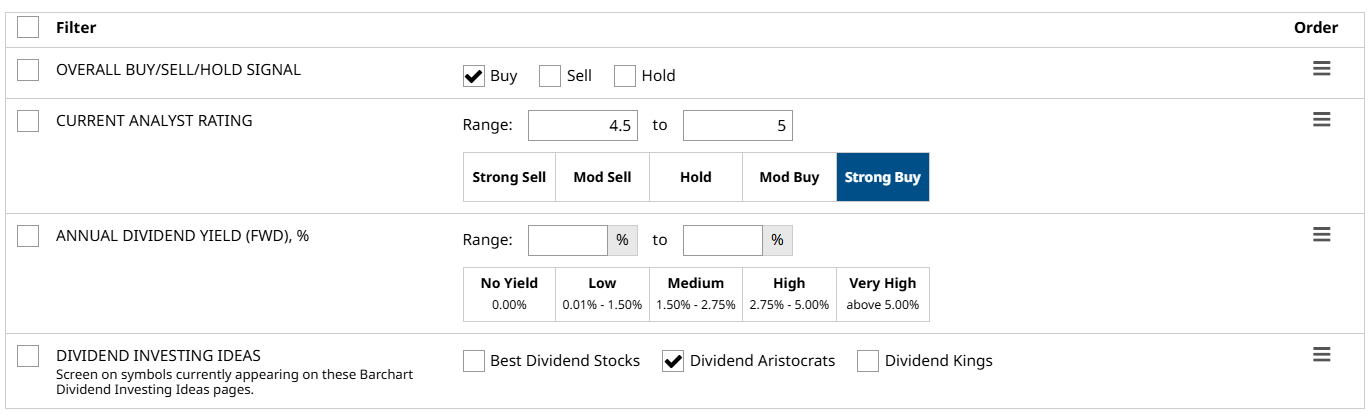

With Barchart’s Stock Screener, I used the following simple filters:

- Overall Buy/Sell/Hold Signal: Buy only. This filter combines all aspects of Barchart’s Opinion feature to limit the list to stocks that exhibit only an overall positive upward trend, as determined by the selected indicators.

- Current Analyst Rating: 4.5 to 5 (Strong Buy). In addition to positive technical indicators, I opted to limit the resulting list to companies with strong buy ratings, as per Wall Street.

- Annual Dividend Yield (Forward): Left blank so I can arrange the results accordingly.

- Dividend Investing Ideas: Dividend Aristocrats. Barchart offers several investing ideas lists that are updated daily, based on different criteria ranging from themes such as mining or oil stocks, to trade picks based on unusual option activities, to lists curated based on technical indicators like the J-pattern or the golden cross.

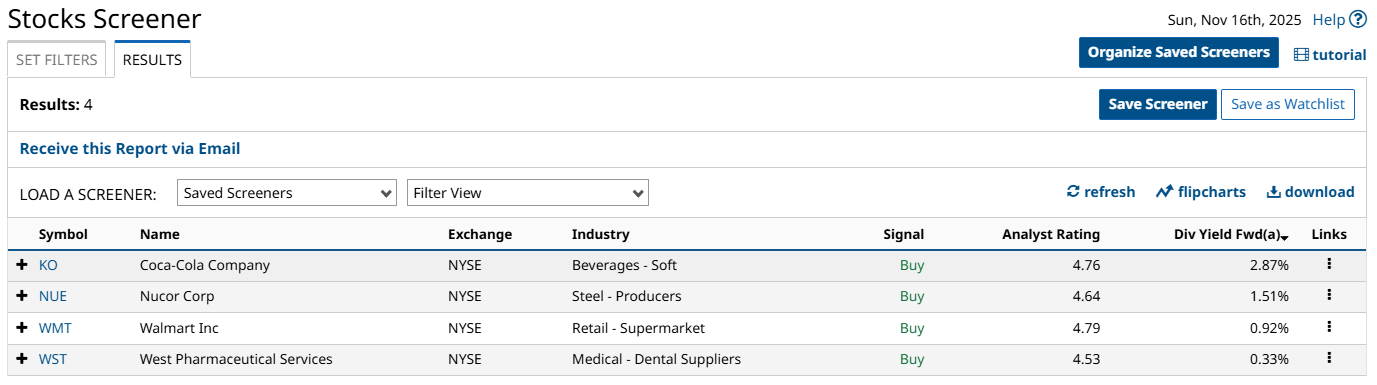

With these filters in place, I ran the screen and got four companies:

So, with that out of the way, let’s cover all three- plus a bonus fourth because I think it belongs, starting with the company with the highest yield.

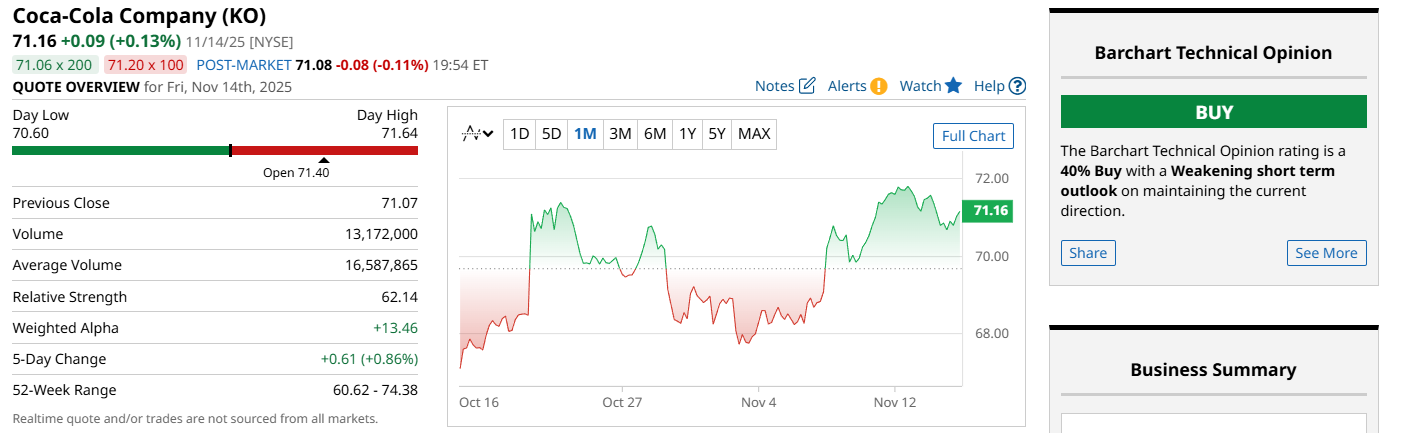

Coca-Cola Company (KO)

It’s no longer surprising that Coca-Cola takes the top spot yet again. I’ve featured it in many top dividend stocks lists before, including ones that cover Dividend Kings. Of course, the company is well-known for its namesake brand, as well as other well-loved beverages like Sprite, Fanta, & Minute Maid,

Today, the company pays $2.04 per share per year, which translates to a yield of just under 3%, and KO stock maintains a strong buy rating from Wall Street analysts. It also has a 40% buy rating from Barchart Technical Opinion; however, the recent price spike suggests the stock is now showing technical weakness.

Nucor Corp (NUE)

Nucor Corp is a steel and steel-product fabrication company, with operations in materials recovery and recycling. Like Coca-Cola, it's also a Dividend King and was recently featured in my top Dividend Kings article.

The company pays $2.20 per share per year, which reflects about a 1.5% yield - not bad, considering it has 52, going 53 years of dividend increases this upcoming December. NUE stock also has a strong buy rating from Wall Street and a strong buy from Barchart Technical Opinion today.

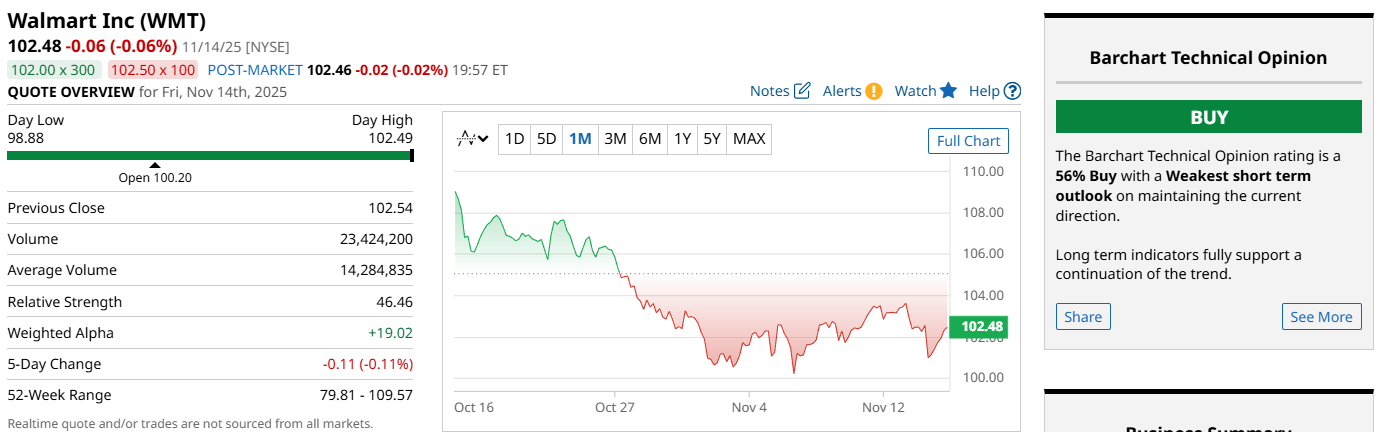

Walmart Inc (WMT)

Next up is Walmart, one of the world's largest retail companies. The company offers a diverse range of products, including groceries, clothing, home goods, and electronics, and has a growing presence in the e-commerce sector.

Today, the company pays 94 cents annually, which translates to a yield that’s just shy of 1%. However, analysts have been very bullish on WMT stock, rating it a strong buy, while technical indicators are generally positive based on the buy rating from Technical Opinion.

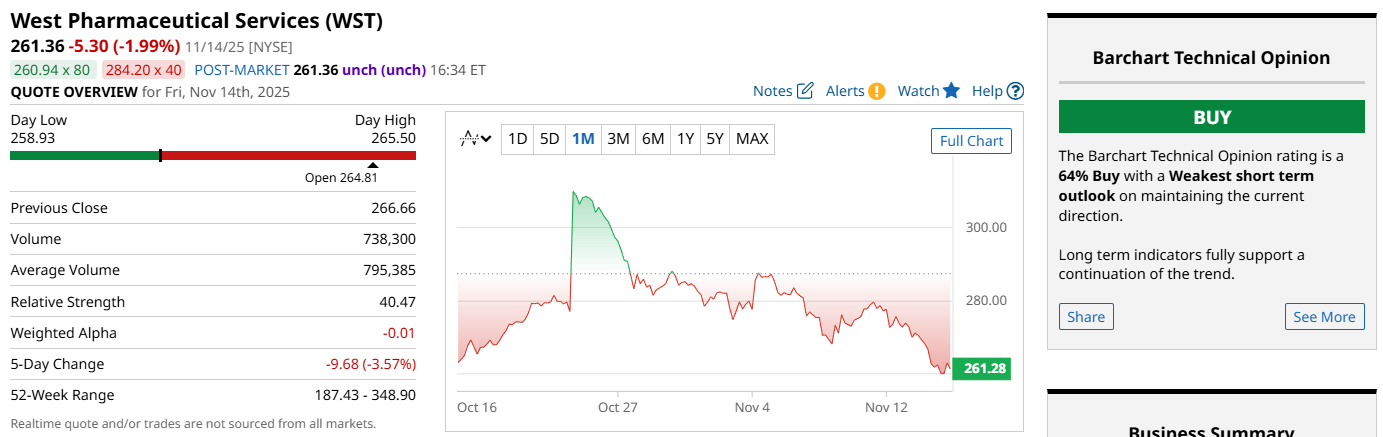

West Pharmaceutical Services (WST)

Last but not least is my bonus pick: West Pharmaceutical Services. This company specializes in designing and manufacturing packaging, delivery, and sealing systems for injectable drugs, which include traditional syringes, vial stoppers, and other advanced self-injection devices, such as the SmartDose On-Body Delivery System Platform (OBDS).

West Pharma may not be as popular as the other three Dividend Aristocrats on this list, but if you’ve ever stayed in a hospital, your doctors likely used their products at some point. This just goes to show that you don’t have to be a big name to make it as a Dividend Aristocrat - you just have to have a stable business model and steady cash flow to sustain dividend increases.

Today, West Pharma pays 88 cents per share, which works out to about a 0.33% yield - admittedly, the lowest on this list by a good margin. However, analysts rate WST stock a strong buy with almost 50% potential upside over the next year. It also maintains an overall buy rating based on Technical Opinion scores.

Final Thoughts

Some of the best Dividend Aristocrats out there offer more than growing income - they offer the opportunity for steady growth, as well. However, investors should be selective when choosing their Aristocrat. Here, Wall Street ratings and Barchart Opinion can help filter out market noise and provide a clearer sense of which stocks deserve your attention.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)