If you’re eating your way through your kid’s Halloween candy, then you know it’s officially the holiday season. Thanksgiving is around the corner, then Christmas. This has been a GREAT time for the S&P 500 Index ($SPX) historically. So, is a year-end run incoming in 2025?

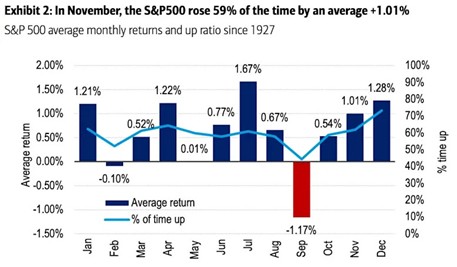

Let’s start with the MoneyShow Chart of the Day – a look at the S&P 500’s average monthly returns going back to 1927.

Source: Bank of America Global Research

(If you want to get more articles and chart analysis from MoneyShow, subscribe to our Top Pros’ Top Picks newsletter here.)

You can see that November’s average return hovers just above 1%, while December’s clocks in at almost 1.3%. Plus, your chance of having a winning month increases sequentially in the last three months of the year.

Now let’s state the obvious: Seasonality helps with pattern analysis. But it doesn’t guarantee anything. September is historically a lousy month, with an average loss of 1.17%. But September was a great month this year, with the S&P rising 3.5%.

I’m still leaning bullish here in Q4. So, if I HAD to make a prediction, I DO think we finish the year off with a flourish.

But I’m watching sentiment. I’m watching market breadth. I’m watching earnings. And I’m watching yields and the dollar. If conditions start deteriorating, I’ll let you know – and I’ll adjust my stance!

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/Apple%20products%20arranged%20on%20desk%20by%20tashka2000%20via%20iStock.jpg)