/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

Palantir Technologies Inc. (PLTR), with a market cap of $426 billion and specializes in developing advanced software platforms for government and commercial clients. The company, headquartered in Denver, Colorado, plays a key role in supporting counterterrorism efforts and intelligence operations across the United States, the United Kingdom, and other global markets.

Companies worth $200 billion or more are generally described as “mega-cap stocks,” and PLTR perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the software infrastructure industry.

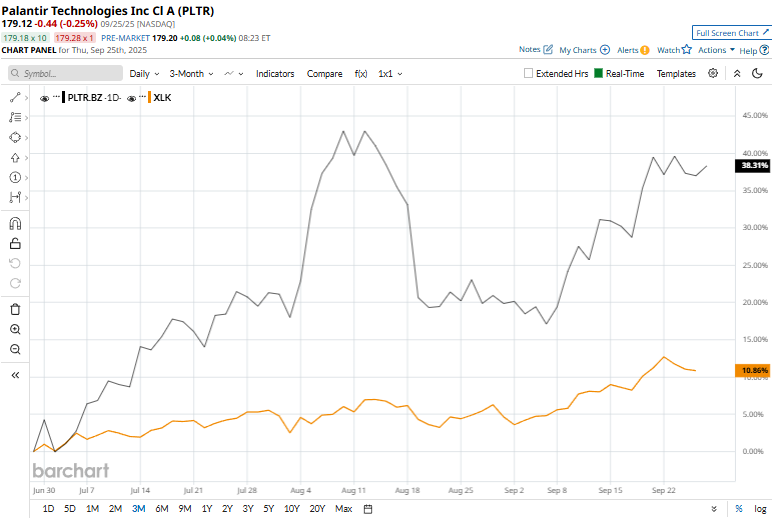

PLTR recorded its 52-week high of $190 on Aug. 12, and is currently trading 5.7% below the peak. The stock surged 25.4% over the past three months, outpacing the Technology Select Sector SPDR Fund’s (XLK) 11.5% returns over the same time frame.

Shares of PLTR have been on a remarkable run, skyrocketing 382.5% over the past year, far eclipsing XLK’s 24% gain in the same period. The momentum has only accelerated in 2025, with the stock climbing 136.8% year-to-date, compared with XLK’s more modest 19.6% rise.

Technically, the rally shows no signs of losing steam. PLTR has maintained a position above its 200-day moving average for the entire past year and has traded mostly above its 50-day moving average since late April, underscoring a strong and sustained uptrend.

On Sept. 23, shares of Palantir Technologies climbed over 1% after the U.S. Treasury Department awarded the company a new contract centered on strengthening data integrity and enhancing technical infrastructure. The deal underscores Palantir’s growing role as a trusted government technology partner, reinforcing its reputation for delivering advanced data analytics and infrastructure solutions.

Its rival, Microsoft Corporation (MSFT), has lagged behind, with its shares rising 20.3% on a YTD basis and 17.3% over the past 52 weeks.

Despite the robust momentum, analysts are skeptical. Among the 21 analysts covering the PLTR stock, the consensus rating is a “Hold.” On the bright side, it currently trades above its mean price target of $157.72.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Server%20racks%20by%20dotshock%20via%20Shutterstock.jpg)