/The%20Tesla%20Cybercab%20on%20display_%20Image%20by%20Josiah%20True%20via%20Shutterstock_.jpg)

Tesla (TSLA) remained in focus on Thursday after the EV giant said it has secured a key Cybercab patent, reinforcing its commitment to innovation in autonomous vehicle technology.

The announcement arrives amid significant challenges in the company’s core business, particularly in Europe where sales declined 37% last month, as Chinese rival BYD (BYDDY) continued to steal market share.

Still, Tesla stock has been a lucrative investment in recent months, currently up nearly 100% versus its April low.

Is a Cybercab Patent a Reason to Buy Tesla Stock?

The Cybercab patent confirms TSLA is making progress in its robotaxi program, with recent approval in Arizona complementing existing operations in Texas, California, and Nevada.

The firm’s pivot toward robotics and artificial intelligence (AI), including the Optimus humanoid robot, represents a major strategic shift – with Elon Musk expecting it to make up 80% of Tesla’s future value.

However, the billionaire entrepreneur’s track record of unfulfilled promises, including repeated claims about full self-driving capability, raises questions about execution risks.

Meanwhile, TSLA stock is already trading at a stretched valuation of about 250x trailing earnings, indicating elevated expectations that may be difficult to meet without significant traction in its AI and robotaxi initiatives.

Investing in TSLA Shares at Current Levels Is a Risky Bet

Investors should remain wary of owning Tesla shares at current levels also because the company’s core automotive business, faces declining EV sales, shrinking margins, and intensifying competition, particularly in Europe and China.

Plus, the electric vehicle firm’s increasing reliance on automotive regulatory credits and interest income for profitability is concerning, especially given the elimination of domestic regulatory credits under President Donald Trump..

The expiring $7,500 federal EV tax credit at the end of September is expected to create additional headwinds for Q4 demand, which could trigger a notable selloff in TSLA shares.

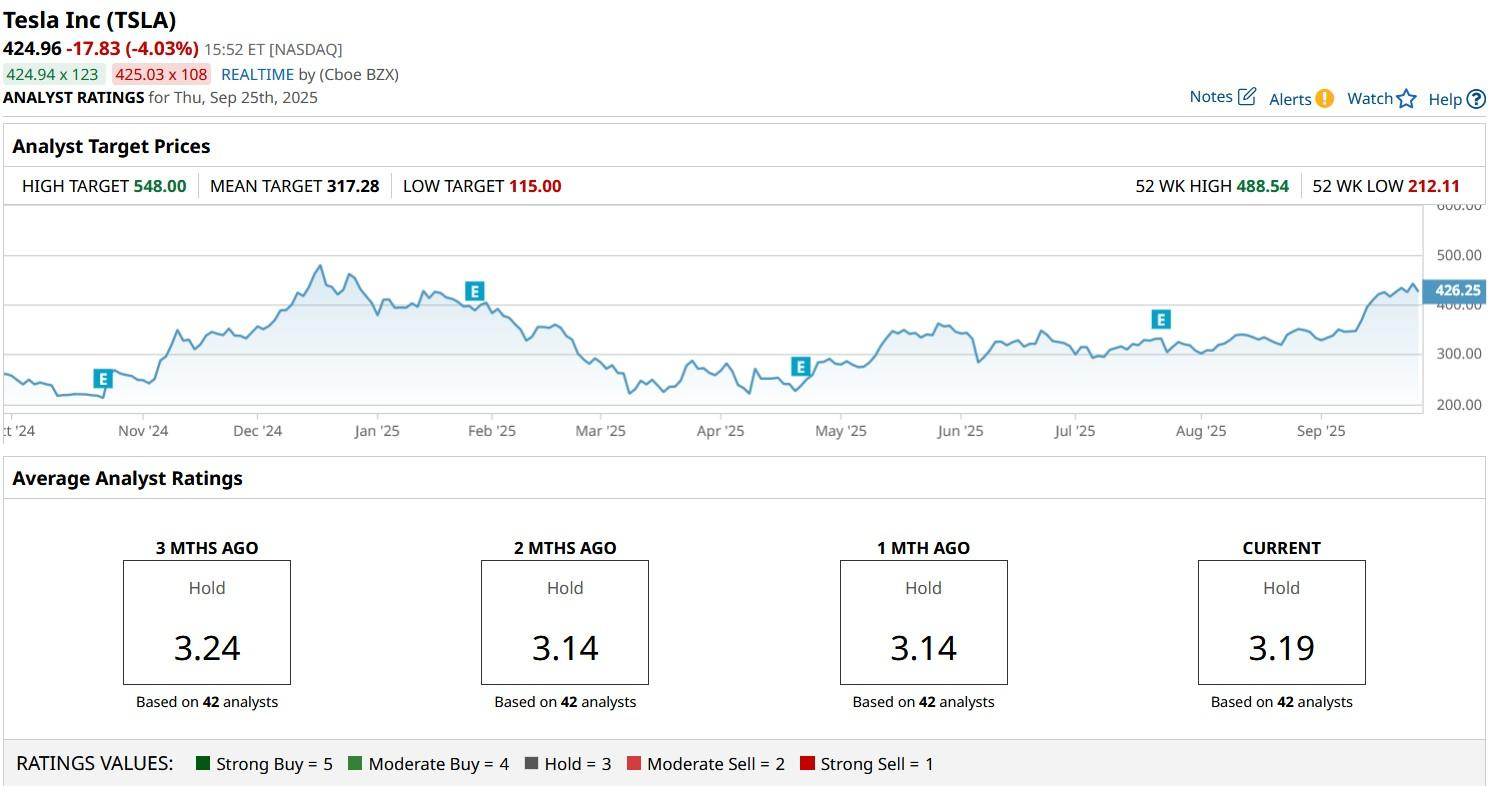

Tesla Remains a ‘Hold’-Rated Stock Among Wall Street Analysts

Wall Street also recommends caution in initiating a new position in TSLA stock at current levels.

According to Barchart, the consensus rating on Tesla shares sits at “Hold” only with the mean target of about $317 indicating potential downside of roughly 25% from here.

/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)