The J. M. Smucker Company (SJM), headquartered in Orrville, Ohio, is a leading American manufacturer of branded food and beverage products. With a market cap of $11.5 billion, the company has evolved from its origins in apple butter production to encompass a diverse portfolio of consumer goods. Smucker operates through four primary segments: U.S. Retail Coffee, U.S. Retail Frozen Handheld and Spreads, U.S. Retail Pet Foods, and Sweet Baked Snacks.

Companies with a market value of $10 billion or more are classified as “large-cap stocks,” and SJM is a prominent member of this category. It stands out in the consumer-packaged goods sector due to its robust portfolio of iconic brands, including Folgers, Jif, and Meow Mix, which provide a strong market presence and consumer loyalty. The company's strategic acquisitions, such as Hostess Brands, have diversified its product offerings and expanded its reach.

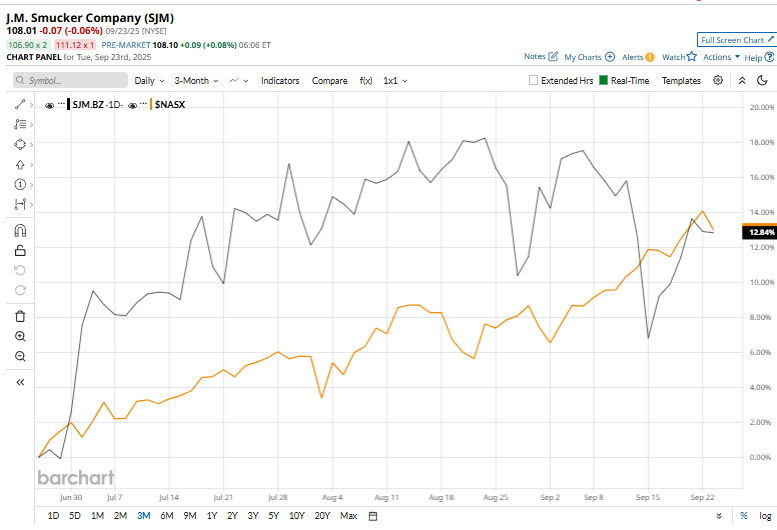

However, SJM has been trading 13.9% below its 52-week high of $125.42, met on Nov. 26, last year. However, the stock has surged 11% over the three months, underperforming the broader Nasdaq Composite’s ($NASX) 15% rise over the same time frame.

On a YTD basis, SJM has declined 1.9%, compared to $NASX's 16.9% rise. Over the past year, SJM has declined 9.2%, trailing $NASX’s 25.6% rise over the same period.

The stock has dipped below its 50-day and 200-day moving averages since mid-September, reinforcing a downtrend.

On Aug. 27, The J.M. Smucker released its fiscal 2026 first-quarter earnings, and its shares dipped 4.4%. It reported net sales of $2.11 billion, a marginal decrease from the same quarter of the previous year. Its adjusted EPS was $1.90, down 22% year over year due to higher commodity costs, unfavorable volume/mix, and derivative losses. Both the topline and bottom line failed to surpass the market’s expectations. Additionally, cash flow weakened, with operating activities resulting in a $10.6 million outflow compared to a $172.9 million inflow in the prior year. Free cash flow was negative at $94.9 million, a significant decline from the $49.2 million generated in the same quarter last year.

Its peer, Hormel Foods Corporation (HRL), has dropped 22.1% in 2025 and 22.4% over the past 52 weeks, underperforming SJM.

SJM has a consensus rating of “Moderate Buy” from 18 analysts covering it. Its mean price target of $118.88 indicates a modest 10.1% upside potential from the current market price.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)