With a market cap of $9.4 billion, The Interpublic Group of Companies, Inc. (IPG) is a leading global advertising and marketing services firm headquartered in New York City. Established in 1930 as McCann-Erickson and rebranded as IPG in 1961, the company has grown to employ approximately 51,000 people across over 100 countries.

Companies worth between $2 billion and $10 billion are generally described as “mid-cap stocks,” and IPG perfectly fits that description. IPG’s market leadership stems from strong global presence, a diverse service portfolio through top networks, long-standing client relationships, a focus on innovation and technology, and efficient operations, all of which help it maintain an edge in the advertising industry.

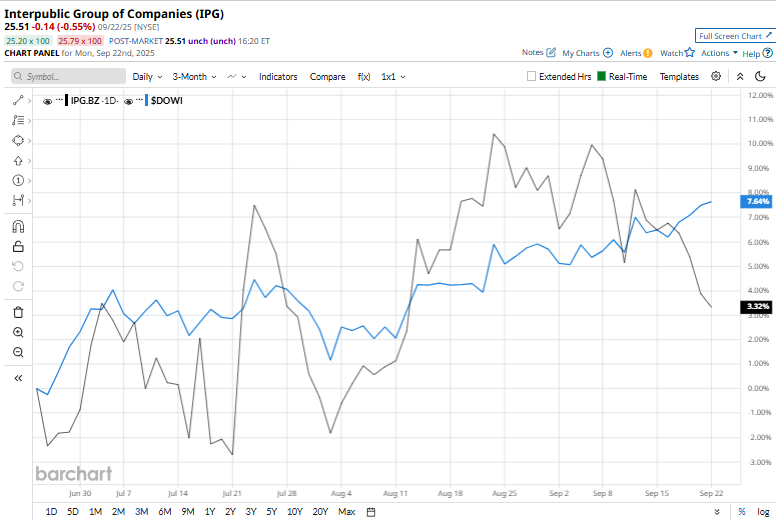

IPG shares have faced challenges and are currently trading 22.8% below their 52-week high of $33.05, touched on Dec. 9, 2024. The stock has surged 8.9% over the past three months, lagging behind the broader Dow Jones Industrial Average’s ($DOWI) 9.9% rise during the same time frame.

IPG has declined 9% on a YTD basis, underperforming $DOWI’s 9% rise. Moreover, over the past 52 weeks, IPG's 18% decline has been outperformed by $DOWI's 10.3% increase.

IPG has remained chiefly below its 200-day and 50-day moving averages since the end of October, indicating a downtrend.

On Jul. 22, Interpublic Group released its Q2 2025 results, and shares surged nearly 7%. It posted an adjusted revenue of $2.2 billion, in line with expectations and adjusted EPS of $0.75, exceeding forecasts. The strong performance was fuelled by robust spending in its media and healthcare-focused segments, along with growth in sports marketing and public relations.

IPG’s rival, Omnicom Group Inc. (OMC), has fallen behind IPG, with a fall of 13.4% on a YTD basis and a 27.2% drop over the past 52 weeks.

Among the nine analysts covering the IPG stock, the consensus rating is a “Moderate Buy.” The mean price target of $30.51 suggests a 19.6% upside potential from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/A%20photo%20of%20a%20Sandisk%20Solid%20State%20Drive%20by%20Top%20Popular%20Vector%20by%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20phone%20and%20site-by%20Majahid%20Mottakin%20via%20Shutterstock.jpg)