/Broadcom%20Inc%20logo%20on%20phone%20and%20site-by%20Majahid%20Mottakin%20via%20Shutterstock.jpg)

Broadcom (AVGO) is one of the world’s leading technology companies specializing in semiconductor infrastructure software. The company works on everything, from data centers and networking gear to wireless devices and cybersecurity solutions. Broadcom’s cutting-edge chips and systems enable faster internet, AI innovations, and secure enterprise operations for tech giants.

Founded in 1991, the company is headquartered in Palo Alto, California, with operations spanning across 25 countries.

Broadcom Stock Report

Broadcom’s stock has shown mixed performance lately as the stock reacts to market volatility with a drop of 3% over the previous five days and a negative 7% return over a month. Year-to-date (YTD), the stock reflects broader tech pressure, sliding over 6% while being down 11% in the last three months. However, on a longer time frame, like 52 weeks, it provides a 48% return, which further increases to 164% in two years.

Compare this to the S&P 100 ($ONE) index, which outperforms Broadcom on the near side as it maintains a flat performance while Broadcom struggles, while the S&P 100 loses out heavily in the longer timeframe, where it provided a 17% return in 52 weeks and 46% in two years.

Broadcom Results Shines

Broadcom posted stellar Q4 2025 results on Dec. 11, 2025, with adjusted earnings reaching $1.95 per share, topping analyst estimates of $1.87. Revenue for the quarter reached a record $18.0 billion, up 28% year-over-year (YoY) while beating analyst forecasts of $17.6 billion.

Looking into the company’s financials, adjusted EBITDA totaled $12.2 billion, spiking 34% YoY with free cash flow growing 36% to $7.5 billion, taking the full-year FCF to $26.9 billion. Semiconductor revenue hit $11.1 billion, increasing 35% YoY, citing accelerated AI demand. Operating margin touches 66.2% with expenses rising 16% to $2.1 billion with heavy R&D work while cash reserves stood firmly at $16.2 billion, increasing 73% YoY.

Management also included Q1 2026 guidance where they anticipate revenue of $19.1 billion, signaling a 28% growth rate, while continued AI demand is expected to double semiconductor revenue to $8.2 billion. Lastly, the adjusted EBITDA margin is expected to be 67%.

Broadcom is scheduled to publish its first-quarter 2026 results on March 4, 2026.

Broadcom Upgraded by Analyst

Wolfe Research upgraded Broadcom to “Outperform” with a $400 price target, signaling an upside of 20% from the market rate. This reflects growing confidence in Google's (GOOG) (GOOGL) TPU program scale and Broadcom's strong role as a key supplier.

Channel checks show TPU shipments could hit 7 million units yearly by 2028, making it a real rival to Nvidia (NVDA) GPUs. Google's third-party access boosts custom chip demand, with Broadcom poised to grab a big share.

Wolfe raised 2027 forecasts to $154.5 billion in revenue and $16 EPS, driven by higher TPU volumes and AI growth. For 2026, AI ASIC revenue jumps to $44 billion (3.3 million TPUs), 2027, AI revenue hits $78.4 billion (5.1 million units). TPUs lead XPU growth, with networking at $15.1 billion in 2026 (up 75% YoY).

Upside could come from Meta (META) and OpenAI projects. The $400 target uses a 22x 2027 bull-case EPS of $18, below Broadcom's three-year average 25x multiple.

Should You Bet on AVGO Stock?

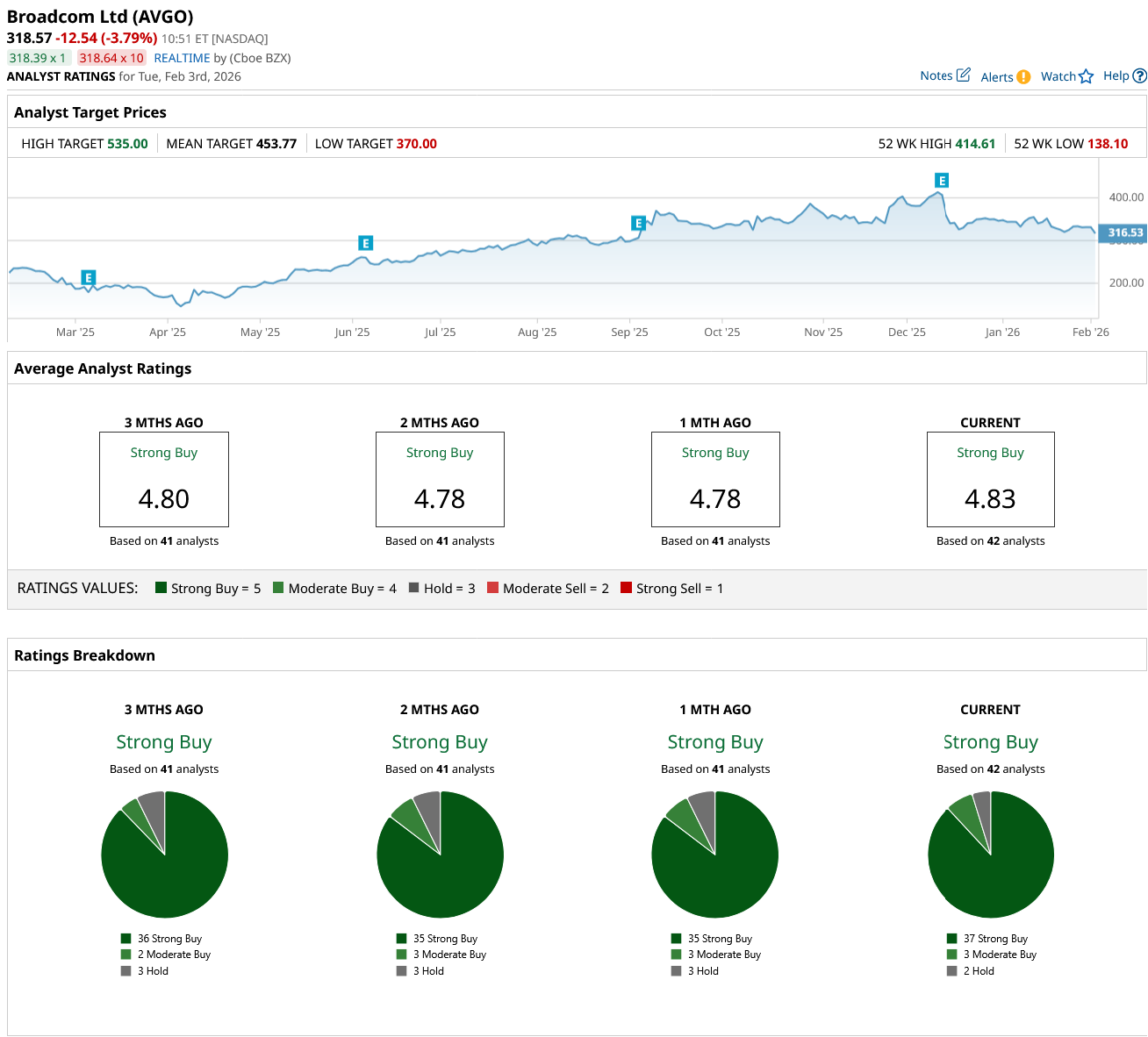

Despite the recent dip, the stock still garners plenty of support on Wall Street with a consensus “Strong Buy” rating and a mean price target of $453.77, reflecting an upside potential of 42% from the market rate. The stock has received ratings from a total of 42 analysts, with 37 “Strong Buy” ratings, three “Moderate Buy” ratings, and two “Hold” ratings.

The recent pullback from highs, coupled with upcoming quarterly results, makes it an appealing time for potential investors.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/A%20photo%20of%20a%20Sandisk%20Solid%20State%20Drive%20by%20Top%20Popular%20Vector%20by%20Shutterstock.jpg)

/Tesla%20dealership%20with%20cars%20in%20lot%20by%20Jetcityimage%20via%20iStock.jpg)