This week’s Bull Strangle Watch List reflects a deliberate focus on diversification, structure, and tradeability, rather than chasing short-term momentum. The list spans 27 stocks across 10 sectors, complemented by 4 ETFs, providing broad exposure while avoiding concentration risk. The Bull Strangle approach is built around owning stock in technically stable names while pairing that position with disciplined option selling. The goal is not to predict market direction, but to identify stocks with orderly price behavior, manageable volatility, and clearly defined risk boundaries.

Two names that stand out this week—each from a different sector—are Xplr Infrastructure LP (XIFR) and Centene Corp (CNC).

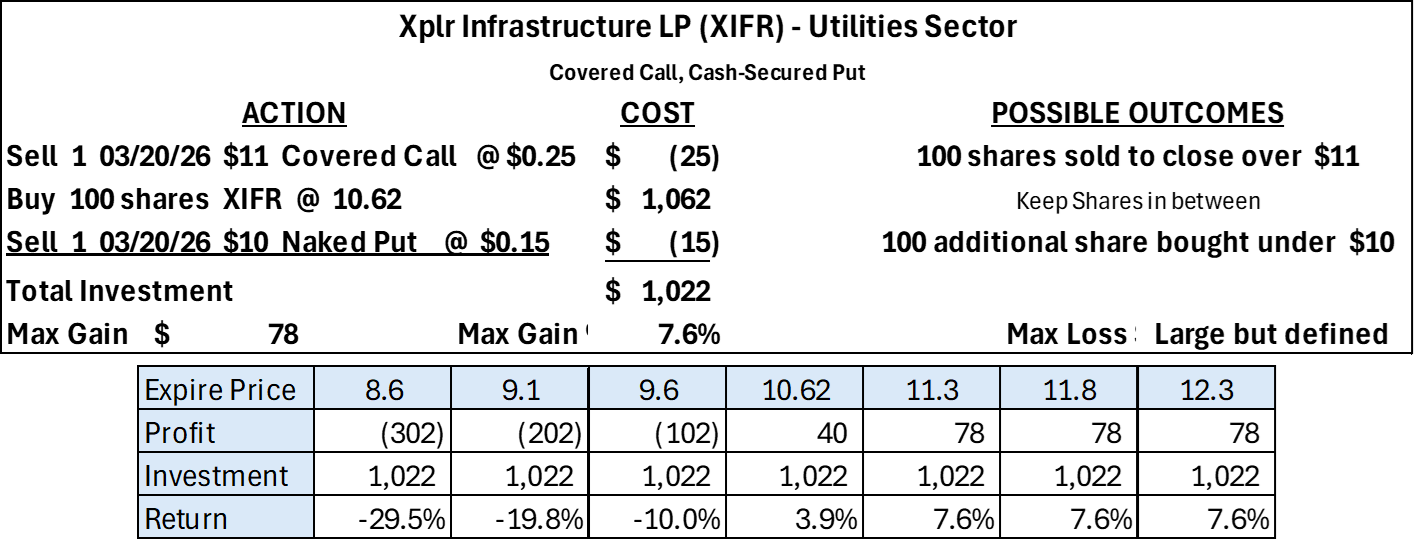

Xplr Infrastructure LP (XIFR) — Utilities / Infrastructure

Xplr Infrastructure has spent recent months stabilizing after a prolonged decline, transitioning into a sideways-to-slightly-up consolidation. Price has been building a base between $9.50 and $11.00, with higher lows forming. More recently, XIFR has pushed back above its short- and intermediate-term moving averages, signaling improving momentum without aggressive upside extension. Pullbacks have been shallow and contained, suggesting selling pressure has eased.

From a Bull Strangle perspective, XIFR offers:

- Defined support from a well-established base

- Moderate volatility relative to prior declines

- A structure that favors range-based income generation rather than directional bets

This makes it a candidate for disciplined premium collection where risk can be clearly mapped.

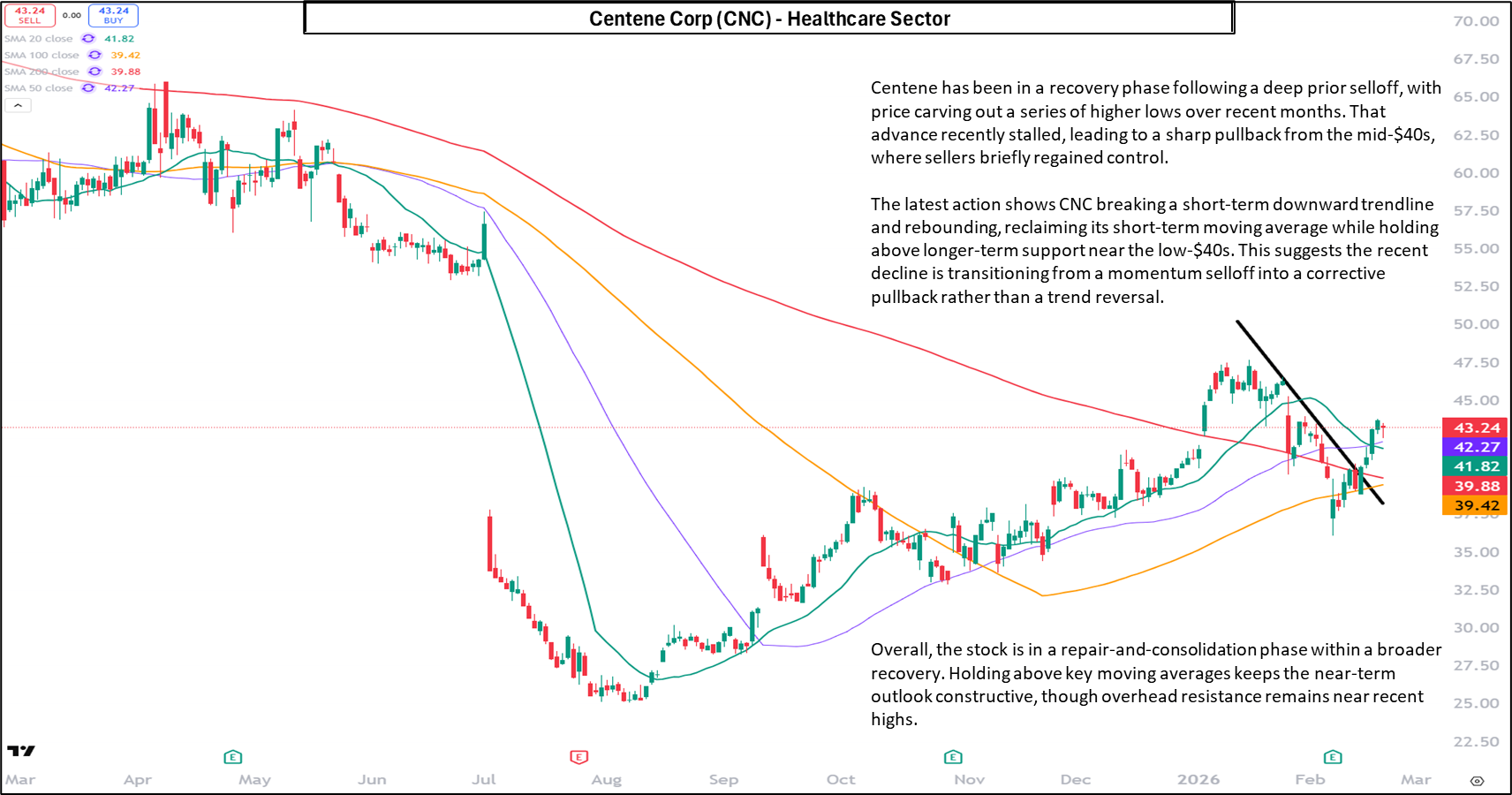

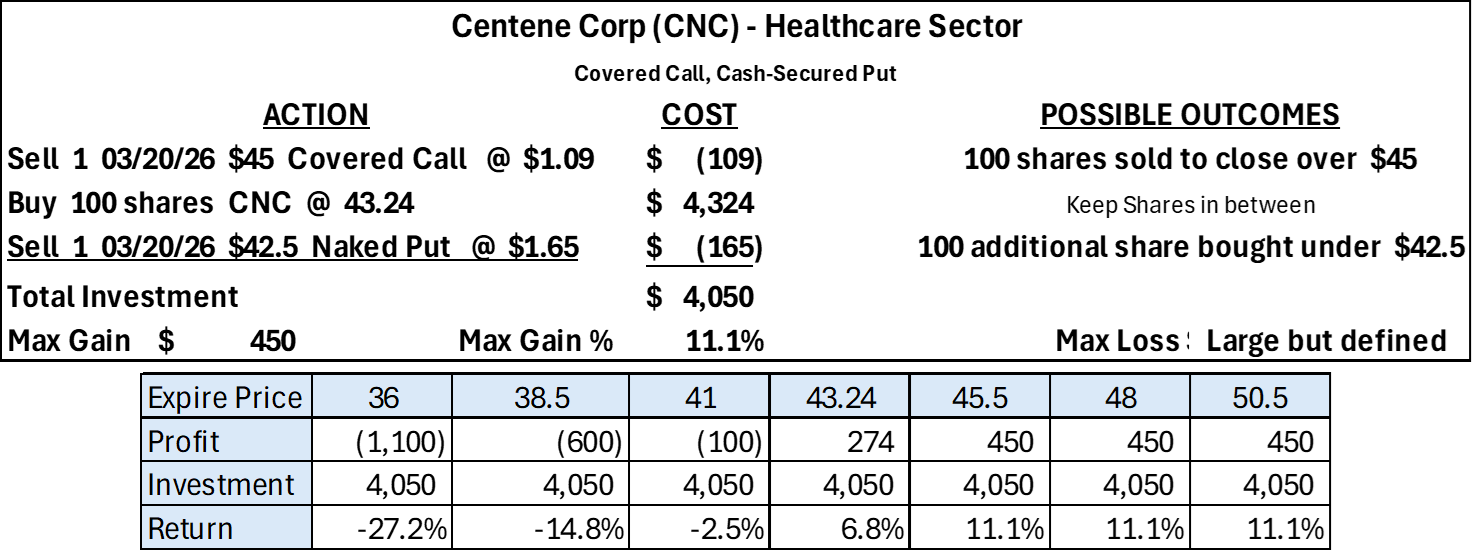

Centene Corp (CNC) — Healthcare

Centene represents a different profile: a stock in repair following a deep selloff, now transitioning into a recovery and consolidation phase. After rebounding sharply off its lows, CNC recently pulled back from the mid-$40s, forming a short-term downward channel.

The latest action shows CNC breaking that short-term downtrend and stabilizing above key moving averages, suggesting the pullback is corrective rather than the start of a new decline. Price behavior has become more orderly, with buyers stepping in at higher levels than during prior selloffs.

For Bull Strangle positioning, CNC provides:

- Improving technical structure within a broader recovery

- Clear reference points for risk management

- A volatility profile that supports a premium without excessive instability

Healthcare exposure also adds a defensive element to the broader watch list.

Why the Broader Watch List Matters

The strength of the Bull Strangle Watch List is not found in any single stock, but in its intentional breadth. With 27 stocks across 10 sectors, plus 4 ETFs, the list is designed to:

- Reduce reliance on any single market theme

- Balance cyclical, defensive, and income-oriented sectors

- Allow selectivity based on market conditions and volatility regimes

This flexibility is especially important in markets where indexes may be consolidating near highs and leadership continues to rotate.

Bottom Line

This week’s Bull Strangle Watch List emphasizes structure over speculation. Stocks like XIFR and CNC illustrate two different—but complementary—setups: one emerging from a base, the other repairing after a selloff. Both offer defined risk, improving technical behavior, and the potential to support consistent, repeatable income strategies. As always, the focus is not on forecasting outcomes, but on positioning around stocks that behave well, allowing option income to accumulate while risk remains controlled.

For readers interested in a structured, rules-based framework for combining stock ownership with systematic premium selling, the book The Bull Strangle Strategy is available on Amazon. The Bull Strangle Newsletter provides weekly trade planning, strike selection guidance, and portfolio management insights, all built on the same disciplined methodology.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Alphabet%20Inc_%20and%20Google%20logos%20seen%20displayed%20on%20a%20smartphone%20by%20IgorGolovniov%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)