/Robinhood%20app%20on%20phone%20by%20Andrew%20Neel%20via%20Unsplash.jpg)

Robinhood (HOOD) shares are up 15% on Monday after the online trading platform confirmed it will replace Caesars Entertainment (CZR) in the benchmark S&P 500 Index ($SPX) on Sept. 22.

The upcoming inclusion in the S&P 500 marks a significant milestone for the Nasdaq-listed financial technology company, which was once seen as a meme stock only.

Robinhood stock has been a game-changing investment in 2025. At the time of writing, the retail brokerage is trading up nearly 300% versus its year-to-date low set in early April.

Why Robinhood Stock Soared on Index Inclusion News

Investors cheered HOOD stock primarily because index inclusion could prove a near-term catalyst for the financial services giant.

Once Robinhood joins the S&P 500, index-tracking funds (including ETFs) will have to invest in it to replicate the index’s composition, potentially driving passive inflows and increasing demand for its stock.

Becoming a part of the benchmark index also signals institutional validation, elevating Robinhood from its meme stock past to blue-chip status.

Simply put, index inclusion could help improve the visibility, liquidity, and credibility of HOOD stock, potentially attracting long-term capital into the online trading platform.

HOOD Shares Are Already Trading at a Huge Premium

While index inclusion sure is positive for Robinhood shares, investors are recommended treading with caution in the fintech stock due to valuation concerns.

At the time of writing, the company’s shares are trading at a forward price-earnings (P/E) ratio of a little under 70x, which is much higher than its larger peer, Interactive Brokers (IBKR).

In fact, even Nvidia (NVDA), the artificial intelligence (AI) darling itself, is going for 41x only.

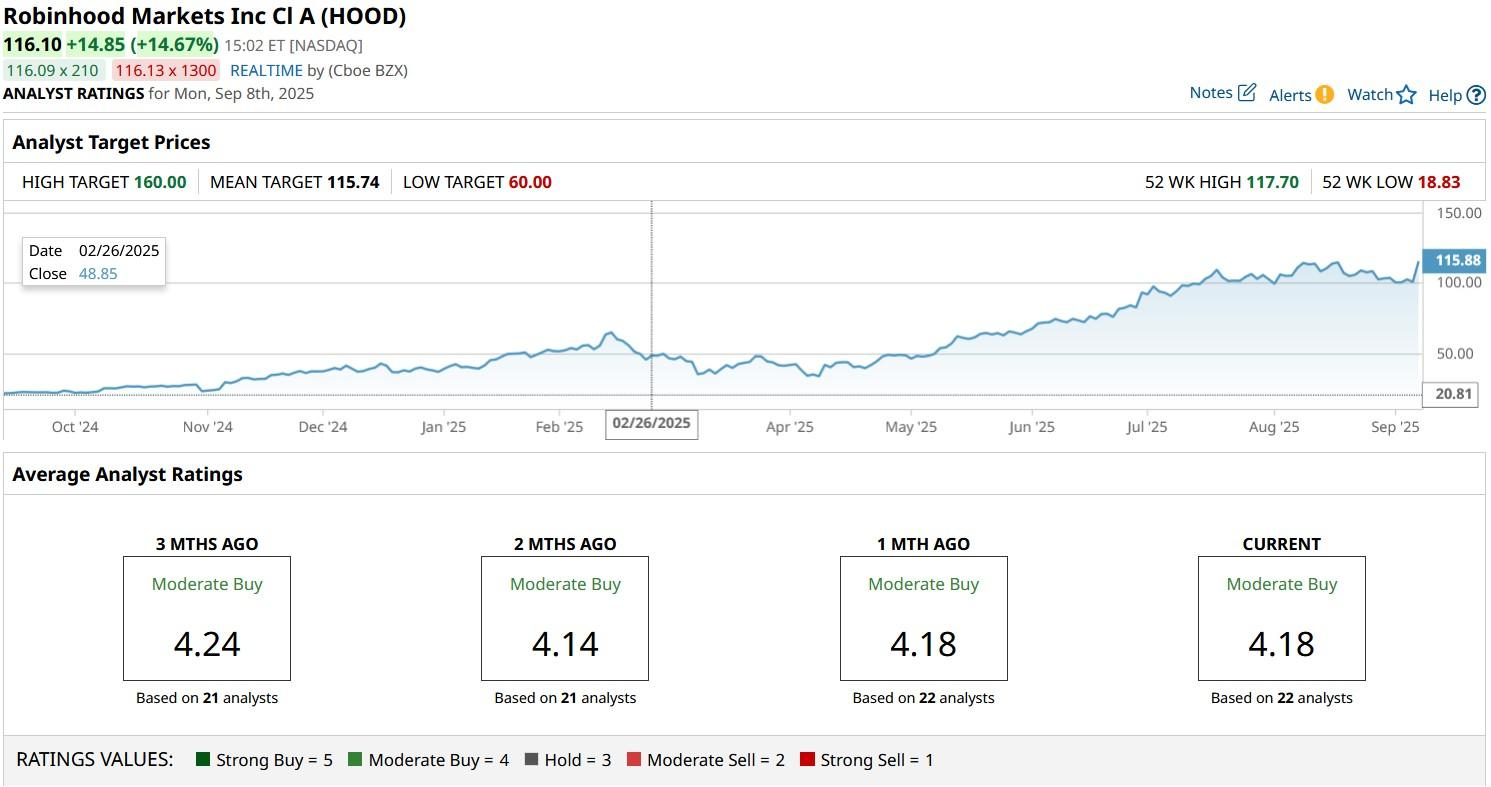

How Wall Street Recommends Playing Robinhood

Investors should also note that even Wall Street analysts now agree that Robinhood’s stock price increase has gone a bit too far.

While the consensus rating on HOOD shares remains at “Moderate Buy,” the mean target of about $116 is already in line with its current price.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)