Opendoor Technologies (OPEN) has been surging higher on strong momentum recently, with shares gaining over 789% since late June in a classic meme-trade rally, driven by both retail investor enthusiasm and optimism surrounding potential interest rate cuts. The company's recent trajectory has been particularly influenced by Federal Reserve Chair Powell's signals of possible September rate cuts, which sent the stock up 39% in a single session last Friday.

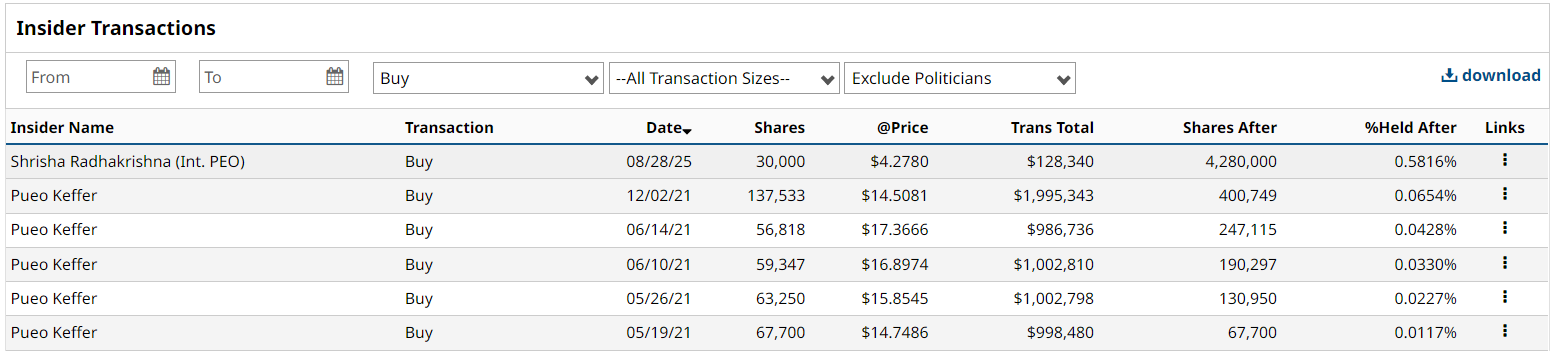

OPEN stock is soaring again to wrap up this week, rising 9% in the early minutes of today’s trading on reports that insider Shrisha Radhakrishna purchased 30,000 shares of OPEN stock at $4.278 each. That brings the Opendoor President and interim company leader’s stake to 4.28 million shares.

Notably, this marks the first insider buying activity on OPEN since December 2021, so investors are cheering the rare indication of high-level confidence.

What's Behind the Insider Buying on Opendoor?

The appointment of Shrisha Radhakrishna as interim leader earlier this month marks a significant transition period for Opendoor, with the company pursuing a strategic transformation from a traditional iBuying platform to an artificial intelligence (AI)-driven, multi-product ecosystem. This strategic shift has captured investor interest, particularly as Radhakrishna describes AI as a "core primitive" for the company's next growth phase – although skeptics question the effectiveness of AI application in home inspections and valuations.

Despite the stock’s impressive rally, analysts remain divided on Opendoor's prospects, with concerns centered on the sustainability of the stock's performance given the company's historical profitability challenges and high operational costs. The consensus recommendation is a tepid “Hold,” and the average price target of $1.11 implies expectations for OPEN to drop considerably from current levels.

Is OPEN Stock a Buy?

Longer-term, it’s worth pointing out that OPEN stock is down 89% from its all-time highs, set in February 2021. Technical indicators suggest resistance at current levels, and analysts expect losses to persist through 2026, though the potential for lower interest rates could help revitalize the housing market and benefit Opendoor's leveraged business model.

While revenue remains below its 2022 peak of $15.6 billion, the company's bottom line has shown improvement with narrowing losses. The stock's future performance appears to be heavily dependent on both macroeconomic factors, particularly interest rates, and Opendoor's ability to successfully execute its AI-driven transformation while managing its capital-intensive business model.

In this context, insider buying is an encouraging sign for OPEN, but investors should still proceed with caution on this high-risk turnaround play.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever. On the date of publication, Elizabeth H. Volk did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)