/Palantir%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock.jpg)

Palantir Technologies (PLTR) has been in the headlines for its steep 17.9% pullback from its Aug. 12 record high of $190, even as the momentum stock continues to maintain a market-crushing 106% year-to-date gain. Today, reports are highlighting an Aug. 21 stock sale by CEO Alex Karp totaling over $60 million, along with $26 million in sales by CTO Shyam Sankar - so, should Palantir bulls panic?

If they haven’t yet, probably not. First, there’s not much of a meaningful sentiment interpretation to take away from planned, automated, and/or tax-related stock sales by executives. Second, following the latest transaction, Karp still owns 6.4 million shares of PLTR stock worth about $1 billion.

Is It Time to Buy the Dip in PLTR Stock?

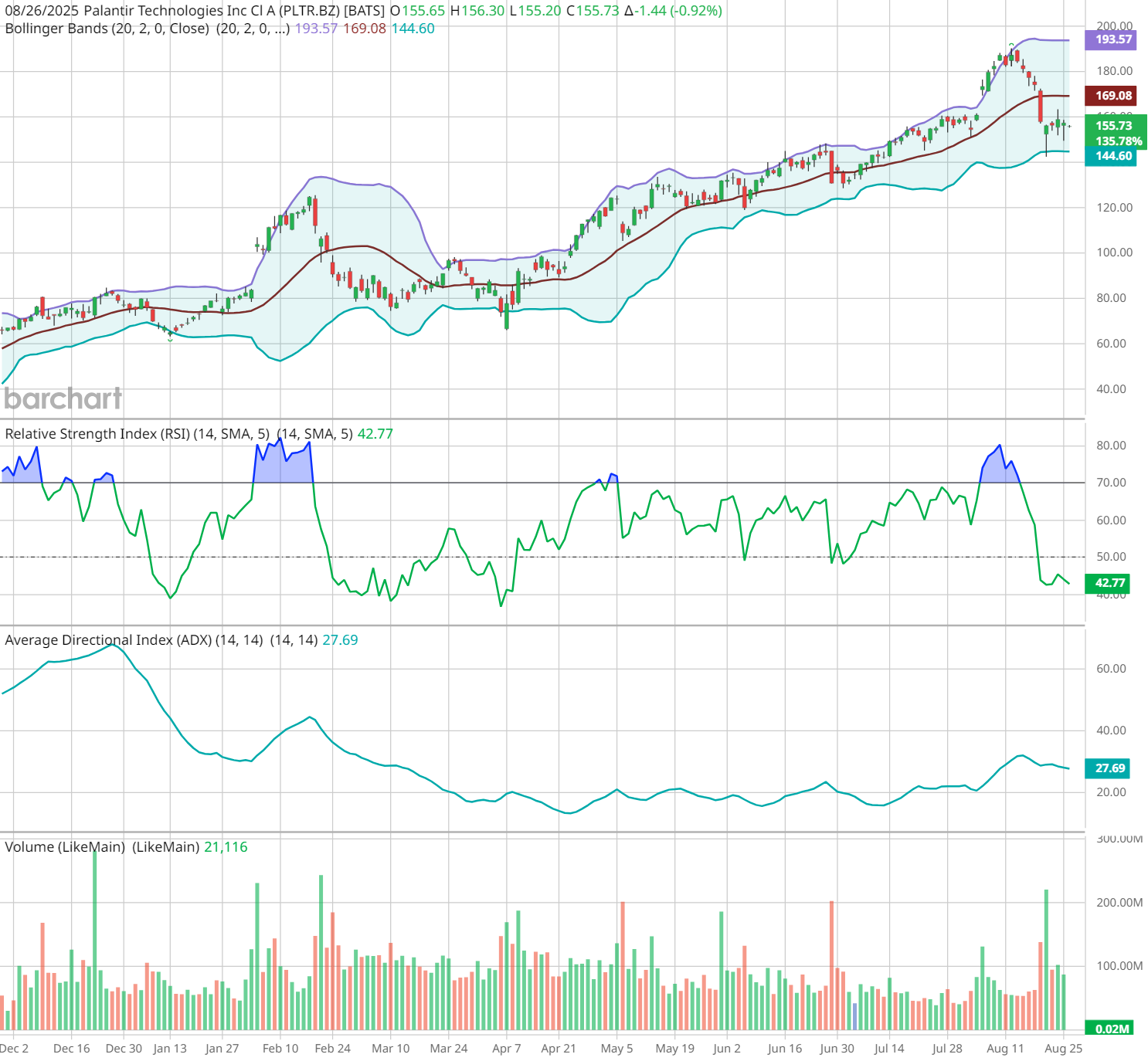

Here’s PLTR with a few different technical indicators to gauge its momentum and overbought status - Bollinger Bands, Relative Strength Index (RSI), and Average Directional Index (ADX) - which seem to indicate the sharp correction is leveling off.

However, valuation concerns loom large over the stock's prospects. PLTR trades at approximately 90 times forward sales and 242 times forward adjusted earnings, making it one of the most expensive components of the S&P 500 Index ($SPX). As a result, the stock was one of the hardest-hit when artificial intelligence (AI) plays were kneecapped last week by OpenAI CEO Sam Altman’s “bubble” warning.

Palantir Crushes Q2 Estimates

During the second quarter, Palantir’s revenue surpassed $1 billion for the first time, as the company demonstrated impressive growth across key segments. U.S. commercial revenue showed particularly strong momentum, surging 93% year-over-year to $306 million, while government revenue increased by 53% to reach $426 million.

The company's growth also continues internationally, as evidenced by its newly expanded partnership with SOMPO Holdings through Palantir Technologies Japan KK. Encouraging adoption of Palantir’s Artificial Intelligence Platform (AIP) platform and consistent securing of major contracts, including a recent $10 billion U.S. Army deal, underscore their market leadership position in data analytics and artificial intelligence solutions.

Should You Buy, Sell, or Hold PLTR Right Now?

Several prominent analysts, including RBC's Rishi Jaluria, maintain bearish outlooks, suggesting additional downside risk of up to 71%. Even after PLTR’s earnings beat earlier this month, Jaluria raised the stock’s price target only to a Street-low of $45 and backed an “Underperform” rating, with the analyst writing that “we question the durability of AIP-led momentum.”

While institutional investors like Lake Street Private Wealth have increased their positions, the current stock price appears to have priced in several years of future growth, warranting careful consideration at present levels. There’s no sign that investors need to panic over Karp’s planned stock sales, but Palantir’s extreme valuation multiples suggests new buyers may want to approach the stock with caution, despite its impressive operational performance and market leadership in AI capabilities.

This article was generated with the support of AI and reviewed by an editor. On the date of publication, the editor did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20logo%20on%20phone%20and%20stock%20data-by%20Rokas%20Tenys%20via%20Shutterstock.jpg)

/Palantir%20by%20rblfmr%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)