Tesla (TSLA) tumbled nearly 7% on Monday, July 7 as the electric vehicle giant grapples with declining deliveries and CEO Elon Musk’s renewed political ambitions, prompting investors to question whether the stock represents an opportunity or risk.

The EV maker reported 384,122 vehicle deliveries in Q2, marking a 14% year-over-year decline and the second consecutive quarterly drop. This underscores the mounting challenges facing the Austin-based automaker.

Rising competition from Chinese EV manufacturers, offering newer and more affordable models, continues to pressure Tesla’s market share, particularly in China. The company’s reputation has also suffered from the political backlash against Musk, whose recent announcement of forming the “America Party” has reignited investor concerns about leadership distraction.

Musk’s political involvement has created additional headwinds, with his feud with President Donald Trump potentially threatening subsidies benefiting Tesla’s solar and battery businesses.

Despite these challenges, some analysts view the delivery numbers as potentially marking the bottom for Tesla.

Is Tesla Stock a Good Buy Right Now?

Tesla stands at an inflection point as it evolves from a pure-play electric vehicle manufacturer into a powerhouse in AI and robotics. While the Austin-based company continues producing its popular Model Y, Model 3, Model X, and Model S vehicles across facilities in the United States, China, and Germany, CEO Elon Musk’s vision extends far beyond automotive sales.

Tesla’s most ambitious near-term initiative involves expanding robotaxi capabilities, which were launched in Austin this June, leveraging years of autonomous driving development to create a transportation-as-a-service revenue stream. This represents Tesla’s first major step toward achieving what Musk calls “sustainable abundance through affordable AI-powered robots.”

Simultaneously, Tesla's Optimus humanoid robot program is accelerating, with thousands of units expected to work in Tesla factories by year-end and millions projected by 2030. This robotics push could revolutionize manufacturing efficiency while opening entirely new markets.

Tesla’s energy storage business, anchored by utility-scale Megapacks, continues scaling toward terawatt-level deployment annually. The division supports grid stability while capitalizing on the transition to renewable energy.

However, intensifying competition from Chinese EV manufacturers and execution challenges around autonomous technology deployment remain key investor concerns as Tesla navigates this ambitious expansion beyond its automotive roots.

What Analysts Say About TSLA

While analysts estimate Tesla’s sales will fall by 1.5% in 2025, they forecast that the company will soon return to sales growth, with estimates of a 23% increase in 2028. Moreover, adjusted earnings per share are forecast to expand from $2.42 in 2024 to $6.17 in 2028.

If TSLA stock is priced at 70 times forward earnings, it could trade around $420 in early 2028, above its current price of $298. Over the last 12 months, TSLA stock was priced at an average forward price-earnings ratio of 110.55x.

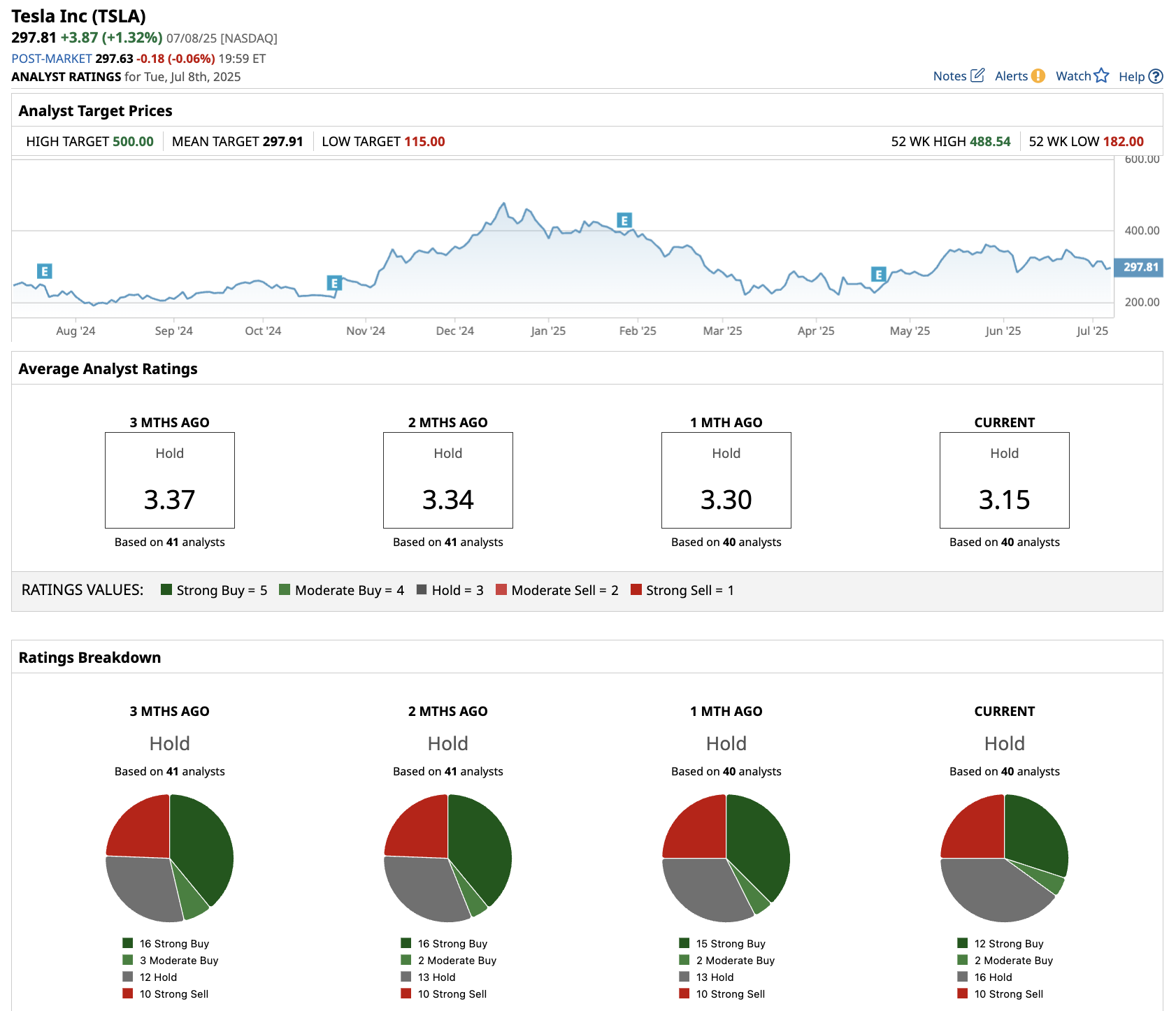

Out of the 40 analysts covering Tesla stock, 12 recommend “Strong Buy,” two recommend “Moderate Buy,” 16 recommend “Hold,” and 10 recommend “Strong Sell.” The average TSLA stock target price is $298, marginally higher than its current trading price.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/NVIDIA%20Corp%20logo%20outside%20building-by%20BING-JHEN_HONG%20via%20iStock.jpg)

/Amazon%20pickup%20%26%20returns%20building%20by%20Bryan%20Angelo%20via%20Unsplash.jpg)