/Amazon%20pickup%20%26%20returns%20building%20by%20Bryan%20Angelo%20via%20Unsplash.jpg)

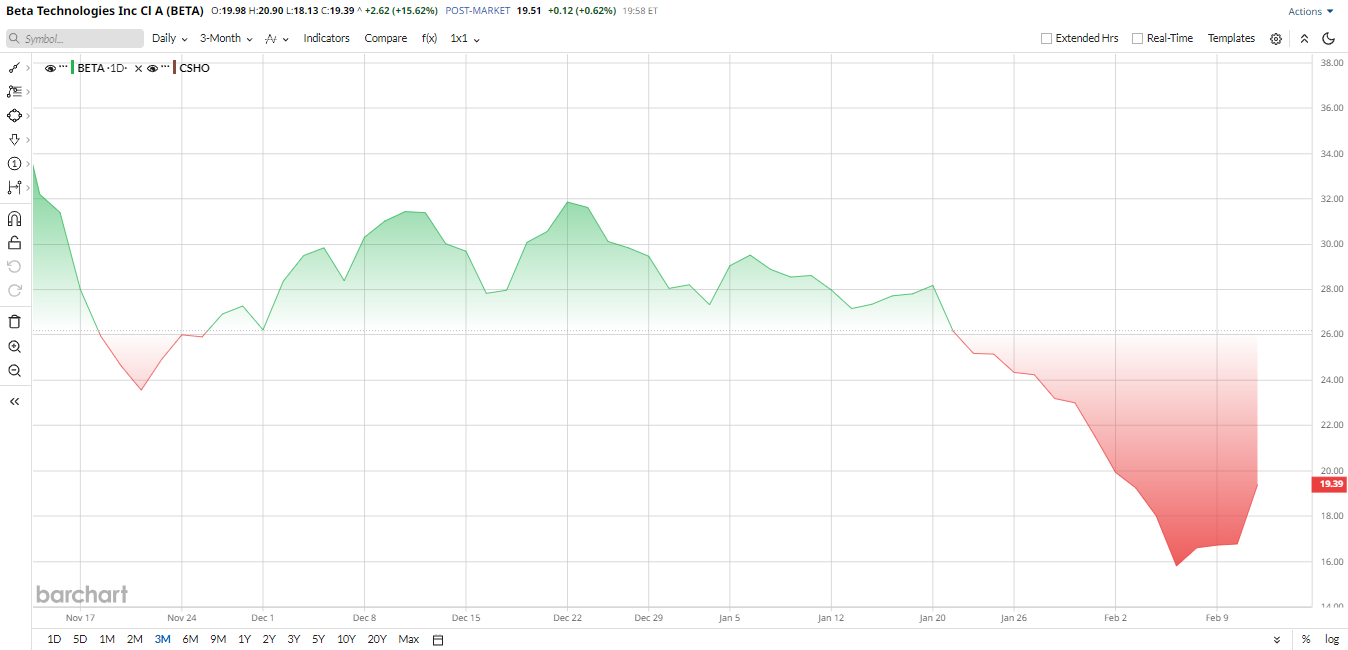

Electric aviation has quickly become one of Wall Street’s most speculative battlegrounds, with companies like Joby Aviation (JOBY) and Archer Aviation (ACHR) swinging wildly as investors weigh certification timelines against long-term disruption potential. It’s been a bumpy few months for a new name like Beta Technologies (BETA). The Vermont-based e-aviation startup went public in November 2025 after pitching its ALIA family of electric aircraft, charging “vertiports,” and propulsion components as a full-ecosystem play, a story that initially excited investors but left the stock well off its IPO pops.

Now Amazon (AMZN) has quietly emerged as a headline buyer. A recent SEC filing shows the e-commerce giant holds roughly 11.75 million BETA shares, about a 5.3% stake, a disclosure that sent the stock sharply higher on Wednesday.

The real question for investors is whether Amazon’s stake is a strategic vote of confidence that meaningfully de-risks Beta’s long road to certification and recurring revenue or just a high-profile footnote that won’t change the company’s capital-intensive runway?

What Makes Beta Unique

Beta Technologies isn’t just another EV startup. It designs the ALIA electric aircraft with both fixed-wing and VTOL variants and supplies core components like propulsion motors, even to competitors. Uniquely, Beta isn’t banking only on one-time aircraft sales. It touts “high-margin recurring” revenue from batteries and aftermarket services as part of its model. On top of planes, Beta is rolling out charging hubs, over 50 sites across the U.S. and Canada, positioning itself as a full ecosystem play for electric flight.

Beta’s stock debut was explosive, but the ride turned choppy. It IPO’d at $34, raising about $1.01 billion, valuing the company at around $7.4 billion. After that launch, investors took profits. By late January 2026, BETA traded roughly 26% below the IPO price. The share price dipped to the mid-teens amid broad technology stock weakness and growth-stock jitters. Even after the Amazon news, BETA remains below its first-day highs, and the stock is still nearing 52-week lows.

Beta is trading at a stratospheric valuation. Its enterprise value-to-sales ratio is on the order of 198×, and its forward P/S is in the hundreds, around 150×. Those are extraordinary multiples compared to established aerospace firms, often under 5×. Worse than this, Beta has negative book equity, giving it a price/book of -2.4× vs. the 4.1× industry average.

In plain terms, Beta is “richly priced” by every measure. Investors are clearly paying for future promise: tech leadership and sales growth, not current profits. On a standalone basis, the stock is extremely expensive relative to peers.

Amazon Takes a 5.3% Stake, So What?

So the e-commerce giant now holds roughly 11.75 million Beta shares, about 5.3% of Class A stock. Importantly, this wasn’t a brand-new investor. Amazon, alongside GE Aerospace (GE), was already a charter backer in Beta’s IPO; its filings say both were 5% shareholders from day one. The fresh disclosure shows Amazon quietly buying more BETA in Q4 2025, worth about $331.6 million.

Why does it matter? First, it’s a big vote of confidence. Amazon has the capital and foresight to bet on long-term tech; if it thinks Beta’s e-plane network will someday plug into its logistics machine, that’s significant. It hints at potential partnerships, for example, Amazon using Beta’s cargo VTOLs to speed deliveries, even if no deal has been announced yet. The immediate result: BETA stock jumped double digits in early trading. That said, experts note the stock is still technically “oversold” and below key moving averages.

In other words, the Amazon news was a short-term catalyst and confidence booster, but Beta still faces execution hurdles. For investors, the key question is whether Amazon’s endorsement translates into actual business, additional orders, or revenue for Beta in the months ahead.

Revenue Growth, Yet Heavy Cash Burn

Beta’s recent earnings illustrate the dual story of small revenues and huge investment burn. In Q3 2025, the company reported $8.9 million in revenue, up dramatically from $3.1 million a year earlier. Product sales like electric motors and service contracts drove most of that growth, and management noted that product revenue exceeded expectations because they delivered motors earlier than planned.

However, Beta is still in heavy development mode. Operating expenses stood at $86.8 million and net loss at $451.8 million, or -$9.83 per share, which was dramatically higher than the prior year. Most of that jump was due to a one-time accounting loss from convertible preferred stock issuance

The good news is Beta’s balance sheet. It closed Q3 with $687.6 million in cash. That dwarfs the $52 million it had a year ago, thanks largely to the $1.01 billion IPO. This gives Beta a multi-year runway as it builds manufacturing and certifies its planes.

Looking ahead, the company reiterated 2025 revenue guidance of $2 million to $3 million and warned of adjusted EBITDA losses of around $295 to $325 million for the year.

Aside from the numbers, Beta is hitting milestones. In Q3, it delivered its first demo ALIA planes to Norway and New Zealand. It completed FAA certification of a composite propeller and started flight testing on its first VTOL prototype.

Partnerships are also expanding. Beta announced a $300 million joint project with GE Aerospace to co-develop a hybrid electric engine and even a deal with General Dynamics (GD) on undersea electric propulsion.

Plus, demand is also emerging. Beta ended Q3 with an order backlog of 891 aircraft worth $3.5 billion across cargo, medical, and passenger use cases. Taken together, the results show execution on engineering and sales but loss-making production.

What Do Analysts Say About BETA Stock?

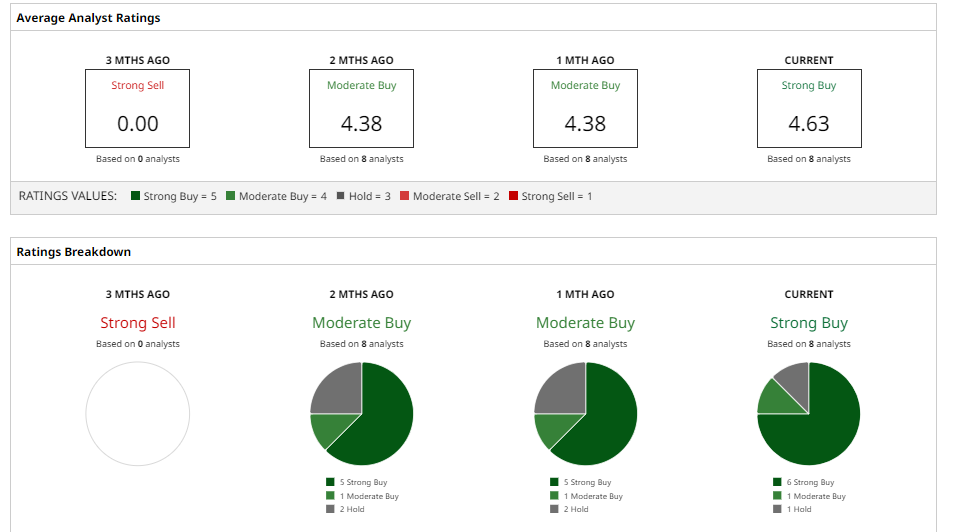

Wall Street’s analysts are largely bullish despite the red ink. Eight major firms cover BETA, and the consensus rating is a “Strong Buy.” The average 12-month price target hovers around $37, so shares could roughly double from today’s price.

Notably, Goldman Sachs initiated coverage at “Buy” with a hefty $47 target. Morgan Stanley started on an “Overweight” call, $34 target, and Bank of America kicked off at "Buy," $35 target. Citigroup and BTIG set targets in the $40 range. Even Jefferies recently raised Beta from “Hold” to “Buy,” albeit with a $30 target.

In short, many analysts see substantial upside if Beta delivers on its ambitious roadmap. Of course, these targets assume successful certification and ramp-up; skeptics point out that even small setbacks in aerospace can be costly.

In my opinion, Amazon’s added stake highlights Beta’s long-term potential. The company’s tech and partnerships are unique, but the business is still in early stages. The IPO cash gives time to execute, and analysts expect big growth down the road. For investors, BETA stock is a high-risk, high-reward bet: it’s expensive and unprofitable now,

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Pfizer%20Inc_%20logo%20sign-by%20JHVEPhoto%20via%20iStock.jpg)

/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)