/Broadridge%20Financial%20Solutions%2C%20Inc_%20logo%20on%20laptop-by%20monticello%20via%20Shutterstock.jpg)

Broadridge Financial Solutions, Inc. (BR) is a New York-based financial technology and corporate services company that provides mission-critical infrastructure, communications, and processing services to the global financial services industry. With a market cap of $20.8 billion, Broadridge operates through Investor Communication Solutions, Global Technology and Operations, and other segments.

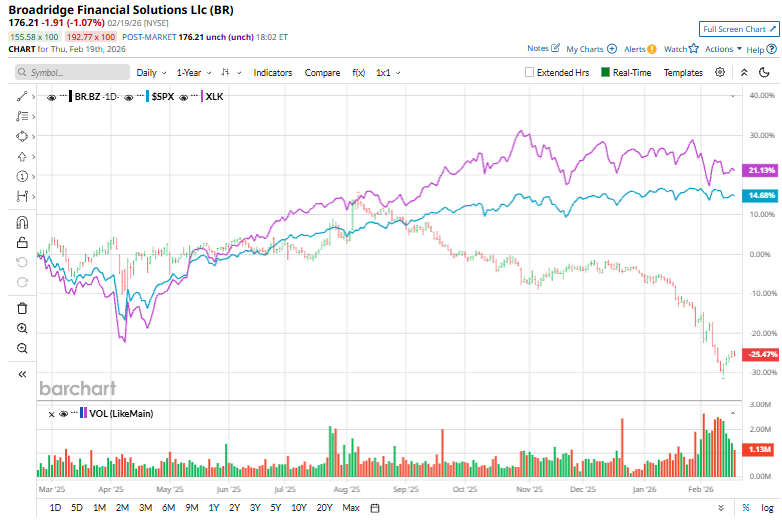

Broadridge shares have observed a 26.3% downtick over the past 52 weeks and 21% drop on a YTD basis. In contrast, the S&P 500 Index ($SPX) has gained 11.7% over the past year and has posted marginal returns in 2025.

Narrowing the focus, Broadridge has also underperformed the sector-focused State Street Technology Select Sector SPDR Fund’s (XLK) 15.8% surge over the past 52 weeks and 2.6% dip on a YTD basis.

On Feb. 3, Broadridge released its Q2 2026 earnings, triggering a sharp 6.3% selloff before shares clawed back 2.2% the next session. Revenue climbed 8% year over year to $1.71 billion, powered by a 9% gain in high-quality recurring revenue, while adjusted EPS edged up 2% to $1.59 and topped expectations. Profitability was held back by a 27% slump in event-driven revenue, largely tied to softer mutual-fund proxy activity, nudging operating income slightly lower. Still, management struck an upbeat tone, lifting full-year adjusted EPS growth guidance to 9–12% and reaffirming other targets, underscoring confidence in durable platform demand and recurring-revenue momentum.

For fiscal 2026, ending in June, analysts expect BR to deliver an adjusted EPS of $9.51, up 11.2% year-over-year. Further, the company has a robust earnings surprise history. It has surpassed the Street’s bottom-line projections in each of the past four quarters.

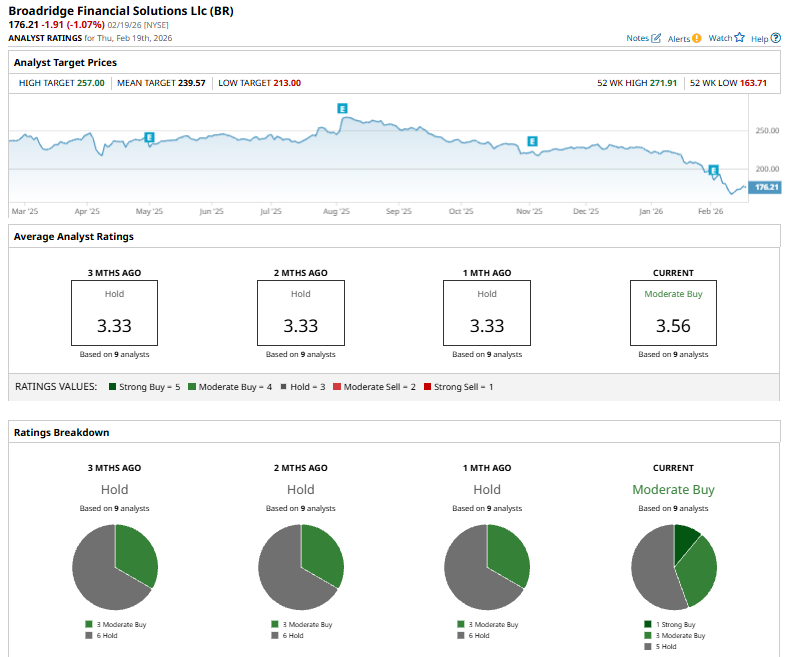

Among the nine analysts covering the BR stock, the consensus rating is a “Moderate Buy.” That’s based on one “Strong Buy,” three “Moderate Buys,” and five “Holds.”

The current consensus is bullish than a month ago, when the stock had an overall “Hold” rating.

On Feb. 10, DA Davidson reiterated its “Buy” rating and $228 price target on Broadridge Financial after the company agreed to acquire CQG’s core trading technology business, a futures and options execution and connectivity platform. CEO Tim Gokey said the deal will cost about $170 million and add roughly $55–58 million in annual revenue. The analyst views the acquisition as strategically aligned with Broadridge’s approach of buying complementary capital-markets technology assets, while noting the firm maintains moderate leverage.

Broadridge’s mean price target of $239.57 represents a 36% premium to current price levels. Meanwhile, the street-high target of $257 suggests a robust 45.8% upside potential.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Apple%20products%20arranged%20on%20desk%20by%20tashka2000%20via%20iStock.jpg)