Verisk VRSK is scheduled to release its first-quarter fiscal 2025 results on May 7, before market open.

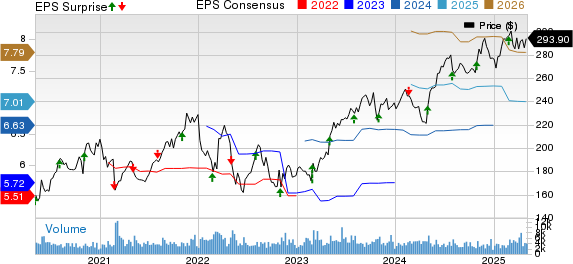

VRSK surpassed the Zacks Consensus Estimate for earnings in the trailing four quarters, delivering an average surprise of 4.8%.

Verisk Analytics, Inc. Price, Consensus and EPS Surprise

Verisk’s Q1 Expectations

The Zacks Consensus Estimate for revenues is $745 million, indicating 6.5% growth from the year-ago fiscal quarter’s actual. VRSK’s client-centric approach facilitated by a global suite of next-generation models is expected to have driven the top line. We anticipate this strategy to have captured strong value-based price realization and extended contract renewal duration.

Our estimate for revenues from the United States is $612.4 million, implying year-over-year growth of 5.4%. We anticipate revenues from the U.K. to be $55.7 million, indicating a 7.3% increase from the year-ago fiscal quarter’s actual. Revenues from Other countries are estimated to rise 13.5% from the year-ago fiscal quarter’s actual to $80.6 million.

The consensus estimate for the bottom line is pegged at $1.67 per share, suggesting 2.5% growth from the year-ago fiscal quarter’s reported figure. Strong margin expansion is anticipated to have fueled the bottom line.

What Our Model Says About VRSK

Our proven model does not conclusively predict an earnings beat for Verisk this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that is not the case here. You can uncover the best stocks before they are reported with our Earnings ESP Filter.

Verisk has an Earnings ESP of -2.34% and a Zacks Rank of 4 (Sell) at present.

Stocks to Consider

Here are a few stocks that, according to our model, have the right combination of elements to beat on earnings this time around.

FIS FIS: The Zacks Consensus Estimate for first-quarter 2025 revenues is pegged at $2.5 billion, indicating growth of 1.7% from the year-ago quarter’s actual. For earnings, the consensus mark is pegged at $1.20 per share, suggesting a 9.1% rise from the year-ago quarter’s reported number. FIS surpassed the consensus estimate in the past four quarters, with an average beat of 9.4%.

It has an Earnings ESP of +0.76% and a Zacks Rank of 2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

FIS is scheduled to declare first-quarter 2025 results on May 6. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Akamai Technologies, Inc. AKAM: The Zacks Consensus Estimate for the company’s first-quarter 2025 revenues is pegged at $1 billion, indicating a year-over-year increase of 2.2%. For earnings, the consensus mark is pegged at $1.58 per share, suggesting a 3.7% decrease from that reported in the year-ago quarter. The company beat the Zacks Consensus Estimate in the past four quarters, with an average surprise of 3.4%.

AKAM currently has an Earnings ESP of +0.07% and a Zacks Rank #3. The company is scheduled to declare first-quarter 2025 results on May 8.

Only $1 to See All Zacks' Buys and Sells

We're not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not - they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 256 positions with double- and triple-digit gains in 2024 alone.

See Stocks Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fidelity National Information Services, Inc. (FIS): Free Stock Analysis Report

Akamai Technologies, Inc. (AKAM): Free Stock Analysis Report

Verisk Analytics, Inc. (VRSK): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

/AI%20(artificial%20intelligence)/Data%20Center%20by%20Caureem%20via%20Shutterstock%20(2).jpg)

/PayPal%20Holdings%20Inc%20HQ%20photo-by%20bennymarty%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)