Investors should be wary of CEOs who aggressively pump up their products and companies. The danger is that overenthusiasm can set expectations high and, if the company falls short, that can make the stock vulnerable to a sell-off.

Case in point: It's not uncommon for Salesforce (NYSE:CRM) CEO Marc Benioff to talk up Agentforce on TV, saying how great the company's artificial intelligence (AI) platform is, and how much better it is than Microsoft's Copilot. The problem is that the early results aren't there to back the assertions, at least not yet.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

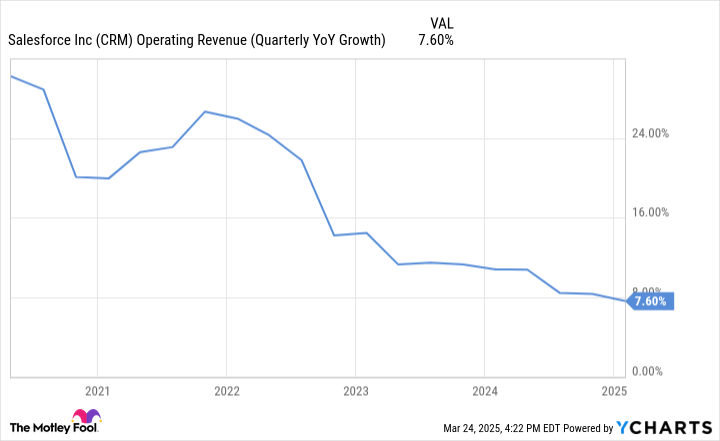

Salesforce's growth has been going in the wrong direction

Benioff sees AI as being a big opportunity for Salesforce, which offers a customer relationship management platform to companies, helping them connect with customers, manage data, and advertise. Agentforce can help automate many tasks and provide "always-on support" for both customers and employees. While it sounds like an exciting opportunity, whether or not the reality matches up with the hype is still a question mark.

On the company's most recent earnings report (for the fourth quarter and fiscal year ending Jan. 31), Salesforce posted quarterly sales of $10 billion, which were up 8% year over year. It's a concerning trend for the business because its growth has been slowing down for multiple years.

Data by YCharts; YoY = year over year.

The company says that its combined data cloud and AI annual recurring revenue currently sits at $900 million and rose by 120% year over year. That's a small slice of the nearly $41 billion that the business expects to generate in sales for the current fiscal year. The Agentforce rollout is, however, still in its early stages (it was launched in October) and could pad that number in the future.

However, the company's guidance for the current year forecasts revenue to rise between 7% to 8%, which doesn't suggest a sharp increase in sales (or any improvement at all).

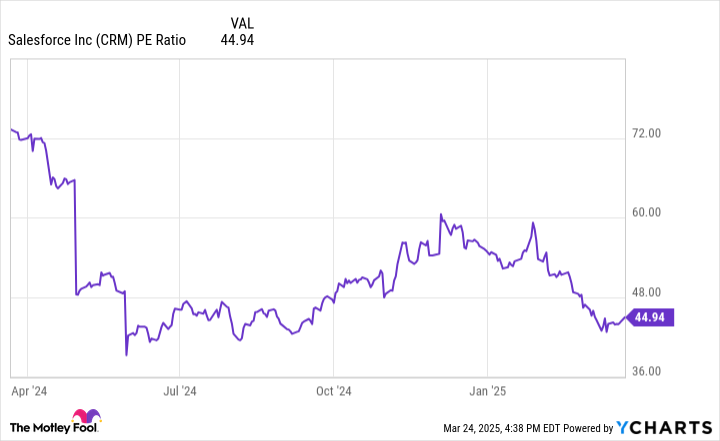

Investors are paying a high premium for the stock

As Salesforce has matured and grown its profits, the stock's valuation has improved significantly. But based on its performance over the trailing 12 months, it's still trading at price-to-earnings multiple (P/E) of 45 -- a high multiple for a business that's growing by single-digit percentages.

Data by YCharts

Many tech companies have been investing heavily in AI to avoid missing out on growth opportunities. The danger is that Salesforce may end up doing the same.

The company said it closed 5,000 Agentforce deals since October, but of those, over 3,000 of them were paid deals. Investors should be careful to pay attention to not only the number of paid deals but also to what the bottom line looks like.

If the company is offering free trials, it may also be pricing deals low for the sake of winning market share. That could hurt its margins, resulting in minimal profit growth even if Agentforce does take off in popularity.

Salesforce is a stock I would avoid

Salesforce's slowing growth a big problem, and despite the hype around Agentforce, it doesn't look like much of a catalyst at this point. Although it's early on, if it was a massive opportunity, I would have expected to see better guidance from the company for the current fiscal year.

Ultimately, the proof will be in the numbers, and until and unless the company's revenue and profit show a significant impact from deploying AI, I would avoid the stock. The risk is that expectations may be too high for the business. And at a time when many companies are offering AI solutions and platforms to help automate tasks, Salesforce may need to spend heavily to stand out among them.

The tech stock is down more than 14% this year, and with its valuation remaining fairly high, there could be more of a decline in the months ahead; this isn't a stock I would take a chance on.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $295,009!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,000!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $523,463!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of March 24, 2025

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft and Salesforce. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)