Public Service Enterprise Group, Inc. PEG or PSEG’s focus on renewable expansion is likely to bolster its footprint in the clean energy market. To efficiently serve customers, the company consistently invests in its infrastructure, strengthening the resilience of its transmission and distribution system.

However, this Zacks Rank #3 (Hold) company faces risks like remediation costs for each manufactured gas plant (MGP) site.

Tailwinds Favoring PEG

PSEG intends to invest nearly $3.8 billion in 2025 for its infrastructure modernization, energy efficiency, electrification initiatives and load growth. It has a capital investment plan of $21-$24 billion for 2025-2029. Such solid investments intend to grow the company's clean energy programs, which will improve infrastructure resilience and consumer reliability. Its solid capital investment plan is estimated to bring in compounded annual rate base growth of 6-7.5% during the same period.

In the clean energy space, the company is investing significantly in solar initiatives in utility-owned solar photovoltaic (PV) grid-connected systems. As of Dec. 31, 2024, the PSE&G segment owned 158 megawatts of direct current of installed PV solar capacity throughout New Jersey.

PSEG has also taken steps to lower its carbon footprint to capitalize on the growing clean energy industry. With this goal in mind, the company accelerated and extended its net-zero ambition by 20 years in June 2021, aiming to reach net-zero carbon emissions by 2030.

Headwinds Faced by PEG

PSEG’s segment, PSE&G, has been collaborating with the New Jersey Department of Environmental Protection to assess and remediate environmental conditions at its former MGP sites. As of Dec. 31, 2024, 38 sites require remedial action, and PSE&G estimates costs of $210-$234 million to complete all sites. Such an expenditure might hurt PSEG’s operating results.

As of Dec. 31, 2024, the company owed $18.96 billion in long-term debt. Its cash balance of $0.13 billion at the end of the fourth quarter fell short of its long-term debt levels and the current debt value of $3.74 billion. This shows that PSEG has a weak solvency position.

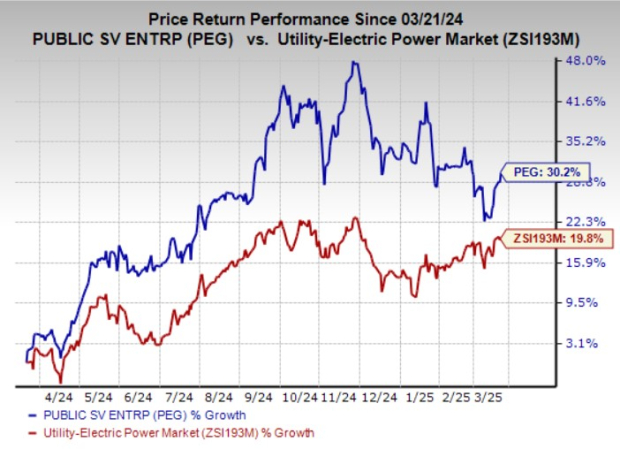

PEG Stock Price Movement

In the past year, PEG shares have risen 30.2% compared with the industry’s growth of 19.8%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the same industry are CMS Energy Corporation CMS, CenterPoint Energy CNP and NiSource Inc. NI, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

CMS’ long-term (three to five years) earnings growth rate is 7.7%. The company delivered an average earnings surprise of 4.76% in the last four quarters.

CNP’s long-term earnings growth rate is 7.5%. The company delivered an average earnings surprise of 0.76% in the last four quarters.

NiSource’s long-term earnings growth rate is 8.2%. The company delivered an average earnings surprise of 23.02% in the last four quarters.

Zacks Names #1 Semiconductor Stock

It's only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NiSource, Inc (NI): Free Stock Analysis Report

Public Service Enterprise Group Incorporated (PEG): Free Stock Analysis Report

CMS Energy Corporation (CMS): Free Stock Analysis Report

CenterPoint Energy, Inc. (CNP): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

/Alphabet%20Inc_%20and%20Google%20logos%20by%20IgorGolovinov%20via%20Shutterstock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)