Despite Tesla CEO Elon Musk being close to President Donald Trump, which was supposed to be bullish for electric vehicles (EVs), the market is selling off most EV and renewable energy stocks this week. The biggest reason is the government beginning to make moves that will hurt the industry, and it could get worse.

There were a lot of big declines this week, but the most notable as I write this are Rivian (NASDAQ:RIVN) falling 9.3% for the week, according to data provided by S&P Global Market Intelligence, Fluence Energy (NASDAQ:FLNC) dropping 19%, and ChargePoint (NYSE:CHPT) dropping 15.8%. While this week may be bad, it may only be the beginning if policies get worse.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Renewables go to the back of the line

We haven't seen action against the $7,500 EV tax credit or other subsidies for renewable energy, but that could be coming as Trump ordered the federal government to sell 25,000 EV chargers. The chargers will be sold at a loss and may cost more to remove than they can be sold for, so it's easy to see this as a war on renewable energy.

This follows the administration's pausing $3 billion in funding for EV charging stations. It's no surprise that ChargePoint's stock isn't reacting to this news positively.

More renewable support may be next

Companies like Fluence and Rivian are dropping because the market is speculating that other renewable energy support will be next. The $7,500 tax credit could be cut or eliminated and generous subsidies for renewable energy generation and batteries could hurt Fluence's economics, which already aren't great.

Losses are piling up

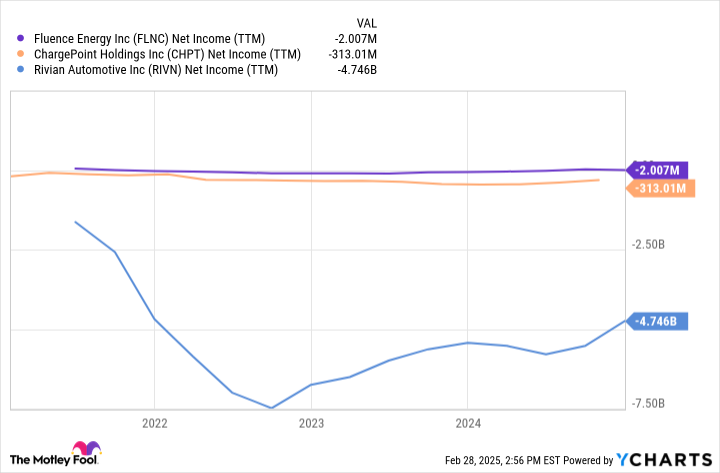

For each of these three companies the losses are piling up. Rivian is losing the most and ChargePoint's losses look unsustainable, but even Fluence is losing money and customers are delaying projects. That resulted in a $600 million reduction in 2025 revenue guidance.

FLNC Net Income (TTM) data by YCharts

The EV market in particular seems challenged with supply increasing faster than demand and companies struggling to improve margins. Rivian said it generated positive gross margins last quarter, but that included $300 million in one-time EV credits and the company isn't going to increase production this year.

The renewable energy market has been here before

Subsidies ebb and flow in the industry and right now investors are on the wrong side of that trend.

What typically happens is the companies with bad economics or weak balance sheets have a hard time adjusting to fewer subsidies and their losses get even worse.

The reason falling stock prices are key is the stock can be a major source of funding. It's hard for these companies to borrow money at attractive rates, so they sell stock to stay afloat. But as stock prices fall that option dries up as well, and in an unsustainable business, that can lead to stocks plunging to zero.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $311,551!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,990!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $519,375!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of February 28, 2025

Travis Hoium has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Fluence Energy. The Motley Fool has a disclosure policy.

/AI%20(artificial%20intelligence)/Data%20Center%20by%20Caureem%20via%20Shutterstock%20(2).jpg)

/PayPal%20Holdings%20Inc%20HQ%20photo-by%20bennymarty%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)