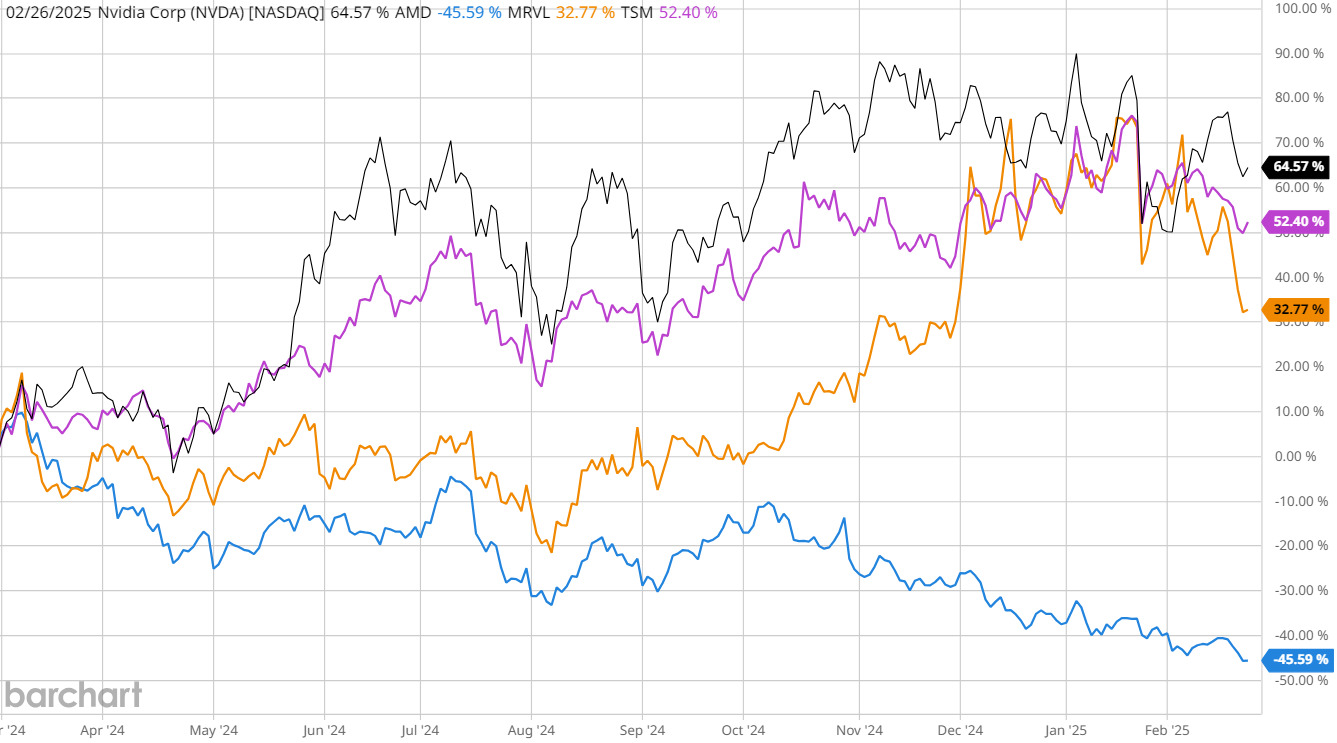

As you may have heard by now, $3 trillion semiconductor giant NVIDIA (NVDA) is set to release its fourth-quarter earnings report tonight. As the largest artificial intelligence (AI) chip specialist in the industry, NVDA is viewed as a major bellwether for overall demand, so investors will be digging into the details of their latest quarterly results - as well as the company’s guidance for the year ahead.

That means tonight’s earnings report should have ripple effects far beyond NVDA shares. Here are a few more AI stocks that could see significant moves in reaction to NVIDIA's earnings report. All three of these companies are closely tied to the AI and semiconductor ecosystem that NVIDIA leads, and their stock prices often move in correlation with NVDA's performance and market outlook.

AI Stock #1: Advanced Micro Devices (AMD)

Trading at $104.58, AMD is NVIDIA's primary competitor in both gaming GPUs and AI chips. They compete directly in the data center AI accelerator market. NVIDIA's results could signal overall AI chip demand, directly affecting AMD's outlook.

AI Stock #2: Taiwan Semiconductor (TSM)

Currently at $193.18, TSM is NVIDIA's primary chip manufacturer - which means the stakes are high tonight for Taiwan Semi’s future orders and production capacity. Strong NVIDIA results could indicate increased demand for TSM's advanced chip manufacturing services, but any sign of weakness could push the Taiwan-based foundry stock lower.

AI Stock #3: Marvell Technology (MRVL)

Last seen at $94.89, Marvell is heavily invested in data center and AI infrastructure. They provide complementary technology for AI applications. As a result, NVIDIA's commentary on data center growth and AI adoption trends could significantly impact Marvell's outlook.

Which AI Stock is the Best Buy Right Now?

Out of these 3 AI chip stocks, MRVL is the most highly rated by analysts, with an overwhelming “Strong Buy” consensus. However, when examining financial fundamentals, TSM stands out with the strongest profitability metrics, boasting a remarkable 40.52% profit margin and the healthiest return on equity at 30.47%.

From a valuation perspective, the forward price/earnings-to-growth (PEG) metric for each indicates that MRVL is priced at a premium relative to its peers, with a PEG ratio of 1.58 compared to TSM’s 0.63 and AMD’s 0.51.

While all three companies are well-positioned in the AI chip market, TSM's combination of strong analyst ratings, superior profitability metrics, and reasonable valuation makes it the most attractive investment option among the three at this time. AMD, despite its lower valuation metrics compared to MRVL, still maintains solid market position and positive analyst sentiment, placing it as a strong second choice.

Taking these factors into consideration, TSM appears to be the best AI chip stock to buy right now, offering the most balanced combination of growth potential, financial stability, and reasonable valuation metrics. However, with NVIDIA’s earnings report likely to spark volatility across the industry through the second half of this week, investors may want to wait before making any major moves.

This article was generated with the support of AI and reviewed by an editor. On the date of publication, the editor had a position in: NVDA , AMD . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Cybersecurity%20by%20AIBooth%20via%20Shutterstock.jpg)