Ardmore Shipping Corporation ASC is scheduled to release fourth-quarter 2024 earnings results on Feb. 13, before market open.

See the Zacks Earnings Calendar to stay ahead of market-making news.

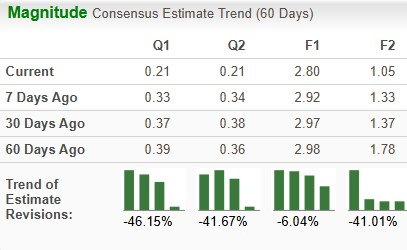

The Zacks Consensus Estimate for ASC’s soon-to-be-reported quarter’s earnings has been revised downward by 46.2% in the past 60 days to 21 cents per share. Meanwhile, the Zacks Consensus Estimate for revenues is pegged at $53.9 million, which indicates a decline of 17.9% from the year-ago levels.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Ardmore Shipping has an impressive earnings surprise history. It surpassed the Zacks Consensus Estimate in each of the trailing four quarters. The average beat is 5.2%.

Against this backdrop, let us take a look at the factors that might have shaped the company’s December-quarter performance.

We expect Ardmore Shipping’s results to reflect the bearishness surrounding the tanker market, as tanker rates are currently not at healthy levels. The slowdown in global economic growth has hurt shipping rates.

Tanker rates have been hit by an oversupply of vessels and subdued demand. Slow demand growth has put downward pressure on freight rates.

Time Charter Equivalent or TCE rates, which represent net revenues (revenues less voyage expenses) divided by revenue days, are likely to have declined in the to-be-reported quarter due to unfavorable spot rates. Moreover, costs are likely to have been steep due to a rise in oil prices, which were up 5.2% in the October- December period.

What Does the Zacks Model Predict About ASC?

The proven Zacks model does not predict an earnings beat for ASC this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of beating estimates, which is not the case here.

Earnings ESP of ASC: Ardmore Shipping has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

ASC’s Zacks Rank: Ardmore Shipping currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank stocks here.

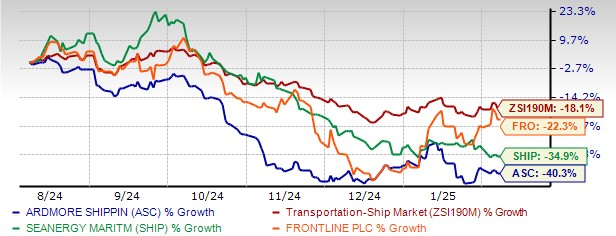

ASC’s Dismal Price Performance

Shares of Ardmore Shipping have plummeted 40.3% in the past six months, underperforming its industry and fellow shipping companies, Seanergy Maritime Holdings SHIP and Frontline Plc FRO.

Six-Month Price Comparison

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Free Today: Profiting from The Future’s Brightest Energy Source

The demand for electricity is growing exponentially. At the same time, we’re working to reduce our dependence on fossil fuels like oil and natural gas. Nuclear energy is an ideal replacement.

Leaders from the US and 21 other countries recently committed to TRIPLING the world’s nuclear energy capacities. This aggressive transition could mean tremendous profits for nuclear-related stocks – and investors who get in on the action early enough.

Our urgent report, Atomic Opportunity: Nuclear Energy's Comeback, explores the key players and technologies driving this opportunity, including 3 standout stocks poised to benefit the most.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Frontline PLC (FRO): Free Stock Analysis Report

Ardmore Shipping Corporation (ASC): Free Stock Analysis Report

Seanergy Maritime Holdings Corp (SHIP): Free Stock Analysis Report

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

/AI%20(artificial%20intelligence)/Businessman%20touching%20the%20brain%20working%20of%20Artificial%20Intelligence%20(AI)%20Automation%20by%20Suttiphong%20Chandaeng%20via%20Shutterstock.jpg)

/EV%20in%20showroom%20by%20Robert%20Way%20via%20Shutterstock.jpg)