Booz Allen Hamilton Holding Corp. BAH reported impressive third-quarter fiscal 2025 results, wherein earnings and revenues beat the Zacks Consensus Estimate.

Quarterly adjusted earnings per share of $1.55 surpassed the Zacks Consensus Estimate by 4.7% and increased 10% from the year-ago fiscal quarter’s actual. The company reported revenues of $2.9 billion, which beat the consensus estimate by 2.7% and increased 13.5% on a year-over-year basis. Revenues, excluding billable expenses, were $2 billion, up 11.8% on a year-over-year basis.

The earnings beat failed to impress the market, as there has not been any major price change since the earnings release.

BAH’s Backlogs Increase

The total backlog increased 14.8% from the year-ago quarter to $39.4 billion, staying our estimate of $39.5 billion. The funded and unfunded backlog amounted to $5.3 billion and $9.3 billion, respectively. Funded backlog increased 1.6% missing our anticipation of $5.5 billion. The unfunded backlog rose 1.6% in line with our estimate.

Priced options rose 24.5% to $24.7 billion, surpassing our expectation of $24.6 billion. The book-to-bill ratio was 0.37 compared with 0.72 in the year-ago quarter. The headcount of 35,800 improved 6.2% on a year-over-year basis.

BAH’s EBITDA Margins Rise

Adjusted EBITDA amounted to $331.7 million, a 14.1% increase from the year-ago quarter. It surpassed our projection of $279.2 million. The adjusted EBITDA margin on revenues was 11.4%, up 10 basis points year over year.

Key Balance Sheet & Cash Flow Numbers

Booz Allen exited the quarter with cash and cash equivalents of $453.5 million compared with $558.7 million in the preceding quarter. Long-term debt (net of current portion) was $3.3 billion, flat with the preceding quarter.

The company generated $150.8 million in net cash from operating activities. Capital expenditure was $17.2 million. The free cash flow was $133.6 million.

FY25 Outlook

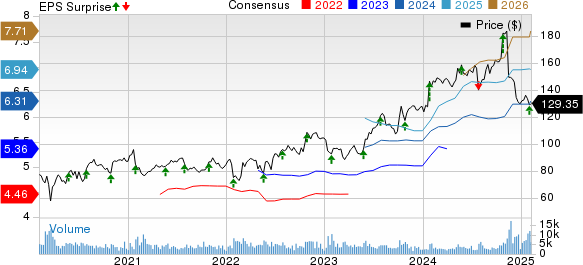

For fiscal 2025, BAH expects revenue growth of 12-13%. It expects an adjusted EPS of $6.25-$6.4 for the year. The midpoint ($6.33) of the guidance range is slightly above the current Zacks Consensus Estimate of $6.31.

Adjusted EBITDA is expected to be $1.31-1.33 billion. The adjusted EBITDA margin on revenues is anticipated to be approximately 11%. Net cash provided by operating activities is projected at $950 million-$1.025 billion. Free cash flow is anticipated at $850 million-$925 million.

Booz Allen currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earnings Snapshots

Gartner, Inc. IT reported better-than-expected fourth-quarter 2024 results.

IT’s adjusted earnings per share of $5.6 beat the Zacks Consensus Estimate by 69.3% and increased 79.3% from the year-ago quarter. Revenues of $1.7 billion surpassed the consensus estimate by 1.8% and improved 8.2% year over year.

Broadridge Financial Solutions, Inc. BR posted impressive second-quarter fiscal 2025 results.

BR’s adjusted earnings of $1.6 per share outpaced the consensus mark by 12.2% and surged 69.6% from the year-ago quarter. Total revenues of $1.6 billion surpassed the consensus mark by 3% and rose 12.8% year over year.

WM WM reported mixed fourth-quarter 2024 results.

WM’s quarterly adjusted earnings of $1.7 per share missed the consensus mark by 5% and declined 2.3% year over year. Total revenues of $5.9 billion surpassed the consensus mark by a slight margin and grew 13% from the year-ago quarter.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.3% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Broadridge Financial Solutions, Inc. (BR): Free Stock Analysis Report

Waste Management, Inc. (WM): Free Stock Analysis Report

Gartner, Inc. (IT): Free Stock Analysis Report

Booz Allen Hamilton Holding Corporation (BAH): Free Stock Analysis Report

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Alphabet%20Inc_%20and%20Google%20logos%20seen%20displayed%20on%20a%20smartphone%20by%20IgorGolovniov%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)