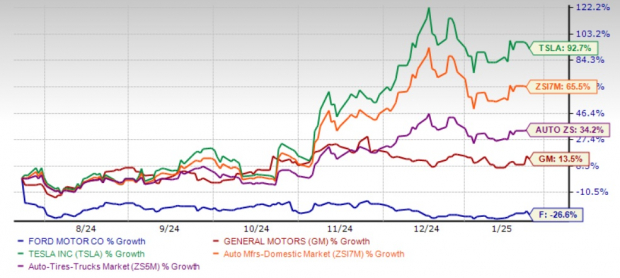

Shares of Ford F have plunged 26.6% in six months, underperforming the industry, auto sector and close peers, including General Motors GM and Tesla TSLA. Although the automaker's overall fourth-quarter 2024 sales grew 9% year over year, contributing to a full-year increase of 4% year over year, its Model e unit, which has been incurring losses, poses significant growth challenges. Let’s analyze the company’s prospects to figure out if it is the right time to buy, sell or hold the stock.

6-Months Price Performance

Image Source: Zacks Investment Research

The U.S. legacy automaker’s sales got a boost from diverse powertrain options and vehicle types. In 2024, Ford’s U.S. retail sales increased 6% year over year, doubling the broader industry growth rate while fourth-quarter retail sales grew 17% year over year, led by a 25% year-over-year rise in F-Series trucks. It sold 2,078,832 vehicles in 2024, up 4% year over year and was the third best-seller in the country just behind GM and Toyota TM. The company has entered 2025 with bolstered inventories to offset potential supply disruptions during key product launches, including the new Expedition, Navigator and Bronco.

A Few Factors Favoring Ford

Ford’s strong lineup, including F-series trucks and SUVs, is set to grow with new Maverick, Bronco and Expedition Navigator launches. The automaker’s Ford Pro segment is projected to generate $9 billion EBIT in 2024. With $28 billion in cash, $46 billion in liquidity and $2 billion in annual efficiency targets, F’s financial strength supports its Ford+ priorities. Its more than 5% dividend yield, far above the S&P 500 average, underscores its commitment to shareholder returns, offering stability and income amid market volatility.

Near-Term Headwinds Impacting F’s Prospects

Ford’s Model e unit incurred losses of $4.7 billion in 2023 owing to high investments in next-gen products. Ford anticipates that the full-year 2024 loss from the Model e unit to widen to around $5 billion, exacerbated by ongoing pricing pressures and increased investments in next-generation EVs.

Its struggle to manage warranty expenses has been another sore spot. The automaker’s quality issues, especially with older models, have led to elevated warranty costs. Despite efforts to address these issues, Ford has indicated it could take around a year before substantial cost improvements are realized. Unfortunately, this means that Ford could continue to face elevated warranty expenses for some time.

The automaker has cut the full-year 2024 EBIT forecast. It now expects the metric to be around $10 billion, at the lower end of the previously guided range of $10-$12 billion. Apart from warranty costs, higher inflation, particularly affecting Ford’s joint venture in Turkey, is set to exacerbate cost pressures. Increased material prices for the popular Transit van in Europe are likely to erode margins. Ford’s EPS estimates for 2024 and 2025 have moved down by a penny and 2 cents, respectively, in the past 60 days.

Image Source: Zacks Investment Research

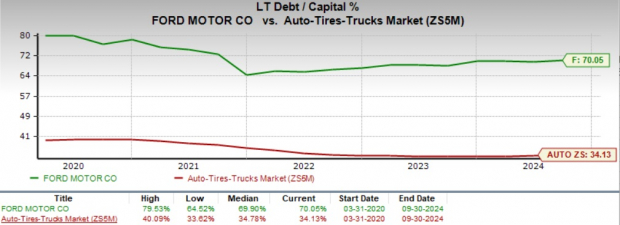

Although the company has a manageable debt level, its long-term debt-to-capitalization is 70.05%, which is quite high compared to the auto sector’s 34.13% and could be a concern in a still higher interest-rate environment.

Image Source: Zacks Investment Research

Conclusion

Ford has been grappling with escalating losses in its Model e unit, surging warranty expenses and heightened material costs. Given the prevailing uncertainty surrounding the duration of these challenges, investors are recommended to consider offloading the stock from their portfolios.

Ford currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.1% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F): Free Stock Analysis Report

Toyota Motor Corporation (TM): Free Stock Analysis Report

General Motors Company (GM): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)