2024 is turning out to be another strong year for the stock market, with the S&P 500 on track for another year of 20%-plus returns. The benchmark index has produced total returns (including dividends) of nearly 25% as of this writing. That follows a total return of more than 26% in 2023.

In addition, the index is set for its fourth gain of 20% or more in the past six years. On a total return basis, it has only had two years of negative returns since the financial crisis of 2008. Those were in 2022, when it had a negative 18% total return, and 2018, when it had about a negative 4% total return. Meanwhile, there have been seven years with returns of 20% or more during that stretch.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

While some investors may be a bit wary about adding money to stocks following two years of such strong returns, the market is just a little over two years into its current bull run. Meanwhile, since 1950, the average bull market in the S&P 500 has lasted about five and a half years, according to Carson Investment Research.

Against that backdrop, let's look at one Vanguard exchange-traded fund (ETF) that I think could be the top index fund performer in 2025.

Image source: Getty Images

Tech to lead the way again

While Vanguard has several great index funds to choose from, my top pick for 2025 is the Vanguard Growth ETF (NYSEMKT:VUG), which tracks the CRSP US Large Cap Growth Index. That index essentially represents the growth stock side of the S&P 500.

The ETF's portfolio is fairly heavily concentrated, with its top three holdings of Apple, Nvidia, and Microsoft representing nearly a third of its value. Add in the next largest four -- Amazon, Alphabet, Meta Platforms, and Tesla -- and you have just seven companies accounting for about 52.5% of the portfolio. This top-heavy weighting adds some risk, but it also positions the ETF to nicely outperform when the tech sector is healthy.

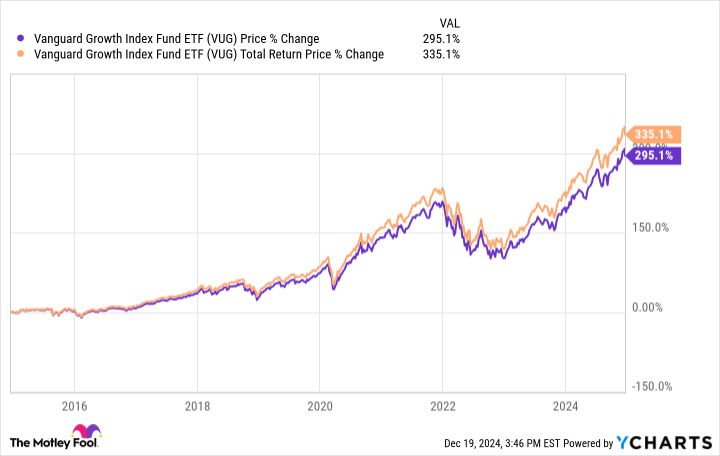

In fact, the Vanguard Growth ETF has a stellar track record, with an average annualized return of 15.6% over the past 10 years, as of the end of November. That easily surpasses the 13.4% average annual return of the S&P 500 over the same period. This year, it was up a better-than-usual 32.1% as of the end of November.

Its performance will continue to be heavily influenced by its top seven holdings -- and that's one reason why it is my top Vanguard ETF pick for 2025. All seven of its top holdings are strong plays on the artificial intelligence (AI) megatrend, which appears to still be in its early innings.

Data by YCharts.

These companies are leaders across various aspects of AI, from AI chips to cloud computing to software to robotics to autonomous driving. As long as spending on AI remains strong and companies look to advance their AI models, I think these stocks by and large will continue to outperform the market.

I prefer the Vanguard Growth ETF over the Vanguard Information Technology ETF (NYSEMKT:VGT), as the latter has an even higher weighting in its top three stocks and doesn't hold Amazon, Alphabet, Meta Platforms, or Tesla. I think all four of those stocks could be strong performers next year.

While there could certainly be a general marketwide rotation to small-cap stocks or value stocks in 2025, I think large-cap growth stocks will continue to keep their momentum. By and large, these companies have been showing strong growth, but they are also largely cash-rich and generate a lot of cash. This should allow them to continue spending on AI and other innovation areas, which I see continue to drive the market forward.

Together with the Federal Reserve continuing to push interest rates lower and a potentially looser regulatory environment, I'm expecting another strong year for the stock market, with large-cap growth names once again leading the way.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $338,855!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $47,306!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $486,462!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of December 16, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Geoffrey Seiler has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Tesla, and Vanguard Index Funds-Vanguard Growth ETF. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

/Apple%20Inc%20logo%20on%20Apple%20store-by%20PhillDanze%20via%20iStock.jpg)

/Elon%20Musk%2C%20founder%2C%20CEO%2C%20and%20chief%20engineer%20of%20SpaceX%2C%20CEO%20of%20Tesla%20by%20Frederic%20Legrand%20-%20COMEO%20via%20Shutterstock.jpg)