Prospects of Zacks Transportation - Rail industry’s participants are being weighed down by challenges like inflation-induced elevated interest rates, concerns pertaining to supply-chain disruptions and the slowdown of economic growth. Most industry players are looking to drive their bottom line amid the headwinds through cost reduction.

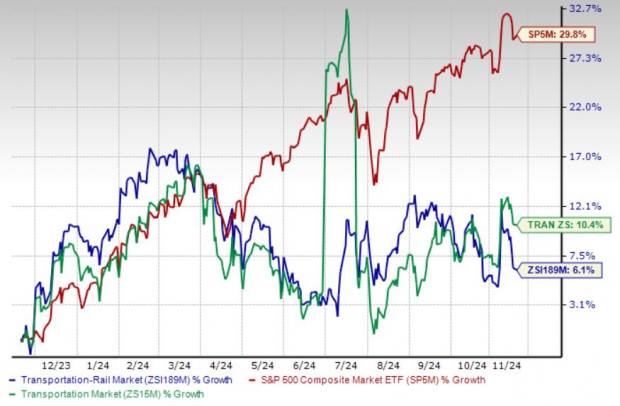

Partly due to these headwinds, theindustry, despite gaining 6.1% over the past year, has underperformed the S&P 500 Index’s 29.8% appreciation. The broader Zacks Transportation sector has surged 10.4% in the said time frame.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Despite the challenges surrounding the industry,some railroad companies like Union Pacific Corporation UNP, Canadian National Railway Company CNI and Norfolk Southern Corporation NSC have consistently paid dividends to their shareholders, thus highlighting their pro-shareholder stance.

Dividend growth stocks generally belong to mature companies, which are less susceptible to significant market swings, and act as a hedge against uncertainty-induced stock market volatility as is the case currently. They offer downside protection with their consistent increase in payouts.

Additionally, these companies generally have strong fundamentals like a sustainable business model, a long track of profitability, rising cash flows, good liquidity and a strong balance sheet.

How to Pick Stocks With Solid Dividend Payouts?

In order to choose some of the best dividend stocks from the aforementioned industry, we have run the Zacks Stock Screener to identify stocks with a dividend yield in excess of 2% and a sustainable dividend payout ratio of less than 60%. Each stock mentioned below presently carries a Zacks Rank #3 (Hold).You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Union Pacific: Headquartered in Omaha, NE, Union Pacific, through its subsidiary, Union Pacific Railroad Company, operates in the railroad business in the United States. Currently, UNP has a market capitalization of $142.82 billion.

UNP pays out a quarterly dividend of $1.34 ($5.36 annualized) per share, which gives it a 2.29% yield at the current stock price. The company’s payout ratio is 49% of its earnings at present. The five-year dividend growth rate is 8.75%. (Check Union Pacific’s dividend history here).

UNP has paid dividends on its common stock for 125 consecutive years, reflecting its pro-shareholder approach. Union Pacific’s consistent initiatives to reward its shareholders through dividends and share repurchases look encouraging. In 2022, UNP paid dividends worth $3.16 billion and repurchased shares worth $6.28 billion. In 2023, the company returned $3.9 billion to its shareholders through dividends ($3.2 billion) and buybacks ($0.7 billion). During the first nine months of 2024, UNP paid $2.40 billion in dividends and repurchased shares worth $831 million. Notably, management expects to buyback shares worth $1.5 billion in 2024.

Canadian National: Based in Montreal, Canada, Canadian National is involved in the rail, intermodal, trucking, and marine transportation and logistics business in Canada and the United States. Currently, CNI has a market capitalization of $68.35 billion.

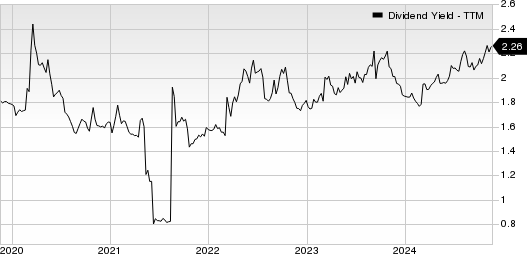

CNI’s quarterly dividend leads to $2.45 per share (annualized), which gives it a 2.26% yield at the current stock price. This company’s payout ratio is 46% of its earnings at present. The five-year dividend growth rate is 9.61%. (Check Canadian National’s dividend history here).

CNI’s efforts to reward its shareholders via dividends and buybacks are encouraging and highlight the company's financial strength. In 2022, CNI paid dividends of C$2.00 billion and repurchased shares worth C$4.71 billion. In 2023, CNI paid dividends of C$2.07 billion and repurchased shares worth C$4.55 billion. During the first nine months of 2024, CNI paid dividends of C$1.61 billion and repurchased shares worth C$2.45 billion.

Norfolk Southern: Headquartered in Atlanta, GA, Norfolk Southern engages in the rail transportation of raw materials, intermediate products and finished goods in the United States. Currently, NSC has a market capitalization of $59.32 billion.

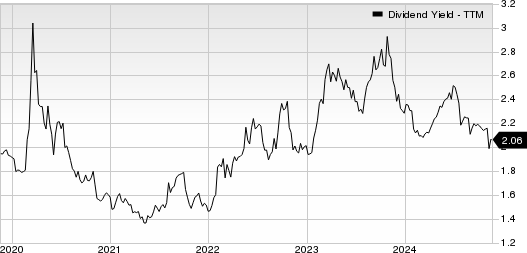

NSC pays out a quarterly dividend of $1.35 ($5.40 annualized) per share, which gives it a 2.06% yield at the current stock price. This company’s payout ratio is 46% of its earnings at present. The five-year dividend growth rate is 10.48%. (Check Norfolk Southern’s dividend history here).

Norfolk Southern's consistent initiatives to reward its shareholders look encouraging. During the first nine months of 2024, NSC paid dividends worth $915 million. In 2023, the company paid dividends worth $1.23 billion and repurchased and retired common stock worth $622 million. During 2022, Norfolk Southern paid dividends worth $1.17 billion and repurchased and retired common stock worth $3.11 billion.

Such shareholder-friendly moves indicate the company’s commitment to creating value for shareholders and underline its confidence in its business.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.7% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Union Pacific Corporation (UNP): Free Stock Analysis Report

Canadian National Railway Company (CNI): Free Stock Analysis Report

Norfolk Southern Corporation (NSC): Free Stock Analysis Report

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)